The global oil industry got a wakeup call with the huge attack on two Saudi oil facilities on Saturday. Oil prices are soaring Sunday night as a result of this attack. Experts in the media are using words such as “game changer”, “crippling”, “big deal”, “big one” etc. to describe the attack. The use of drones by ragtag Houthi militants in Yemen or even by militarily insignificant Iran to successfully target one of the critical supply chains in the global oil market is indeed surprising. We can expect oil prices and oil stocks to rise as the Middle East gets hot again. Starting a war with Iran or other countries in the region will only make the situation worse and accelerate the global economy’s slide into recession. With that said, below are some of the news articles and oil resources that can help investors analyze the events and make informed decisions.

From an article in the BBC:

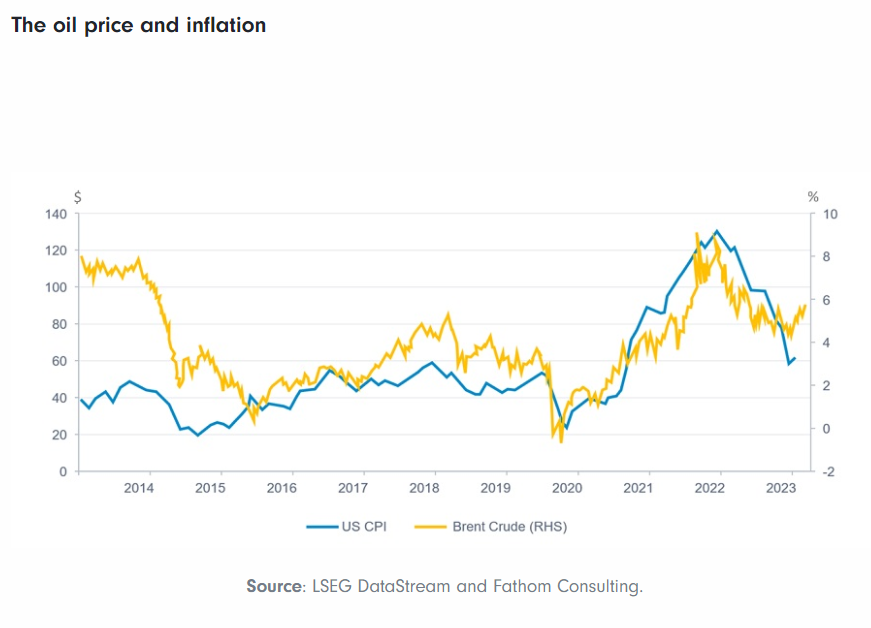

Oil prices hit their highest in four months after two attacks on Saudi Arabian facilities on Saturday knocked out more than 5% of global supply.

At the start of trading, Brent crude jumped 19% to $71.95 a barrel, while the other major benchmark, West Texas Intermediate, rose 15% to $63.34.

Prices eased back slightly after US President Donald Trump authorised the release of US reserves.

It could take weeks before the Saudi facilities are fully back on line.

State oil giant Saudi Aramco said the attack cut output by 5.7 million barrels per day, at a time when Aramco is trying to ready itself for what is expected to be the world’s largest stock market listing.

The drone attacks on plants in the heartland of Saudi Arabia’s oil industry included hitting the world’s biggest petroleum-processing facility. The US has blamed Iran.

Source: Oil prices soar after attacks on Saudi facilities, The BBC

From a piece in MarketWatch:

An intensifying Middle East conflict is threatening to throw the world’s energy market into disarray after weekend drone attacks destroyed parts of Saudi Aramco’s Abqaiq plant — one of the world’s largest processors of oil — and a separate nearby oil field.

On Saturday, the drone attacks, directed at Saudi Arabian oil facilities that account for nearly 10 million barrels of crude-oil production, resulted in massive plumes of black smoke emanating from the oil field, and a shutdown that could lead to about 50% of its production being at least temporarily thrown offline.

Prominent crude-oil strategist Phil Flynn at Price Futures Group told MarketWatch on Sunday that the drone strike was a “big deal” that could result in a major spike in crude-oil prices, because of the potential disruption to global supplies.

Source: Why the Saudi oil attack is a ‘big deal’ that could be a ‘game changer’ in stock markets and crude prices, MarketWatch

An excerpt from an article in WSJ:

Saturday’s attack on a critical Saudi oil facility will almost certainly rock the world energy market in the short term, but it also carries disturbing long-term implications.

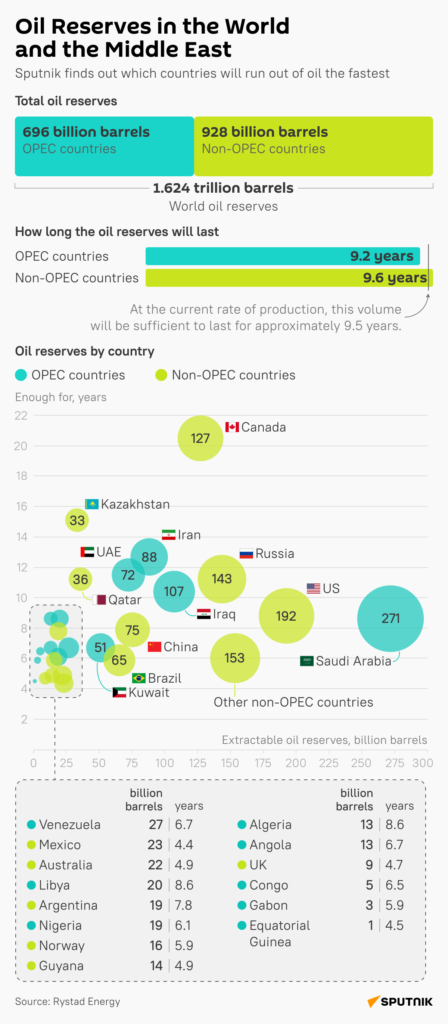

Ever since the dual 1970s oil crises, energy security officials have fretted about a deliberate strike on one of the critical choke points of energy production and transport. Sea lanes such as the Strait of Hormuz usually feature in such speculation. The facility in question at Abqaiq is perhaps more critical and vulnerable. The Wall Street Journal reported that 5.7 million barrels a day of output, or some 5% of world supply, had been taken offline as a result.

