The Too Big To Fail (TBTF) concept is the belief that certain financial institutions are so big and so complex that their failure will be be disastrous to the whole economy. Some of these institutions are indeed so huge that their failure is unimaginable and may wreck the economies of many countries in addition to their domestic economies. Hence in the interest of saving the economy and contrary to economic principles, governments prop them up even if they are about to collapse due to their own reckless actions.

In the U.S., the TBTF concept was put into action during the recent credit crisis when certain financial institutions were saved from collapse. For example, Citigroup (C) and Bank of America (BAC), two of the super-banks were bailed out by Uncle Sam in order to save the economy. Institutions such as Citi and BofA are like giant a octopus that spread its tentacles into every country and every business possible from traditional banking to exotic derivatives to insurance and many others in between. Similar scenarios played out in other countries such as the UK, France, Germany, The Netherlands, etc. where failed TBTF lenders were bailed out in the interest of common good. So investors in these TBTF institutions were protected by the behavior of the respective governments. However while these banks were saved many smaller institutions were allowed to failed. In the U.S. for example, National City Bank, Washington Mutual, Lehman Brothers, Countrywide Financial, Fannie Mae, etc. and many other tiny banks failed as they were considered non-TBTF institutions and were sacrificed for their sins. Accordingly investors in these companies were wiped out for the most part as the state failed to bail them out.

So should investors consider the TBTF theory when making investment decisions?

The answer to the above question is it depends. At the financial institutions level the theory can be considered as one factor when selecting a company for investment. However it cannot be applied to at the country level.

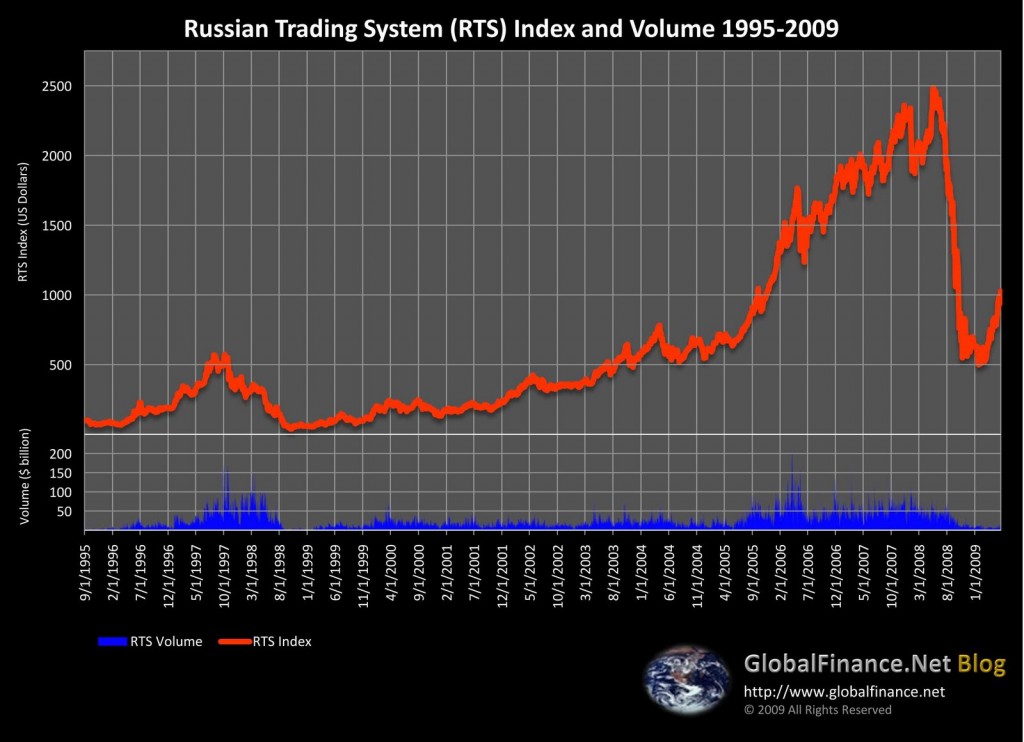

In the early 1990s global investors were attracted to the Russian market after private enterprises bloomed with the fall of communism. By late 1997, the main RTS index peaked at 571, making it the hottest emerging market in the world at that time. But one year later it crashed to an all-time low of 37. The daily trading volume of all shares traded at the stock exchange plunged to just $2 million. The collapse of the Russian equity market was triggered when the government defaulted on bonds and the rubble went into a free fall. Equity investors in the Russian market lost their investments.

RTS Index Chart 1995 – 2009

Click to enlarge

Source: Global Finance Blog

Following the logic of Too-Big-To-Fail theory, investors falsely believed that a nuclear-power such as Russia would never let the economy fail especially since the country of 144 million was just enjoying the early stages of free-market capitalism. However they were proven wrong and the TBTF theory failed miserably when applied at a country level.

From Russian Crash Shows Globalization’s Risks published by The Washington Post in November 1998:

On April Fool’s Day 1998, IMF Managing Director Michel Camdessus, in a speech to the U.S.-Russia Business Council, complained that “cozy relationships” with the government were allowing businesses to avoid paying taxes and compared Russia’s system to the “crony capitalism” of South Korea. “The continued large fiscal deficit leaves Russia highly vulnerable to swings in market sentiment,” he said.

But most investors weren’t listening. One emerging market analyst who left a job at one investment bank to go to another, said, “If markets are going up, there are big bonuses and everybody is happy. If you’re a Cassandra, you could deter money from coming in. People don’t want to hear that kind of thing. They don’t want to hear the bad news.”

In the U.S. banking business, there is a concept known as “too big to fail.” It applies to a handful of banks so big that most investors expect that the U.S. government would bail them out to prevent a broad financial panic even though the U.S. government has no legal obligation to come to the banks’ rescue.

A version of that philosophy applied to Russia. Investors thought it was too great a nuclear power to fail.

(emphasis added)

Update:

On July 1, 2011 Russia bailed out Bank of Moscow with $14.4 billion making it the biggest bailout in the nation’s history according to a report titled The Russian Edition of Too Big to Fail in the latest issue of Bloomberg BusinessWeek.

Disclosure: No Positions

Related ETF:

Market Vectors® Russia ETF (RSX)