Currently the top U.S. tax rate on qualified dividends is 15%. This rate applies to tax-payers who are in the 25% to 35% tax brackets. This means that hypothetically an ordinary American in the 25% tax bracket having an earned income of $50,000 and getting a $1,000 in qualified dividends pays $150 in dividend taxes and a multi-millionaire in the highest tax bracket of 35% having an earned income of $120.0 million and getting the same $1,000 in qualified dividends also pays $150 in dividend taxes. Qualified dividends are dividends earned from stocks held for more than one year 60 days. This low dividend tax rate is set to expire on Dec 31, 2012 unless Congress extends the current tax rates.

The Wall Street Journal’s Jason Zweig discussed this issue in an article last month. From Dividends: Start Screaming:

At one second after midnight on Jan. 1, 2013, the maximum tax rate on dividends is likely to go from 15% to either 18.8% or 43.4%. The best-case scenario: Congress retains the top dividend-income tax rate of 15%, and the only increase is the scheduled 3.8% surtax on investment income for high earners. The worst case: Congress decides dividends are to be taxed at ordinary-income rates, and the highest rate jumps to 39.6%, plus the same 3.8% surtax.

The payout ratio for U.S. companies is near the all-time low of 34%. Here is another interesting quote mentioned in the article:

C.J. MacDonald, a portfolio manager at Westwood Holdings, an investment firm in Dallas, points out that companies paid out roughly 60% of their earnings as dividends in 1960—even though the tax rate on dividends topped out then at a confiscatory 91%.

So U.S. firms paid out a larger portion of their earnings even when the top dividend tax rate stood at 91% compared to the low rate now and they did not withhold profits due to the higher taxes for shareholders.

What will be the impact of a higher tax rate on dividends for dividend-paying stocks?

The investment advisory firm of Miller/Howard Investments, Inc. has published a white paper analyzing the answer to the above question. The paper states that it will not matter for investors in dividend stocks if the tax regime changes.

The research paper referenced a Federal Reserve study where the authors analyzed the effect of tax changes using US stock market vs. European markets, US stock market vs. REITs (as the tax cut did not benefit income from REITs), and high-yield dividend stocks (3% yield and greater) vs. low-yield stocks and non-dividend payers. Their conclusions were:

- There was little if any imprint of the dividend tax cut on the value of the aggregate stock market.

- High-yield stocks did receive a boost but the effects were short-lived.

- REITs dropped on the day before bill was signed but recovered within days.

- A substantial portion of US stocks were held in accounts or entities for which the lower dividend tax rate did not apply.

Similar to the top dividend tax rate at 15%, the top long-term capital gains tax rate is also 15% for investors in the 25% or higher tax-brackets. Long-term capital gains applies to gains from assets held for over one year.

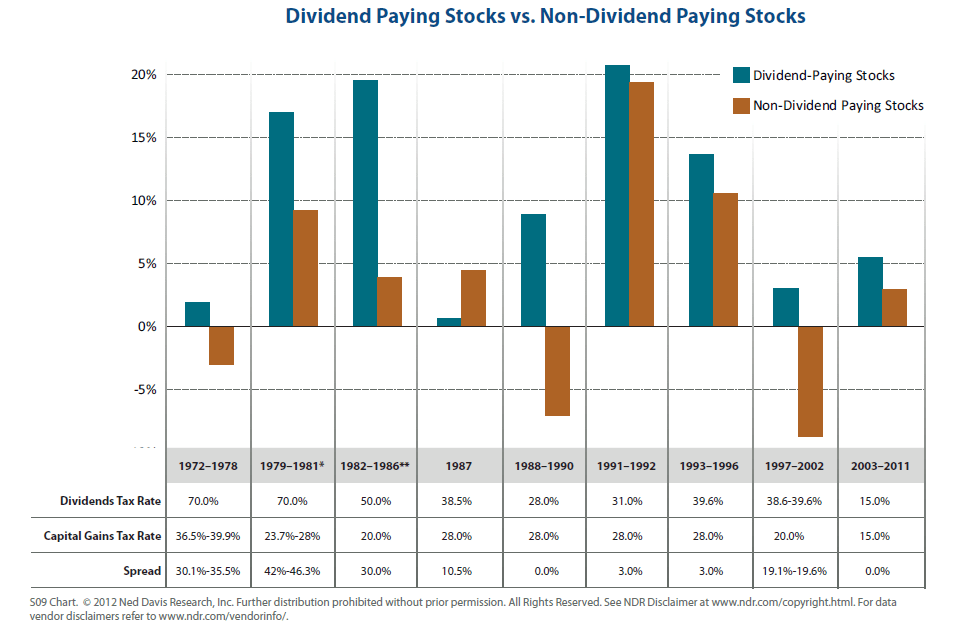

How did dividend-paying perform when the capital gains tax rate and dividend tax rates were different?

The following chart from Ned Davis Research comparing the performance of dividend-payers and non-dividend payers over different tax regimes in the past offers the answer:

Click to enlarge

via Ned Davis Research

The chart shows that there was no impact on the performance of dividend-paying stocks even with beneficial capital gains tax rate over dividend tax rate.

Source: A dividend tax hike? What does it mean for dividend-paying stocks?, Miller/Howard Investments, Inc.

I agree that any tax changes on dividends after Dec 31, 2012 will not affect the performance of dividend stocks. Even though there may be a slight impact in the short-term, prices should recover quickly. Another factor that must be considered is that most of the stocks are held in non-taxable retirement accounts such as 401(K), IRAs etc. where earnings grow tax-free until withdrawn.Hence in summary, dividend investors need not worry too much about any tax law changes. Instead of wondering about what Congress might do, investors can take advantage of the current lower dividend stock prices and add to their portfolios now through the rest of the year.

Related ETFs:

iShares Dow Jones Select Dividend ETF (DVY)

SPDR S&P Dividend ETF (SDY)

Vanguard Dividend Appreciation ETF (VIG)

Vanguard High Dividend Yield ETF (VYM)

Disclosure: No Positions