The universe of foreign stocks available for investment is huge relative to the US market. Thousands of firms trade on a range of markets from other developed countries to emerging and frontier markets. Foreign equity markets are also less concentrated than the US markets and hence offer excellent opportunities for stock pickers. In addition, going overseas offers diversification benefits as well. I have written about concentration in the US markets before many times some of which you can find here and here and here.

Yesterday tech giant Apple(AAPL) crossed the $3.0 Trillion market cap making it the first US company ever to reach that milestone. The past few years and more specifically last year much of the gains in the S&P 500 have been concentrated in the five major firms including Apple. Last year the top five accounted for 31% of the index returns.

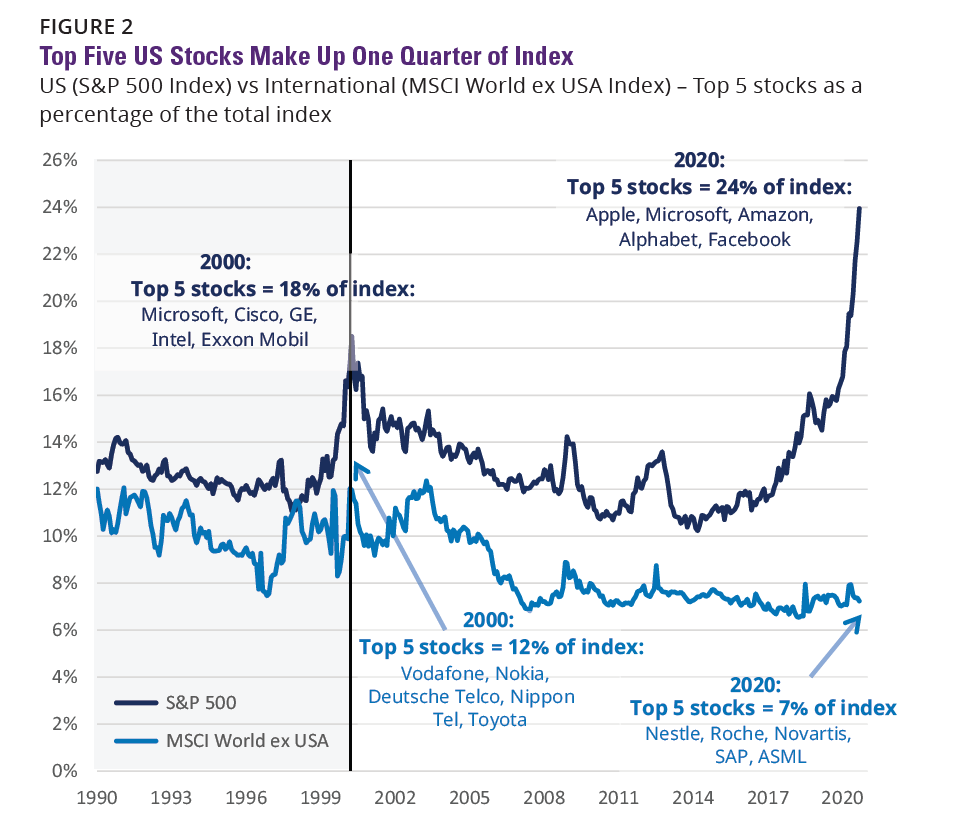

I came across a research whitepaper recently that discussed the case for international stocks. The following chart from the paper shows the weightage of the top 5 firms in the US market as represented by the S&P 500 index and foreign markets using the MSCI World ex-USA index from 1990 to 2020:

Click to enlarge

Source: Six Charts That Make the Case for International Equities and Value by Daniel Woodbridge, HartfordFunds

While the top 5 in S&P 500 represents nearly a quarter of the index the top five in the international equities index denote just 7%. This shows how narrow breadth of the US markets.

Related stocks:

- Amazon.com Inc (AMZN)

- Facebook(FB)

- Alphabet (GOOG)

- Microsoft(MSFT)

- Apple(AAPL)

- Nestle SA (NSRGY)

- Roche Holding AG (RHHBY)

- Novartis AG (NVS)

- SAP SE (SAP)

- ASML Holding NV (ASML)

Disclosure: No positions