Interest rates on Certificate of Deposits(CDs) in banks have soared this year. From virtually paying nothing a few years ago CDs have become the asset to own by any investor in this high interest rate times. For instance, the rate on 1-year CDs have jumped to as high as 5.67% according to Bankrate data. With such high rates it almost sounds foolish to invest in the stock market. Growth stocks are going to get hurt by lack of access to cheap capital. Investing in other stocks are risky as well due to multiple factors from a potential government shutdown to a recession and everything in between. No wonder the equity market is in the doldrums for the past few months.

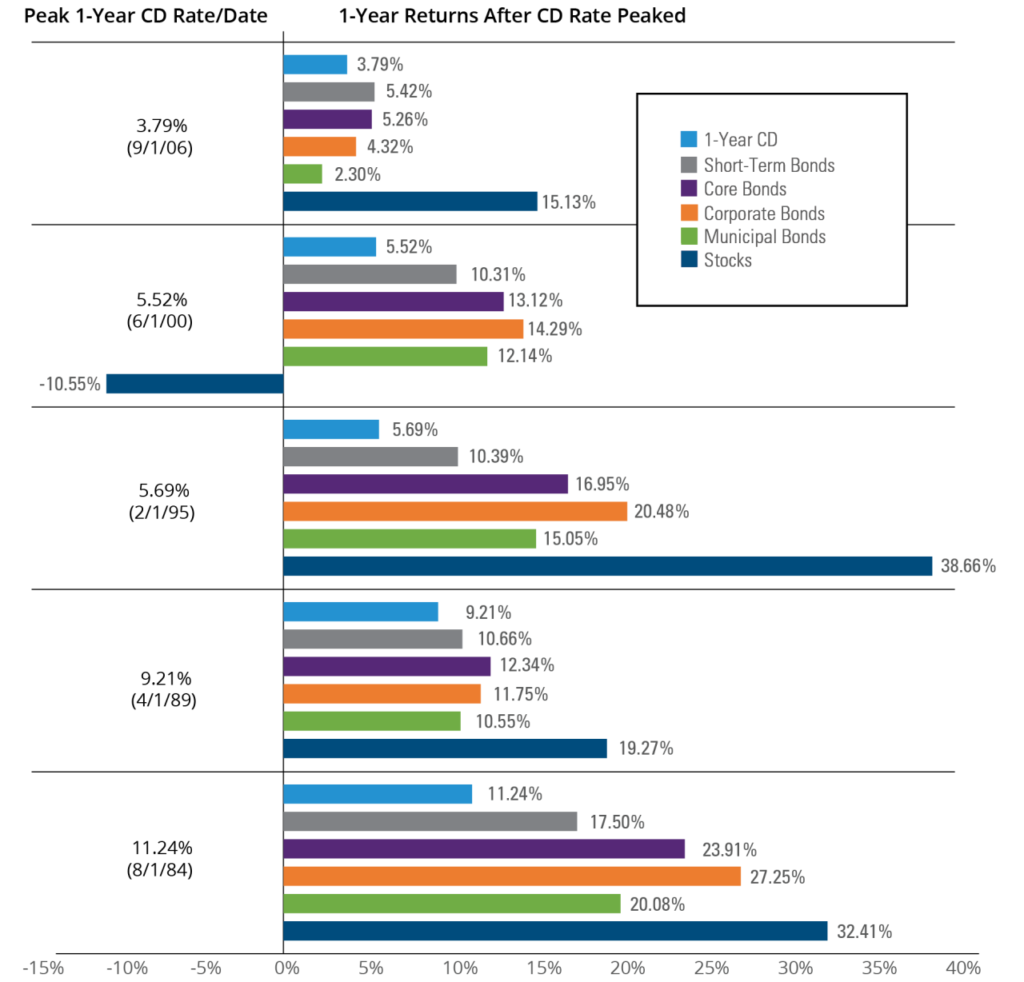

I recently came across an article at Hartford Funds which discussed on the performance of other assets 1 year after the return on 1-year CDs peaked. According to their research, the return on other assets outperformed CD returns one year after CD rates peaked. The following chart shows the performance of other assets over CDs from a select few periods in the past:

Click to enlarge

Note: The above returns do NOT include the impact of inflation and taxes which would reduce returns

Source: Is a Good CD Rate Too Good to Be True?, Hartford Funds

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares TIPS Bond ETF (TIP)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Vanguard Total Bond Market ETF (BND)

Disclosure: No positions