Many large U.S. banks were bailed out with tax payers’ funds during the Global Financial Crisis (GFC). Since then these banks have gotten even bigger by acquisitions and decline in competition as struggling smaller banks are left to fail by Uncle Sam. These small group of elite institutions aka known as “Systemically Important Financial Institutions” (SIFIs) are now required to hold more capital as a percentage of assets because of the Dodd-Frank law. This extra capital has come to be known as the “SIFI surcharge” in the industry.

According to an article in The Wall Street Journal recently the global equivalent of this charge is expected to confirmed by the G-20 leaders when they meet in Cannes, France next month.

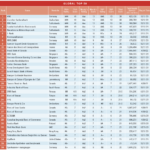

So what are some of the Global Too-Big-To-Fail(TBTF) Banks?

Click to enlarge

Source: Big Banks Find No Comfort in Capital Cushion

Dexia is a French-Belgian bank that is on the verge being dismantled by France and Belgium. From an investment perspective investors may consider adding Sweden-based Nordea Bank (NRBAY). It has a dividend yield of over 5%. While states may declare these banks as TBTF banks it does not mean investors can invest in their common stocks without any worry of getting wiped out. Germany’s Commerzbank (CRZBY), UK’s Royal Bank of Scotland (RBS), etc. may still fail and equities can become worthless but the banks themselves will not disappear completely. They may be merged with other larger peers or reorganized in a different shape.

Disclosure: Long CRZBY, STD, ING,RBS, SCGLY, BBVA