I wrote a post back in September about why ordinary investors should not time the market. This post adds another angle to the same topic.

The first decade of the 21st century has been called as “The Lost Decade” for U.S. stocks as they were flat to down. In addition, the S&P 500 lost 23% for the period from Dec 31, 1999 thru Dec 14, 2009.

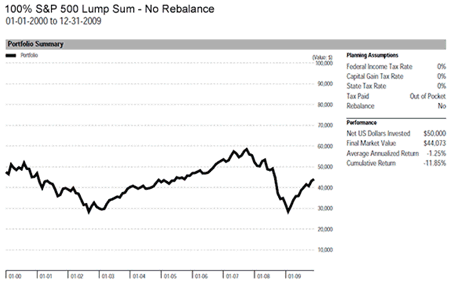

Over the period from the start of 2000 to the end of 2009, a person who had invested a lump sum of $50,000 would have had an annualised return over the period of -1.25%, or a cumulative return of -11.85% as shown in the chart below:

Click to enlarge

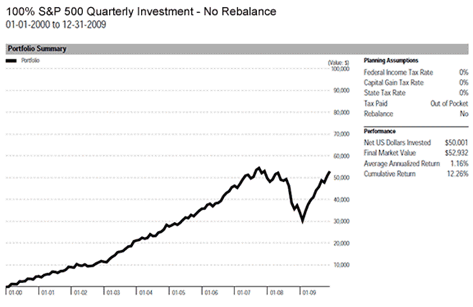

However over the same period, a person who invested $50,000 in quarterly installments of $1,250 would have had an annualised return over the period of 1.16%, with a total cumulative return of 12.26%.

Source: GenXFinance.com

The difference in returns between the two strategies is incredible. The charts also confirm that timing the market does not work. Hence investors saving for retirement (or) other long-term goals should invest periodically even if it is in small amounts. Investors with a large amount to invest should also spread out the investments over a period of time instead of dumping all the funds at one time. This strategy is especially important to adhere to during extreme volatile market conditions like the one global equity markets are going through.

Source: PSG Angle: Control the Controllables and Make Peace with the Rest, PSG Asset Management

Related ETFs:

iShares MSCI Emerging Markets Indx (EEM)

Vanguard Emerging Markets ETF (VWO)

SPDR S&P 500 ETF (SPY)

SPDR STOXX Europe 50 ETF (FEU)

Disclosure: No Positions