The US equity markets as represented by the S&P 500 has performed very well so far this year despite the dramatic selloff in late first quarter. The S&P 500 is down just 3.09% year-to-date on price return basis. However the market has become more highly concentrated with a handful of firms doing the heavy lifting. So much so that it seems like the S&P 500 might as well be called as the S&P 5 to highlight the importance of the 5 companies. Of course, we are talking about the FAANG group of current market darlings. The FAANG represents Facebook(FB), Amazon(AMZN), Apple(AAPL), Netflix (NFLX) and Google or its parent Alphabet (GOOG).

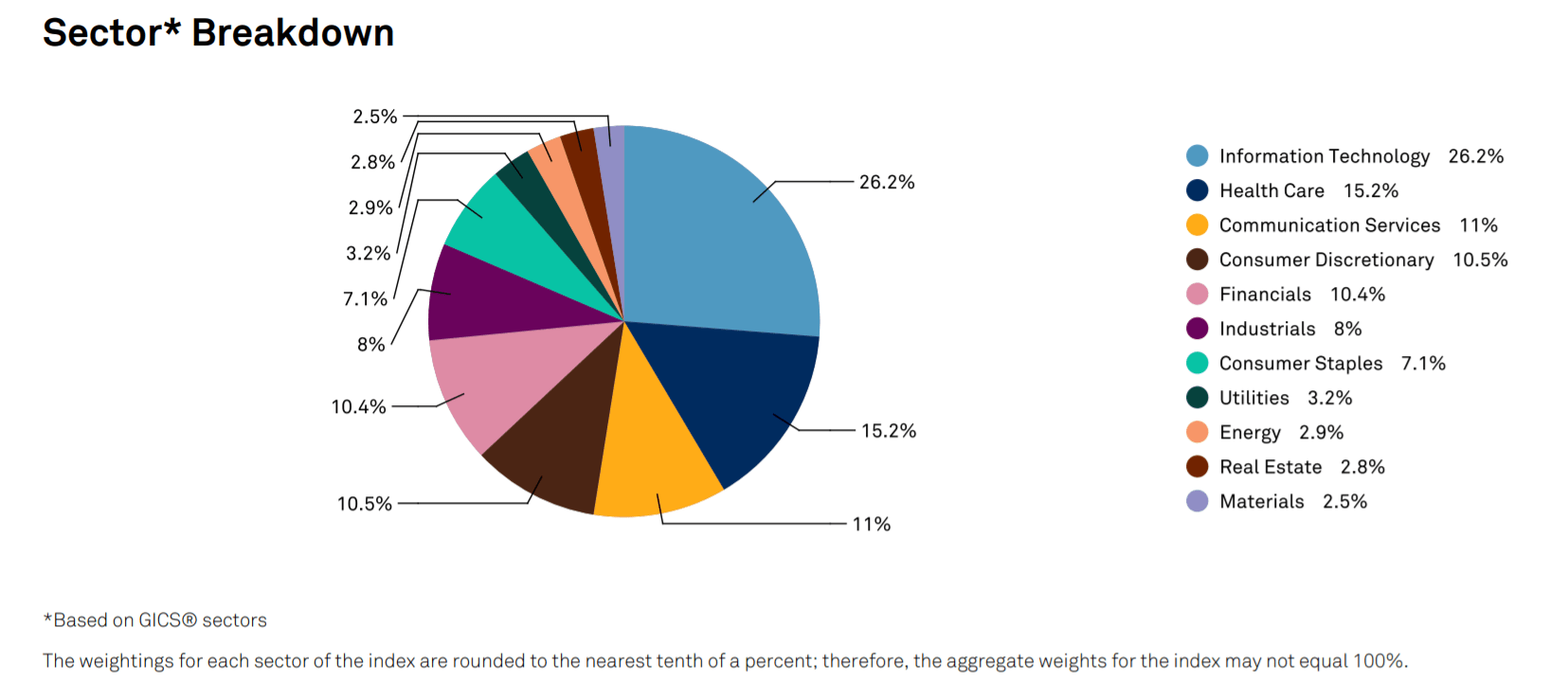

At the end of 2019, Information Technology and Communication Services sectors accounted for 33.6% of the index. By May end of this year, the weightage for these sectors jumped to 37.2% as shown in the chart below. Amazon is part of the Consumer Discretionary sector. When some of that sector’s weight is added the overall concentration goes even higher. Moreover Amazon has shot up by about 50% year-to-date while Netflix has gone up by over 44%.

Click to enlarge

Note: The above chart is based on data as of May 31, 2020

Source: S&P Indices

Once sector concentration reaches too high, selloffs can occur in the following year according to a January article by John Petrides at Tocqueville Asset Management. To illustrate the argument, he gave examples of the past meltdowns in the energy, dot com and financial sectors.

From the article titled The S&P “5”:

Sector Concentration Risk

At the end of the year, the Technology and Communication Services sectors (which holds the likes of Alphabet and Facebook), combined were 33.6% of the S&P 500. If you add in Amazon, which is categorized as a Consumer Discretionary stock, the concentration is closer to 36%. Sector concentration is not unusual for the Index, but we have seen this story play out before. In 1999 the Tech and Telecom sectors combined were near 40%; Financials in 2007 were at 22%; and Energy in 2008 was at 16%. Once these sectors reached these peaks, the following years were met with a precipitous sell off: the blow-up of the dotcom bubble in 2000, the collapse of Bear Stearns beginning in 2007, and the emergence of U.S. shale to squash the “peak oil” debate. The current sector concentration is not a forecast of impending doom, but rather a wake-up call for investors to be aware of the potential risk being taken by simply “owning the market.”

Note: The above chart shows data through the end of 2019

Source: The S&P “5”, Tocqueville Asset Management

Key Takeaway:

Caution is warranted when the concentration of one or more sectors becomes too high in the index. Accordingly it is important to diversify across different firms in many sectors. In addition, “buying the market” by simply picking up an ETF or an index fund is also risky as they track the S&P 500.

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions