Gold is an important asset class to own in a well-diversified portfolio. Holding even a small percentage of one’s asset in gold can cushion a portfolio when markets volatile. As gold is generally considered as a safe heaven asset class, investors tend to rush into it when equities decline. Simply put, gold is a defensive asset. When equity markets go through risk-off periods gold is one of the few asset classes that tend to benefit. Though gold does not offer income in the form of say dividends like stocks it can offer stability and peace of mind when there is blood on the street.

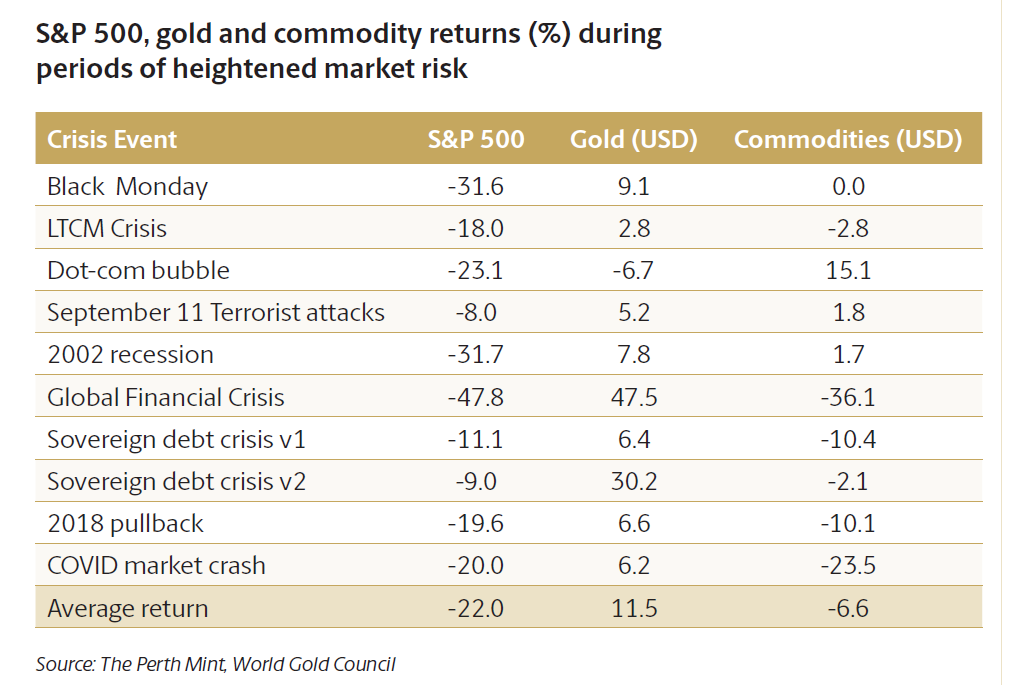

Gold’s outperformance during periods of heightened equity market stress in the past 30 plus years is shown in the table below:

Click to enlarge

Source: The case for gold: A special report for institutionally managed superannuation funds, The Perth Mint

During the great Global Financial Crisis(GFC) of 2008-09 stocks plunged an incredible 48%. Gold on the other hand rose dramatically with a gain of about 48%. Similarly during the two European sovereign debt crises gold earned a positive return while equities fell.

Below is an excerpt from the above report:

Historical outperformance when equities decline

There are many research papers highlighting the fact that gold has historically been amongst the best performing assets when equities suffer their most significant drawdowns.Examples include an AQR paper titled Good Strategies for Tough Times. Published in 2015, it looked at the ten worst calendar quarters for global equities between 1972 and 2014, when equities on average fell by just over 19% in those quarters.

The paper found that gold was the highest performing single asset during those quarters, returning +4.2% on average, outperforming global fixed income (+3.9%), and a hedge fund composite (-5.9%).

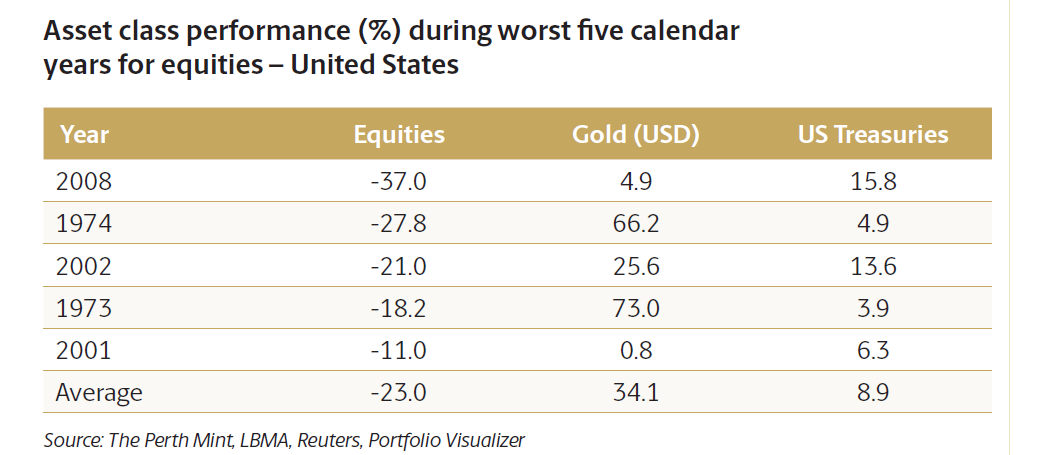

Perth mint researched and found during the worst five year calendar years for US stock market between 1971 and 2000, gold performed much better as shown in the table below:

Click to enlarge

Source: The case for gold: A special report for institutionally managed superannuation funds, The Perth Mint

Gold strongly outperformed US Treasuries as well during the five periods shown above. In each of the five calendar year return for stocks, gold delivered an astonishing gain of almost 35%.

This again proves the resilience and importance of owning gold.

Related ETFs:

Disclosure: No positions