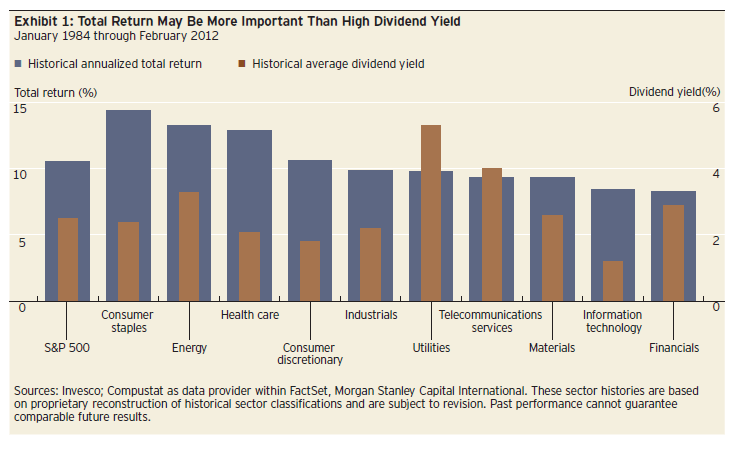

When considering dividend-paying stocks, some investors tend to select stocks with high dividend yields rather than the long-term total return. However this is not a winning strategy. Instead of falling into the so-called “yield trap”, investors are better off picking stocks based on total return over the long-term, according to a research report by Invesco published earlier this year.

Click to enlarge

Source: Investment Insights: In the Long Run with Dividend-Paying Stocks, Invesco

Among the S&P’s ten sectors, traditionally the utility sector has had the highest dividend yield. But the sector ranks the sixth in terms of total return during the period shown in the chart above. On the other hand, the consumer staples sector has lower yield than the utilities sector and is comprised of many of the oldest dividend payers and growers. But this sector ranked the highest in total returns during the same period. The financial and telecom sectors also returned lower total returns despite having high dividend yields.

In order to test this theory I reviewed the ETFs corresponding to the ten S&P sectors. The current dividend yields of the SPDR ETFs for the sectors are noted below:

| S.No. | S&P Sector | ETF Name | Ticker | Dividend Yield as of Nov 23, 2012 |

|---|---|---|---|---|

| 1 | Consumer Discretionary | Consumer Discretionary Select Sector SPDR Fund | XLY | 1.45% |

| 2 | Consumer Staples | Consumer Staples Select Sector SPDR Fund | XLP | 2.71% |

| 3 | Energy | Energy Select Sector SPDR Fund | XLE | 1.71% |

| 4 | Financials | Financials Select Sector SPDR Fund | XLF | 1.69% |

| 5 | Health Care | Health Care Select Sector SPDR Fund | XLV | 1.95% |

| 6 | Industrials | Industrials Select Sector SPDR Fund | XLI | 2.20% |

| 7 | Information Technology | Technology Select Sector SPDR Fund | XLK | 2.15% |

| 8 | Telecommunication Services | Technology Select Sector SPDR Fund | XLK | 2.15% |

| 9 | Materials | Materials Select Sector SPDR Fund | XLB | 2.08% |

| 10 | Utilities | Utilities Select Sector SPDR Fund | XLU | 3.60% |

Note: The SPDR Technology Select Sector ETF includes represents both the S&P Information Technology and Telecommunication Services sectors.

Source: SPDR

The SPDR Utilities Select Sector ETF (XLU) has the highest dividend yield at 3.60% and the Consumer Staples ETF(XLP) has a yield of 2.71%.

In terms of returns, the 5-year return for XLP is 7.96% while the XLU grew by just 2.15%. For the 10-year period, XLU was up by 10.94% and XLP was up 8.55%.

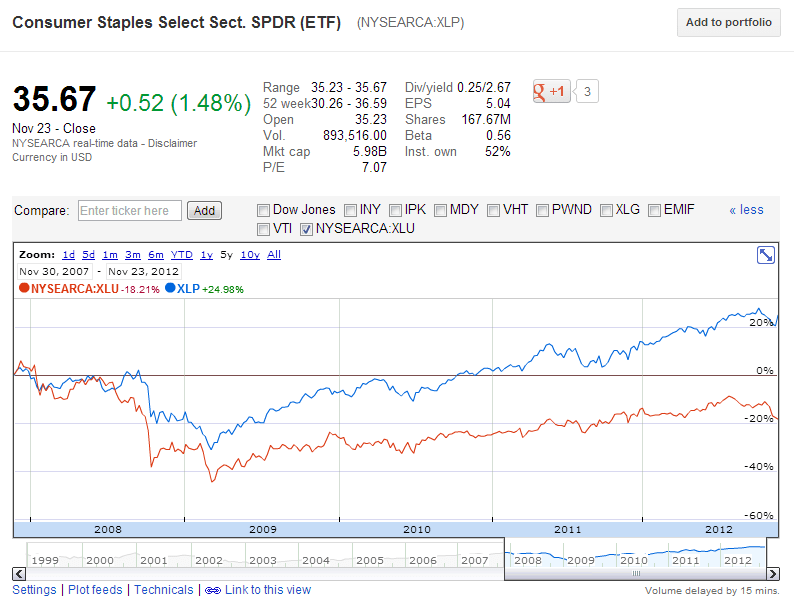

The following chart shows the 5-year price return of the utilities and consumer staples sector ETFs:

Click to enlarge

The utilities sector ETF severely lagged the performance of the consumer staples sector ETF. If dividends were added and total returns calculated the variance would be even higher.

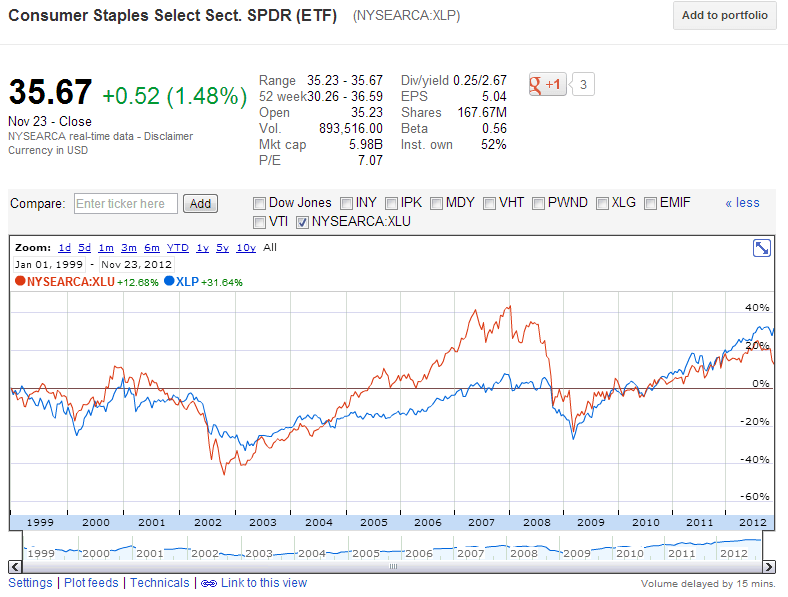

The following chart shows the price return of the utilities and consumer staples sector ETFs since 1999:

Click to enlarge

Source: Google Finance

In the long-term also, the utilities sector ETF’s return was lower than that of the consumer staples sector ETF’s return.