To illustrate the importance of Abqaiq in the oil market’s consciousness, an unsuccessful terrorist attack in 2006 using explosive-laden vehicles sent oil prices more than $2.00 a barrel higher. Saudi Arabia is known to spend billions of dollars annually protecting ports, pipelines and processing facilities, and it is the only major oil producer to maintain some spare output. Yet the nature of the attack, which Iranian-supported Houthi fighters from Yemen claimed was the result of an attack by their forces, shows that protecting such facilities may be far more difficult today. U.S. officials blamed Iran and U.S. and Saudi officials were investigating the possibility that another Iranian-backed group carried out all or part of the attack using cruise missiles launched from Iraq. Iranian officials on Sunday denied responsibility for the attacks.

Source: Saudi Oil Attack Is the Big One, WSJ

Related Resources:

a) Oil Stock Lists:

- The Complete List of Oil and Gas Producers Trading on the NYSE, TFS

- The Complete List of Oil and Gas Producers Stocks Trading on NASDAQ, TFS

- The Complete List of Exchange-listed Oil and Gas Producers ADRs

- The Complete List of Oil & Gas Transmission Stocks Trading on the NYSE, TFS

- The Complete List of Oil Refining & Marketing Stocks Trading on the NYSE, TFS

b) Articles:

- Winners and Losers From Lower Oil Prices

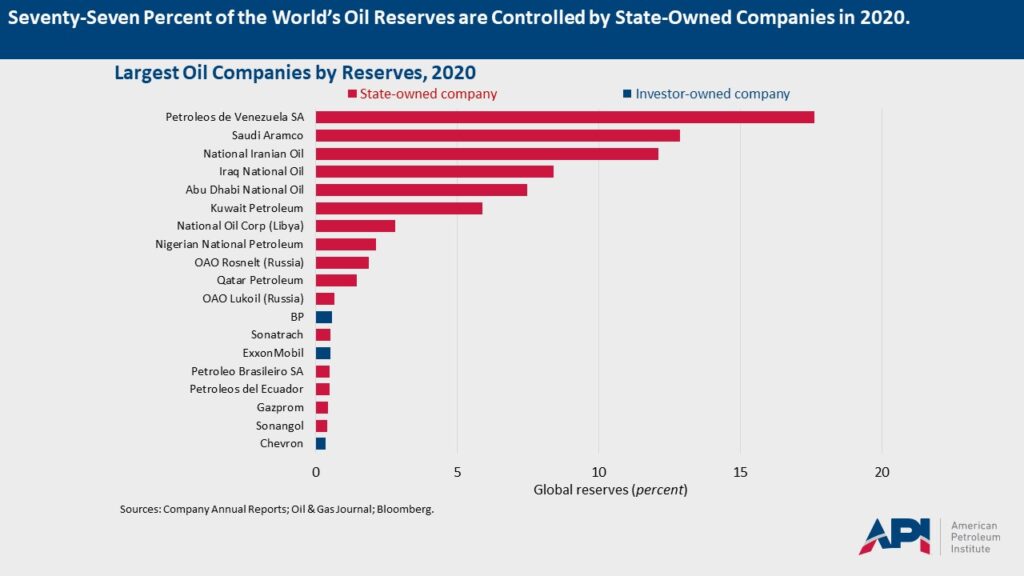

- The World’s Oil Reserves by Country

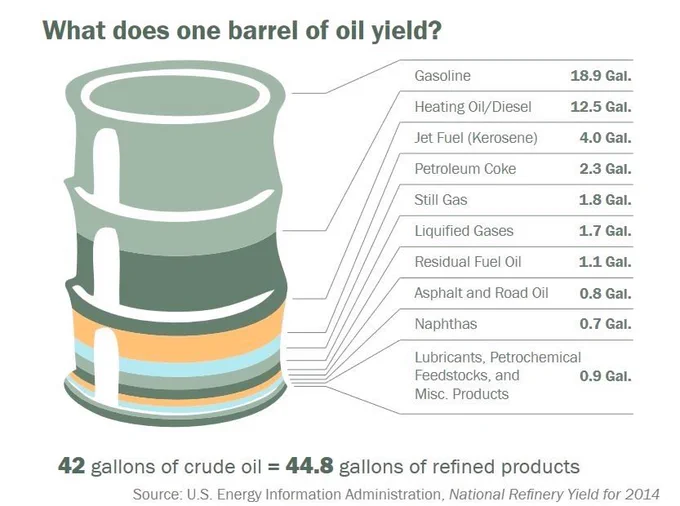

- 10 Fascinating Facts About Oil

- The Real Price of Oil Since 1861: Chart

- This Chart Shows Crude Oil Is A Very Volatile Commodity

- What is the Long-Term Relationship Between Oil and Stocks?

- On Big Oil’s Profit Gusher: Chart

- The Cost of Extraction of Oil by Different Methods

- The Top 20 Global Integrated Oil and Gas Companies 2018