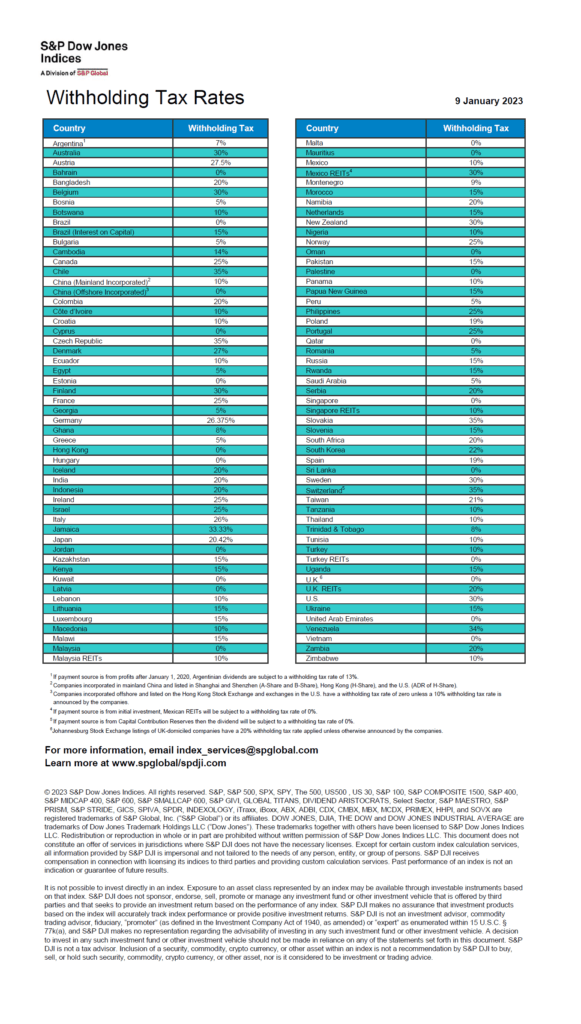

The Dividend Withholding Tax Rates by Country sheet for 2023 has been published by S&P Global. Investors in foreign stocks can refer to this chart for finding if any withholding taxes applicable to dividends. Brazil does not withhold taxes on dividends paid out to foreign investors. Similarly other countries such as Hungary, Hong Kong, Singapore, etc. also do not withhold taxes.

Note on Chile’s Dividend Withholding Tax Rate:

Among emerging markets Chile used to charge 35%. But reduced it to 23.9041123% last year. So the 35% shown in the below table is incorrect.

Though the rate for Canada is noted as 25% in this table, this can be reduced to 15% in non-retirement accounts by submitting NR-301 form to Canada Revenue Agency (CRA). For stocks (excluding REITs) held in qualified retirement accounts such as IRAs, Canada does not withhold any dividends for US residents. So Canadian income equities are ideal for US retirement accounts.

Click to enlarge

Source: S&P Global