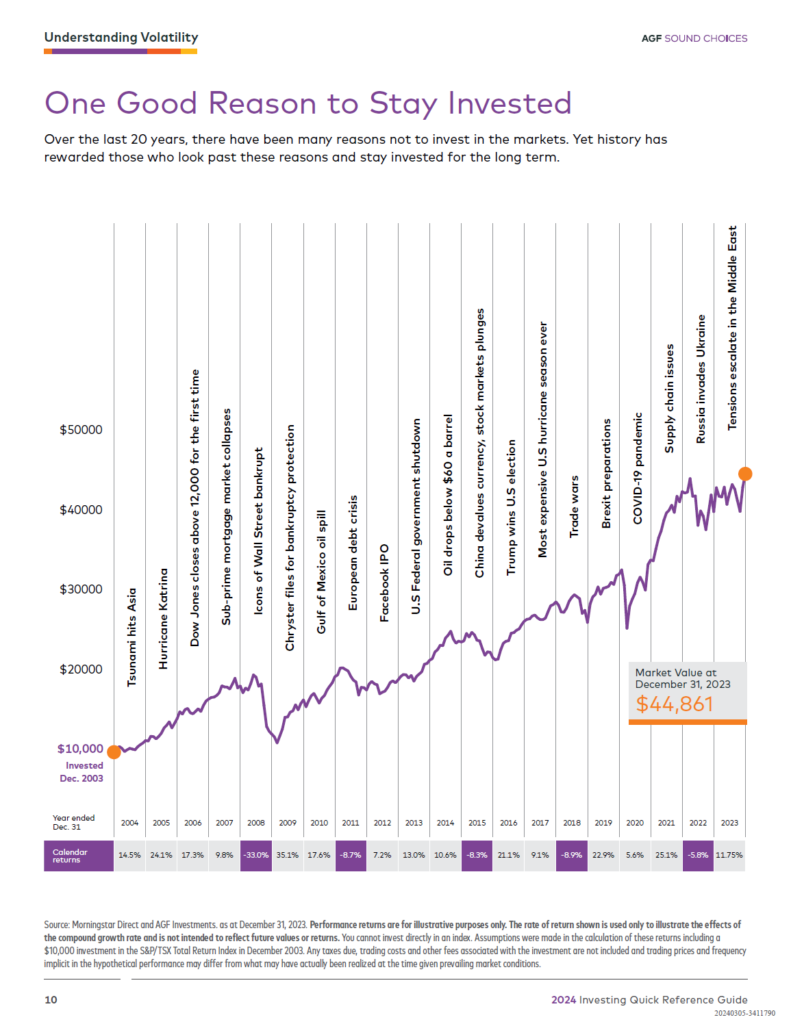

One of the topics I have discussed many before is the concept of patience and long-term investing. Holding quality stocks for many years or decades generally leads to higher returns due to the effect of compounding. Though long-term investing sounds simple it is not easy to follow for a variety of reasons. For instance, on a daily basis we are bombarded with tons of information that we have process thru. Most of it just noise and sometimes it can incredibly difficult to ignore them. I came across the below chart which shows the many events that investors were faced with from 2004 to 2023:

Click to enlarge

Source: 2024 Quick Reference Guide, AGF Investments

Some investors may been tempted to sell out when many of these events occurred. For example, the 2008 Global Financial Crisis(GFC) hit most markets of the world and it looked like all the stocks would go to zero and they would shut down the markets forever. However investors that held on all thru the chaos and continued to have faith in the markets were rewarded nicely. The above chart shows a C$10K investment would have grown to nearly $45K by the end of 2023 based on returns of the S&P/TSX Total Return Index for the Canadian market.

Related ETF:

- iShares MSCI Canada ETF (EWC)

Disclosure: No positions