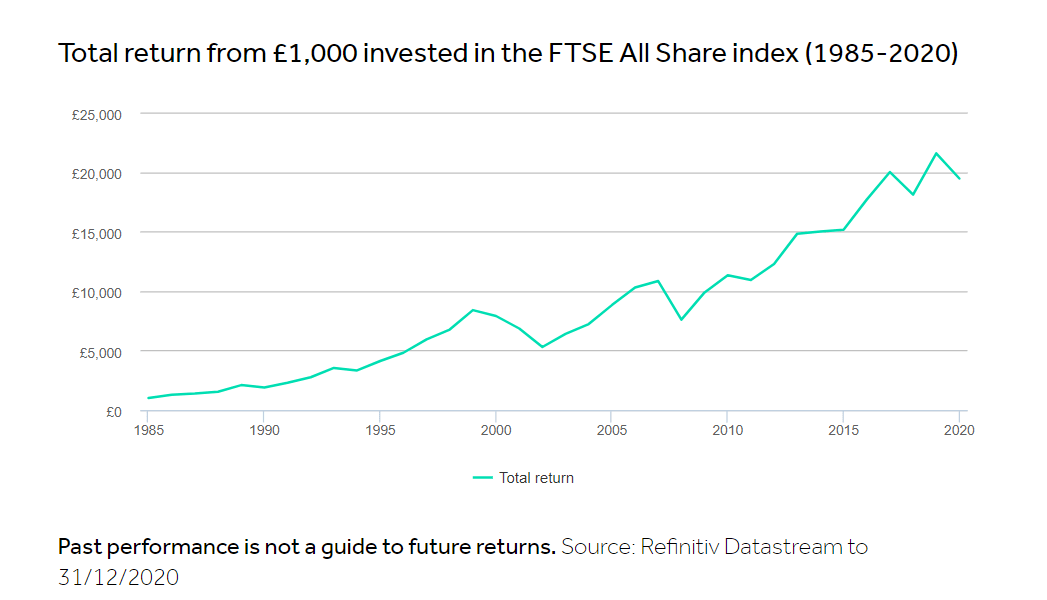

The UK equity market is one of the best markets for income-seeking and long-term investors. In the universe of international stocks, UK stocks are traditionally known for their high dividend yields. In addition, like other developed markets, British stocks also perform well in the long run measured in years or decades. The following chart shows the long-term total return from 1985 to 2020 for FTSE All Share Index. This index consists of the FTSE 100, 250 and the Small Cap Index for a total of about 600 of the largest companies in the UK market.

Click to enlarge

Source: ”The Folklore of the Market” – investing lessons from the 1950s, Hargreaves Lansdown

From the above article:

In the long run (1985-2020) the UK stock market has given investors a total return of a little under 9% a year. Sometimes you might invest in a company or fund that does better than that. Sometimes it will do worse. 9% a year isn’t bad going though, even if future returns might be less generous. Remember that nothing is guaranteed and you could get back less than you invest.

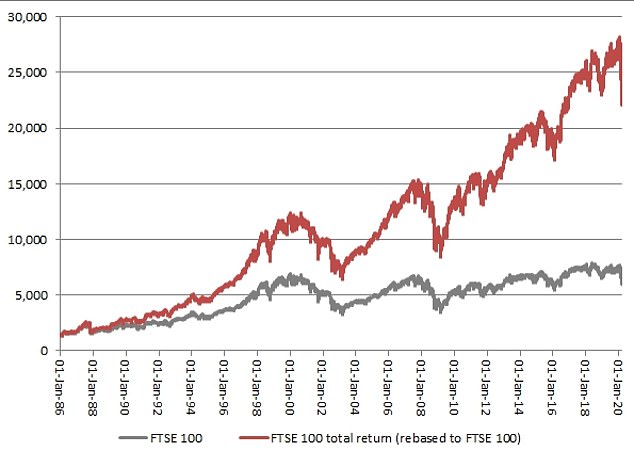

The FTSE All Share Index had a dividend yield of 3.57% as of Dec 31, 2020. The FTSE 100’s dividend yield was even better at 3.77%. This rate is about double that of the yield for the S&P 500. The dividend yield of the S&P 500 is usually under 2%. The high yield on the FTSE 100 can lead to astonishing returns over the run. The chart below shows the wide gap in returns between the FTSE 100 Price Return and Total Return from 1986 thru early 2020.

Click to enlarge

Source: This is Money

The key takeaways are: investing for the long-term can produce excellent returns and high dividends can earn a better total returns than just price returns.

Related: