The U.S. equity market as represented by the S&P 500 has performed very well this year with a return of 17.2% so far based on price return only. When dividends are included the returns will be a bit slightly higher. The returns on the index over the 5 and 10 year period is also very good. Ever since the Global Financial Crisis(GFC) of 2008-09 American equities have enjoyed a strong bull market.

On the other hand, European stocks have languished year over year. Since the GFC, they have under-performed their US peers by a wide margin to say the least.

Let’s take a quick look at the returns of these markets using an ETF as a proxy. The SPDR S&P 500 ETF (SPY) mimics the S&P 500 while the SPDR STOXX Europe 50 ETF (FEU) mirrors the Stoxx 50 index which is the benchmark for European markets including the UK.

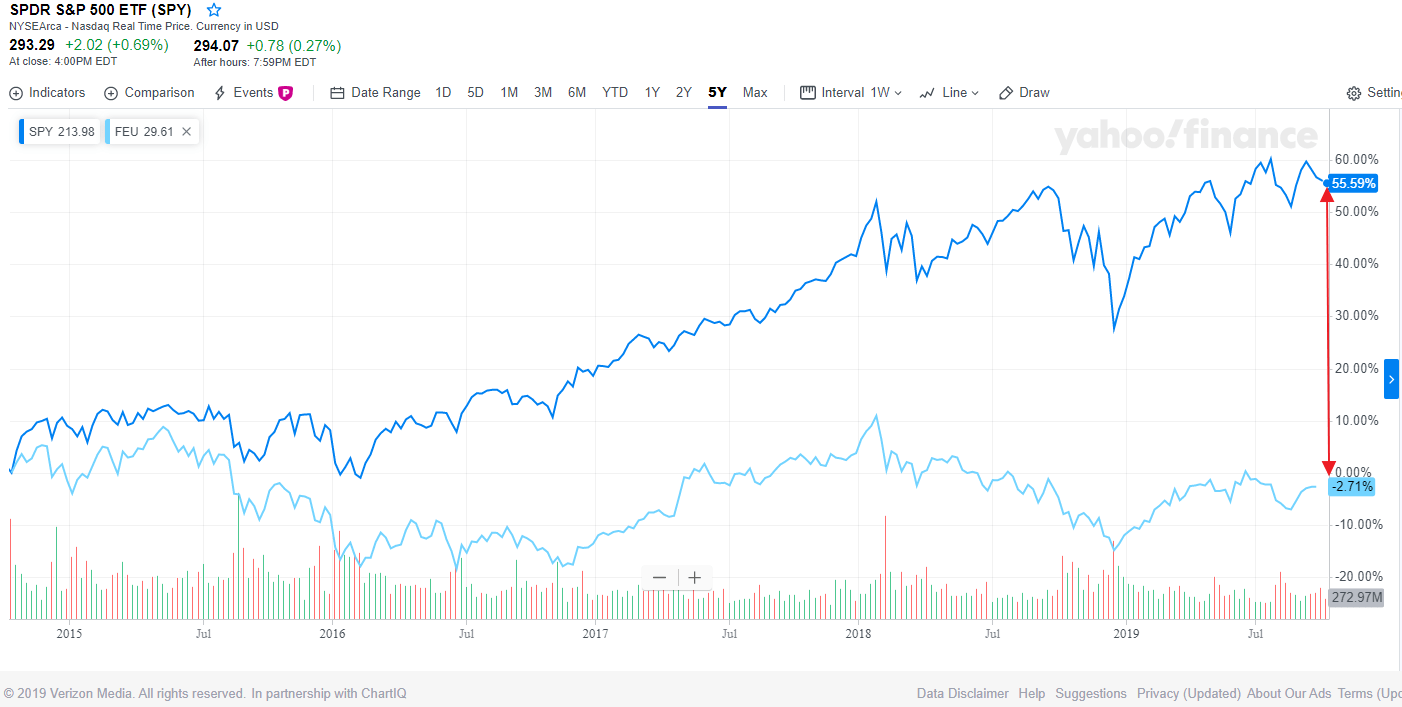

The following chart shows the returns of the two ETFs in the past 5 years:

Click to enlarge

In the past five years, FEU is in the negative territory. But SPY has had an excellent run with returns of over 55%.

