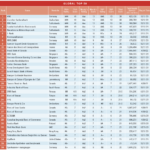

The Financial Stability Board (FSB) has published the list of global banks that are too-big-to-fail. These banks are required to hold as much as 2.5% more capital than other banks by the end of 2012.

The 29 global systemtacially important banks are:

Bank of America Corp.(BAC)

Bank of China Ltd. (BACHY)

Bank of New York Mellon Corp.(BK)

Groupe Banque Populaire

Barclays Plc (BCS)

BNP Paribas SA (BNPQY)

Citigroup Inc. (C)

Commerzbank AG (CRZBY)

Credit Suisse Group AG (CS)

Deutsche Bank AG (DB)

Dexia SA

Goldman Sachs Group Inc.(GS)

Credit Agricole SA

HSBC Holdings Plc (HBC)

ING Groep NV (ING)

JPMorgan Chase & Co.(JPM)

Lloyds Banking Group Plc (LYG)

Mitsubishi UFJ Financial Group Inc.(MTU)

Mizuho Financial Group Inc. (MFG)

Morgan Stanley (MS)

Nordea Bank AB (NRBAY)

Royal Bank of Scotland Group Plc (RBS)

Banco Santander SA (SAN)

Societe Generale SA (SCGLY)

State Street Corp (STT)

Sumitomo Mitsui Financial Group Inc. (SMFG)

UBS AG (UBS)

Unicredit SpA

Wells Fargo & Co. (WFC)

Via: Financial Post

Disclosure: Long many banks in this list