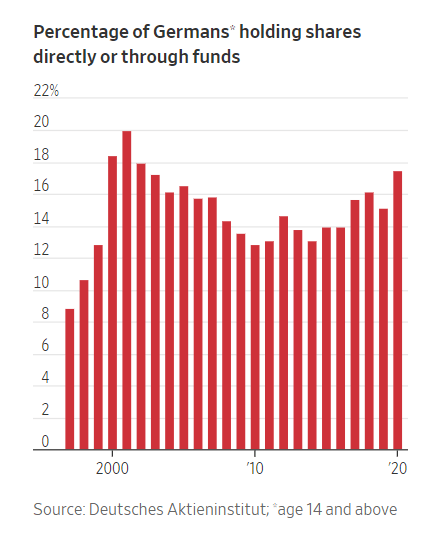

One of the key questions that linger on emerging market investors is: When will emerging markets turn into developed markets?

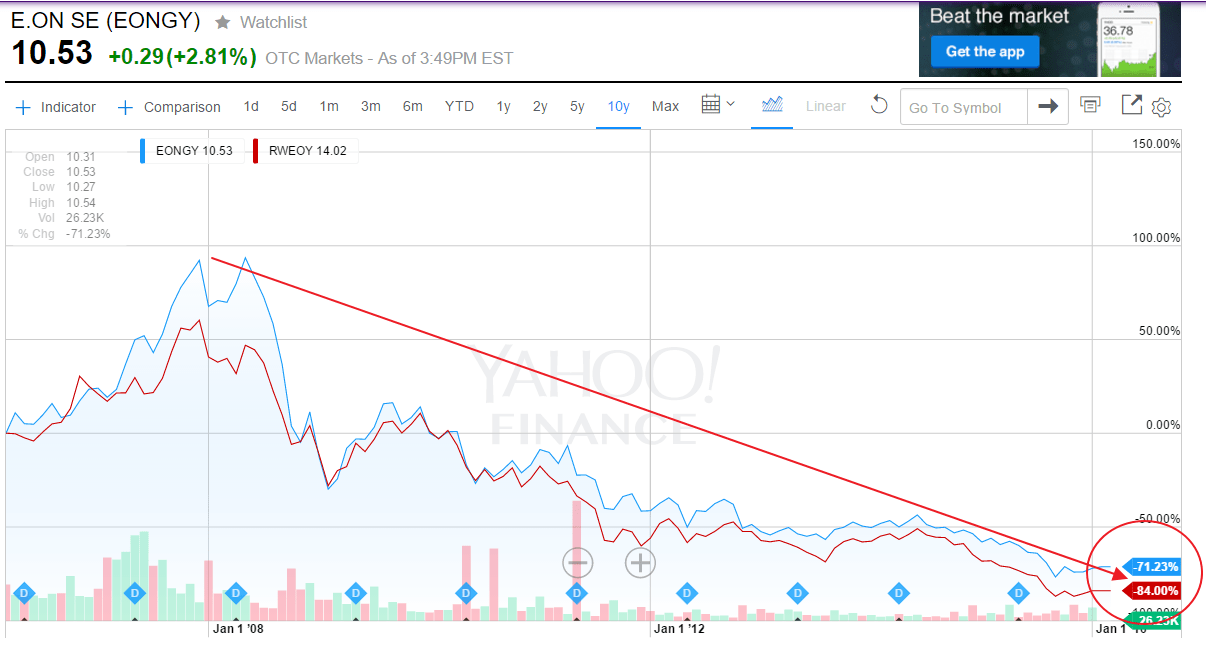

An emerging market technically means it is emerging and at some point in the future will reach the developed market status. However that does always work out that way.In fact, some call emerging markets as “submerging markets” as they disappoint investors year after year.

This year also emerging markets are performing poorly so far. For example, China is off by about 22% and Brazil is down by 11%. Continue reading ‘Some Thoughts On When Emerging Markets Will Turn Into Developed Markets’ »