Despite the talk of so-called recovery the real economy is still struggling.U.S. banks are still weighed down by loan losses especially on consumer loans such as credit card loans. While the losses from credit losses are smaller compared to residential or CRE mortgages, they are still significant to monitor for many reasons some of which are discussed below.

As unemployment continues to worsen credit card losses will worsen. Consumers usually first default on credit cards before skipping mortgage or car payments since credit cards are unsecured. In a recent report on the credit card industry Credit Suisse analyst Moshe Orenbuch voiced concern over claims that consumer credit is stabilizing. Moshe said “The combination of continued job losses and increasing bankruptcies means that the improvement in losses is over a year away.’’ A bloomberg article last month also mentioned that credit card defaults are increasing as the unemployment rate is rising.

The three biggest credit card issuers – JPMorgan Chase, Bank of America, Citibank – all reported that consumers fell behind on payments last month. Payments overdue at least 30 days are an indicator future defaults.

“Loans at least 30 days overdue climbed to 4.69 percent from 4.48 percent in August at JPMorgan, and to 7.53 percent from 7.47 percent at Bank of America, the companies said in federal filings. Loans at least 35 days late rose to 5.5 percent from 5.38 percent at Citigroup, according to a separate filing by the New York-based lender.

Discover said late payments increased to 5.57 percent in September, from 5.35 percent the previous month. Capital One, the third-biggest issuer of Visa credit cards, said delinquent loans rose to 5.38 percent from 5.09 percent.”

Charge-off rates in July were:

Bank of America(BOA) = 14.54%

Citibank(C) = 12.14

Discover Financial Services(DFS) = 9.16%

Capital One Financial(COF) = 9.32%

American Express(AXP) reported this week that card defaults and delinquencies did not rise in September. 30-day defaults fell to 4.0% from 4.3% in 2Q,2009. Net charge-offs stood at8.6%. Capital One also reported strong results for 3Q,2009.

However one should not take for granted the profit numbers reported by credit card issuers. These companies can easily do many things which can boost the earnings for a quarter such as offering default consumers one-time payment options to make the loans current.

Household debt rose 115.7% over the past 10 years between 1999-2008. But in 2007-2008 it grew only 0.4%. Credit card loans form a significant portion of households as they were easy to get during the credit bubble periods. Credit card issuers pushed them on everyone from college undergrads to illegals who could pay the monthly minimums.

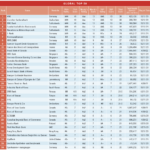

The Top 10 U.S. Credit Card Issuers by Credit and Debt Outstanding at the end of 2008 (Amount in millions of $) (1):

Note:

(1) Credit card loans managed basis includes direct credit card loans to consumers and

securitized loan portfolios that the banks manage. Based on bank regulatory filings with the FDIC

and Federal Reserve.

(2) JPMorgan Chase acquired retail businesses of Washington Mutual.

(3) Wells Fargo & Co. acquired Wachovia Corp.

Source: SourceMedia’s PaymentsSource

It is interesting to see that GE’s GE Money Bank appear in this list. GE is more of a financial services company than an industrial conglomerate nowadays. HSBC North America Holdings is a division of the UK-based HSBC bank(HBC). USAA is a credit union based in Texas that caters mostly to military families.

The September official unemployment rate stood at 9.5%.Most economists estimate that the unemployment rate will exceed 10% some time next year. Already in many states such as Indiana, Michigan the rate is well beyond 10%. Credit card defaults will worsen next year unless the unemployment situation improves.