The ETF industry has grown exponentially in the past few years with hundreds of funds trading the market today. A few of the funds that were unable to garner enough assets or liquidity have died. However every month new ones continue to be created.

ETFs are available for every type of investor need.Wall Street has sliced and diced all the equities into various types based on asset, sector, country, region, market cap, environmental/social, etc. It seems that at this rate companies may eventually run out of letter combinations and may end up going to numbers to accommodate yet more funds. It should be noted however that many of the funds do not become successful but still languish on the market with low asset sizes. Some of the funds tend to have assets in the billions while many barely have a few million or even less. For investors looking to enter the world of ETFs it can be a daunting task to sift thru all the funds available on the market.

In this post, let us review the ten largest equity ETFs based on assets held. Though these funds have asset sizes in the billions, investors continue to pour more into them.

The Ten Largest Equity ETFs based on Assets are listed below:

| S.No. | Fund Name | Ticker | Assets (in $ billions) | Expense Ratio | Launch Date |

|---|---|---|---|---|---|

| 1 | SPDR S & P 500 ETF | SPY | 178.00 | 0.09% | 1/22/1993 |

| 2 | iShares Core S & P 500 ETF | IVV | 68.00 | 0.07% | 5/15/2000 |

| 3 | Vanguard FTSE Emerging Markets ETF | VWO | 66.00 | 0.15% | 3/4/2005 |

| 4 | iShares MSCI EAFE ETF | EFA | 62.00 | 0.33% | 8/14/2001 |

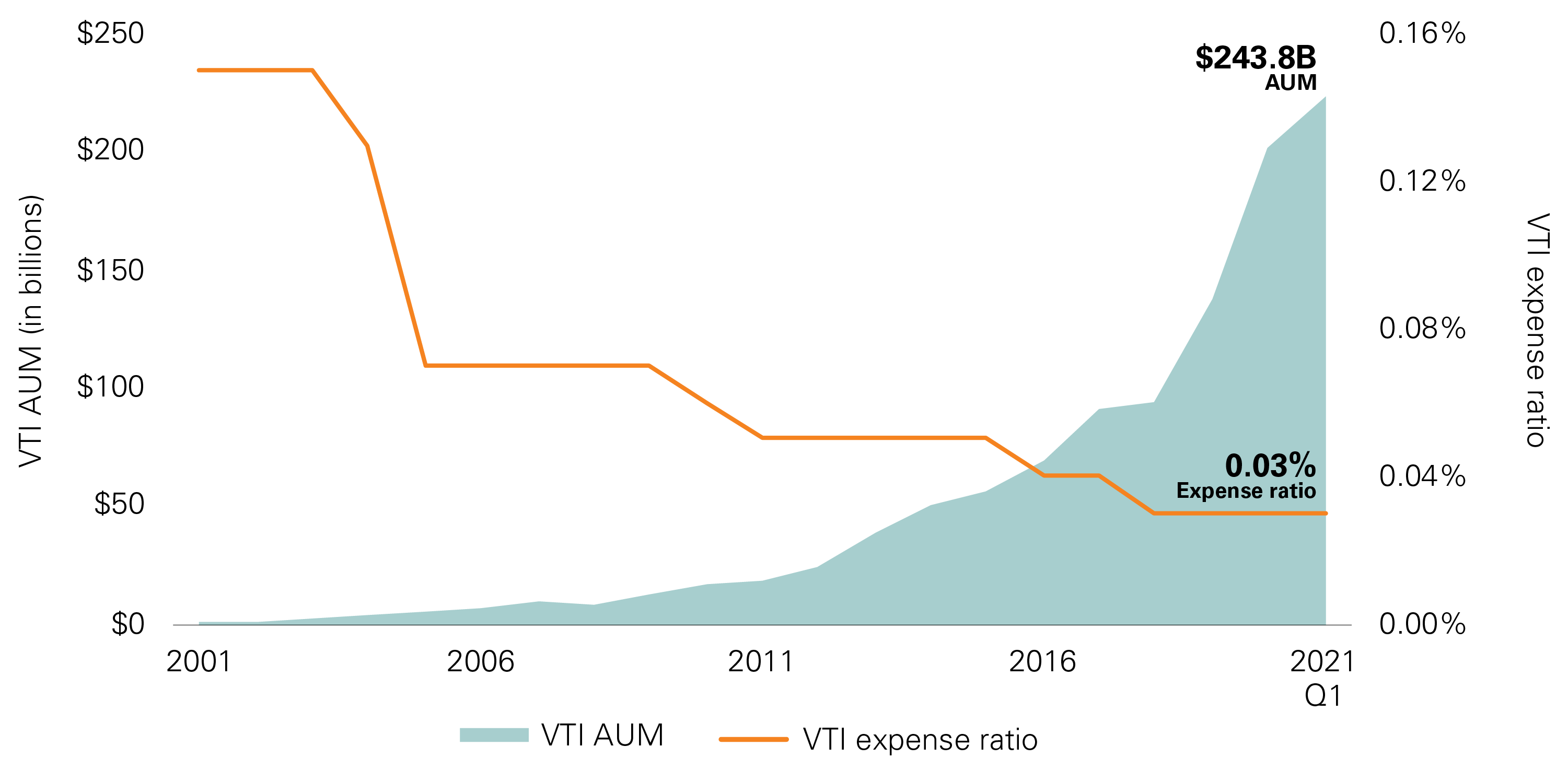

| 5 | Vanguard Total Stock Market ETF | VTI | 57.00 | 0.05% | 5/24/2001 |

| 6 | PowerShares QQQ Nasdaq 100 | QQQ | 39.00 | 0.20% | 3/10/1999 |

| 7 | Vanguard S&P 500 ETF | VOO | 32.00 | 0.05% | 9/7/2010 |

| 8 | iShares MSCI Emerging Markets Index Fund | EEM | 29.00 | 0.67% | 4/7/2003 |

| 9 | iShares Russell 1000 Growth ETF | IWF | 29.00 | 0.20% | 5/22/2000 |

| 10 | Vanguard FTSE Developed Markets ETF | VEA | 28.00 | 0.09% | 7/20/2007 |

Source: WSJ and respective providers

The largest fund is the SPDR S & P 500 ETF(SPY) which tracks the S&P 500 index. As the index is the barometer of the US equity market, it is not surprising to see that the fund tops the list with an asset base in excess of $178 billion. Funds targeting the broad emerging markets and developed markets are also in the list as investors try to gain exposure to these markets in a simple and easy way. The PowerShares QQQ Nasdaq 100(QQQ) has been a perennial favorite for years for investors focused on investing in tech stocks.

In terms of fees, most the of the above funds have very low expense ratios making them extremely attractive to investors.

Disclosure: No Positions