One of the simplest and easiest strategies to be successful in equity investing is to diversify. Diversification involves spreading one’s portfolio between various asset types such as stocks,bonds, gold, etc. Within an asset class it is important to hold many types of that asset. For stocks, one can hold US stocks, foreign stocks, small cap, mid-cap, large-cap, etc.

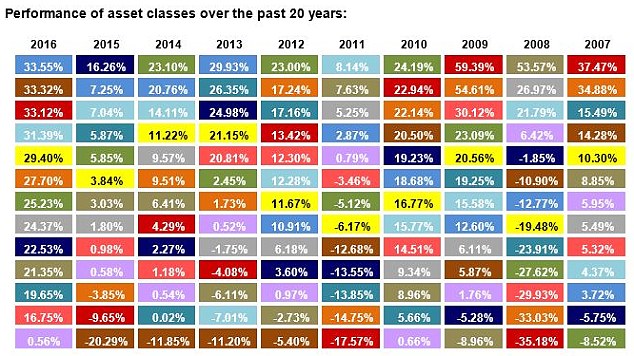

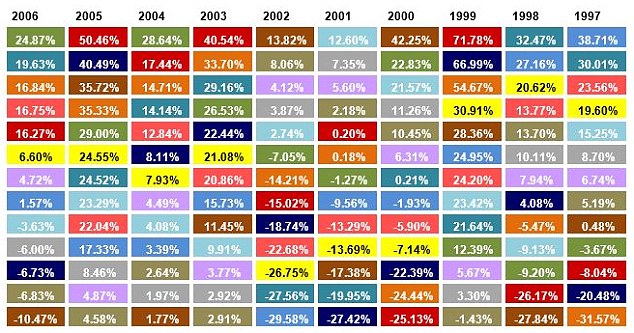

Diversification is highly important because no single asset class has been the top performer every year. I have written about this using Callan Charts below. In the following charts from Fidelity International, we see why the benefits of diversification cannot be under estimated.

Click to enlarge

Source: Top investment performers of the past two decades revealed, This is Money

Related ETFs:

- iShares MSCI United Kingdom Index (EWU)

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Markets ETF (EEM)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

- Vanguard Total Bond Market ETF (BND)

Disclosure: No Positions