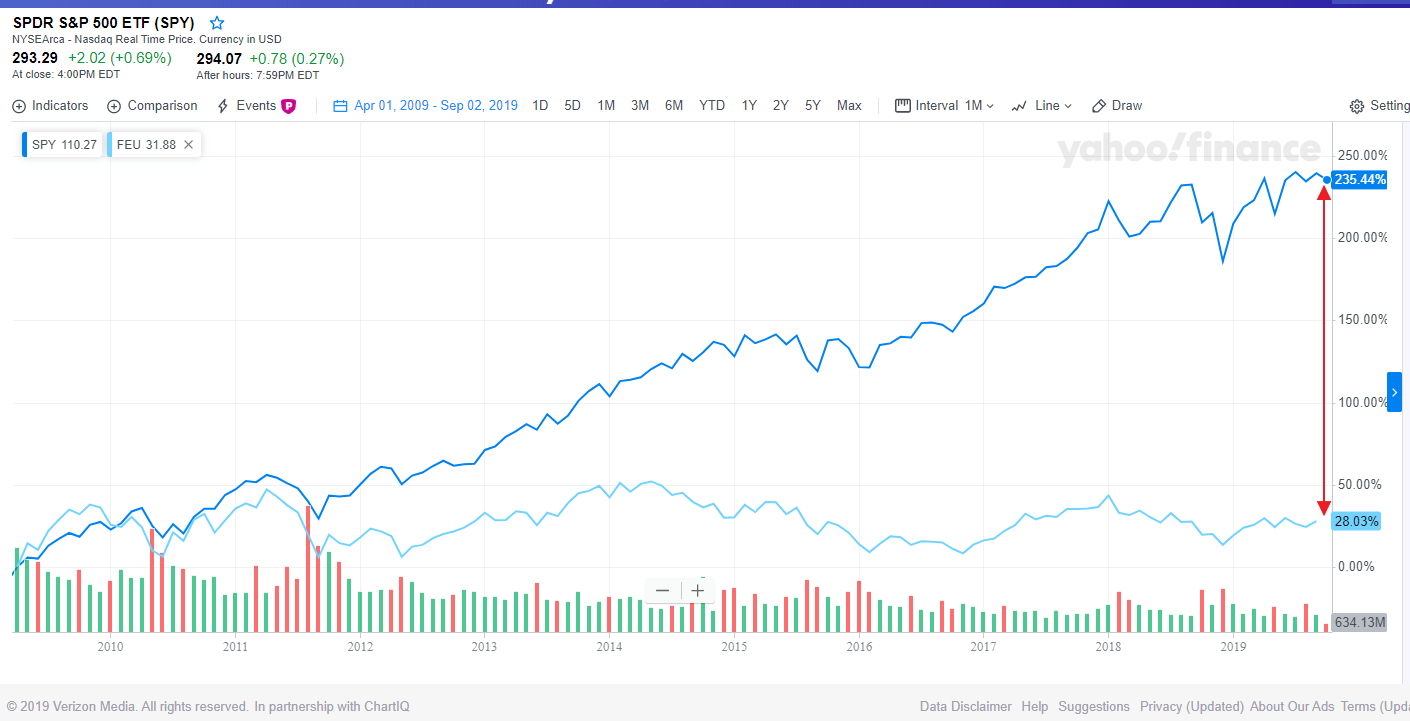

The following chart shows the returns of the two ETFs since April 1, 2009 (approx. trough of GFC):

Click to enlarge

Source: Yahoo Finance

While the SPY has shot up by over 235%, its European equivalent has had a tiny gain of only 28%. The gap in returns is indeed astonishing.

Why European stocks have poorly performed relative to their American peers?

Some of the reasons for the awful performance of European stocks are: lackluster European economic growth, dithering politicians and regulators more interested in drama than substance, lack of swift policy actions, lack of focus on growth by firms, too many political and economic crises wasting time and resources, meager innovation in many industries, etc.

It remains to be see if European stocks stage a comeback in the next 5 years or so bringing joy to equity investors.

Related ETFs:

Disclosure: No Positions