Gold prices closed at $1,280.20 per ounce for August 2017 delivery in New York on Friday. Gold is currently in a bull market that started last year. In the past 5 years though gold has lost 21% according to Kitco. Since 2000, gold has returned over 344% based on prices in US dollars.

5-Year Gold Price Chart

Click to enlarge

Source: Kitco

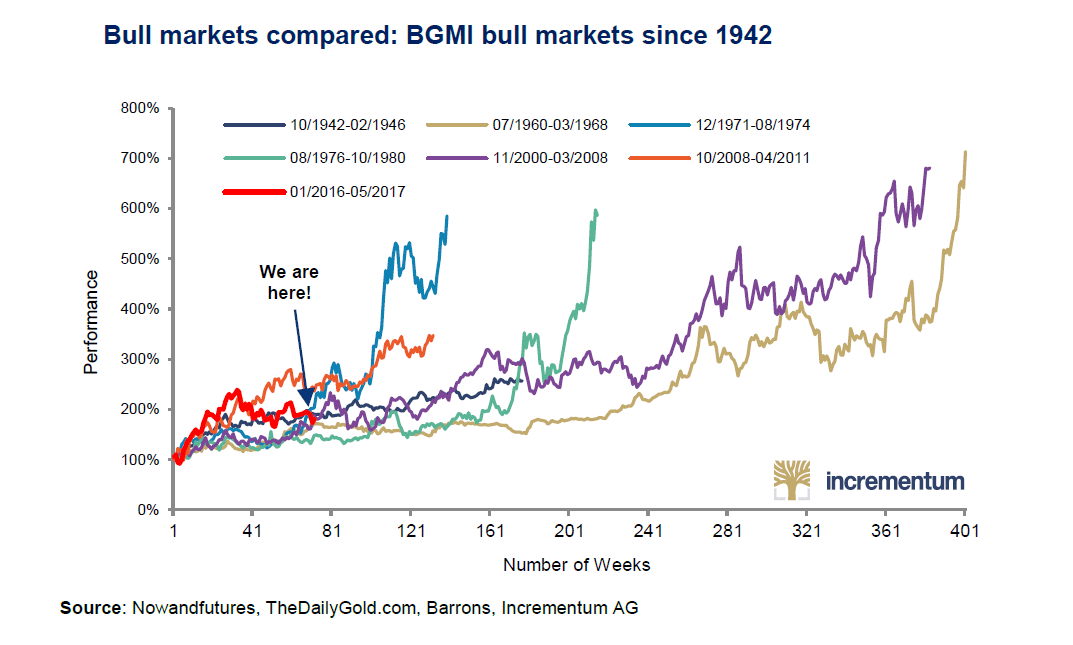

One of the questions on gold investors’ mind may be how long the current bull market in gold will continue? As an asset class, gold prices are volatile and the prices move on a variety of factors including demand in Asian countries like China and India, crashes in equity markets, etc. In a report released last week Liechtenstein-based Incrementum stated that the current bull market could continue when compared with past bull markets.From the In Gold We Trust report:

If one looks at all bull markets in the Barron’s Gold Mining Index (BGMI)13, one notices that the current uptrend is still relatively modest in terms of duration and performance compared to its predecessors. Should we really be on the cusp of a pronounced uptrend in the sector – which we assume to be the case – quite a bit of upside potential would remain.

Click to enlarge

Source: In Gold We Trust, Incrementum

Hat Tip: Frank Holmes @ US Funds

Download: In Gold We Trust 2017 report (in pdf format)

Related ETF:

- SPDR Gold Shares Trust(GLD)

Disclosure: No positions