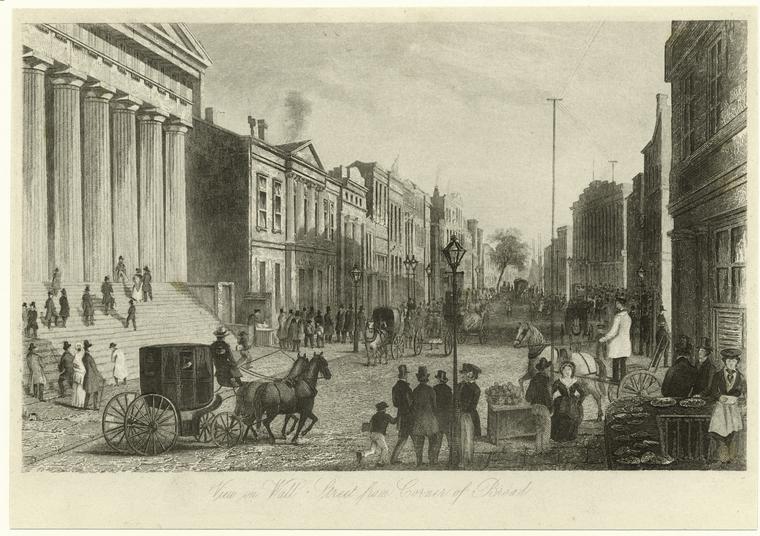

Wall Street in the 1800s

I came across a paper on total returns of bonds, stocks and bills by Dr. Bryan Taylor of Global Financial Data, Inc. The following are some interesting facts from the paper about investing in financial assets during the 1800s in the U.S. :

- “Most people invested in bonds, not stocks

- Virtually all of an equity investor’s returns came in the form of dividends, not capital gains

- There was little difference in the returns to stocks and bonds

- Since the government did not issue treasury bills and deposits were not federally insured, there was no “risk free” investment available to investors

- Bond and dividend yields declined over the course of the century as the risk to investors and inflation declined.

- Although prices rose and fell in any given year, from 1815 to 1914, there was no overall inflation in the US and in most countries on the Gold Standard.”

By the end of the 20th century, most investors were investing in stocks and not bonds and were dependent more on capital gains rather than dividends. In addition, they had risk-free alternatives, saw the interest rates during most of the 20th century and endured one of the worst inflation in human history. It will be interesting to see how the investment world changes in the next century.

Source: GFD Guide to Total Returns on Stocks, Bonds and Bills, Dr. Bryan Taylor, Global Financial Data, Inc.

Related:

- “The Folklore of the Market” – investing lessons from the 1950s, Hargreaves Lansdown, Feb, 2021

- Market Crashes, Stock Scandals: Lessons From the U.S. Frontier, The Wall Street Journal, Jan 27, 2016

I’m trying to do research on investing in the 1800s. Could a woman of wealth in the 1800s invest money, and if so what sort of things would she invest in?

Kind regards

Ruth Royce.

Thanks for your comment.Unfortunately I do not have the answer to your question. You can try researching this topic online.

Sorry.

-David

Ruth,

You might want to research Hetty Green. She was nicknamed, “The Witch of Wall Street” and was reportedly the richest woman in the country during the Gilded Age. I read a biography about her a while back and it detailed a lot of her investing strategies.

Sincerely,

Tom

I am studying through the Victorian Era, I would like to know what kind of investments were made in the 1850’s?

Thank you,

Lily Cambles

Sorry. Unfortunately I do not have that info. Please do some research online. Thanks.

Hi David,

Thanks for highlighting a very interesting article by Dr. Bryan Taylor!

I am not sure I agree with your first two bullet points. Could you point out exactly where in the paper those claims are made?

Best,

Michael

Hi Michael

I made a slightly different interpretation for those two points based on the following para in that paper:

“During the 1800s, there was virtually no inflation, equities played a relatively minor role in investment portfolios, such as they were, equities provided virtually no capital gains, making investors almost solely dependent upon dividends for their returns, and since equities were riskier than bonds, the dividend yield exceeded bond yields until the 1950s.”

I wrote this post so long ago. So I may have misinterpreted at that time.

Thanks for the comment.