Oil is the most important commodities in the world. The price of crude oil impacts most of the global economies. Rising oil prices tend to be a boon to oil producing countries but adversely affect consuming countries. Despite being the most important and highly traded commodity, the price of oil is one of the mysteries of the modern world. Unlike other products, the economic concepts like law of supply and demand, capitalism, etc. does NOT apply to the oil market. In addition, while hoarding of a product to manipulate its price in the open market is illegal in all countries particularly strictly enforced in the developed countries, the oil market is an exception. Unlike any other market, cartels are legally allowed in the oil market whereby a group of countries can control the price of the oil. For example, cartels like OPEC does not exist and are not legally allowed for other commodities or products such as milk, beer, copper, iron ore, gold, etc.

With Brent oil prices now trading at over $72 per barrel for September 2018 delivery, some experts are predicting prices to reach over $100 soon.

Canadian magazine Maclean’s published an article titled What fuels oil prices? by on Friday discussing the factors that drive the price of oil. The following are some of the key takeaways and my comments from that article:

- The price we pay at the pump is determined more by politics than supply and demand.

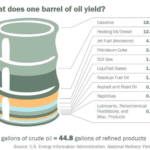

- Oil prices are not determined by the supply and demand of physical oil. In fact, every barrel of physical oil is now traded nine to 12 times on future markets.

- The demand for oil is known as what’s called price inelastic.This means unlike other products demand does not collapse when prices rise to very high levels. For example, even at $4 a gallon a few years people had to use their cars. Though demand slightly decreased because there is no substitute for oil, people could not simply stop filling at the pump despite the exorbitant prices.

- But small changes in supply immediately impacts oil prices. For instance, some warlord in Libya shutting down a well or some guys with blowing up a pipeline Nigeria will lead to jump in prices.

- Oil is the world’s primary source of commercial energy.

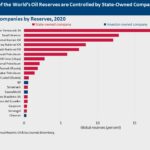

- Seven large, fully integrated multinational corporations flying the flags of primarily two countries (five of them American and two European) dominate the global oil market.

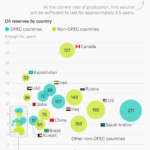

- Though oil is produced in many countries, production costs vary widely. The marginal cost (the cost of producing an additional barrel of oil) is lowest in Saudi Arabia at US$8.98 per barrel; the highest in the U.K. at US$44.33. In Canada, it’s $26.24.

- Saudi Arabia has the lowest cost of production. (On a related note, though the US produces almost an equal amount of oil like Saudi Arabia, the Saudis still hold the power to control the price of oil. This is oil production in the US is in the hands of hundreds of shale producers and NOT by a single company. So the Saudis, not the US, get to determine the price of oil in the global market).

- Oil producing countries such as Saudi Arabia and Russia need at $100 a barrel to balance their budgets.

- Production of oil concentrated in few areas and few hands. For instance, a small group emerging countries mainly the Middle East produce and export most of their oil to major consumers – the US, Japan, Western Europe and China.

Source: What fuels oil prices? by

Related ETF:

- United States Oil Fund(USO)

Disclosure: No Positions

Related:

- Imagine a World Without OPEC, Bloomberg, July 2017