Over the past few years many US banks have diversified into the insurance sector to increase and smoothen their earnings, offer related financial products to customers. During the credit crisis and the current recession insurance brokerage fee income is helping banks with strong and stable revenues while other types of revenues are decreasing. Due to this effect, venturing into an unrelated industry is helping banks. However banks are better of concentrating their main line of business which is banking. Out of the hundreds of Only a banks that tried, only a few of the banks have been successful by adding insurance to their product offerings. Nevertheless insurance brokerage fee income have become a significant part of the earnings of some large banks.

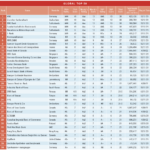

On October 20th, Michael White Associates released the “Michael White-Prudential Bank Insurance Brokerage Fee Income Report” for first half ’09. In the first six months, insurance fee income for a handful of companies was $6.05B. This report “measures and

benchmarks the banking industry’s performance in generating insurance brokerage and underwriting fee income. Results are based on data from all 7,402 commercial and FDIC-supervised savings banks and 932 large top-tier bank holding companies operating on June 30, 2009. Bank holding company insurance brokerage fee income consists of commissions and fees earned by a bank holding company or its subsidiary from insurance product sales and referrals of credit, life, health, property, casualty, and title insurance.”

Click to Expand

The number one ranked bank in insurance fee income thru June this year is Wells Fargo (WFC) which generated brokerage earnings of $995.0M. This amount amounted to a modest 4.94% of the bank’s noninterest income. It operates its insurance segment via Well Fargo Insurance Services.

Citigroup (C) followed next with earnings of $505.0M which is a fall of about 46% from 2008.Due to fear of collapse and the subsequent government bailout, many of Citigroup’s insurance clients jumped ship.

The next highest ranked bank is BB&T(BBT) Corporation of North Carolina which earned $478.0M. For BB&T insurance fee income is a significant part of its earnings since it accounts for nearly 27% of noninterest income. BB&T also increased its insurance activities this year since the fee income earned was about 14% higher than last year. BB&T is also of the just two US banks that appear in the Top 10 Global Insurance Brokers list for 2008.

GMAC (GJM), American Express (AXP), Morgan Stanley(MS) and Discover Financial (DFS) are some of the newly chartered Bank Holding Companies (BHCs). BHCs with assets over $10B have the highest participation in the insurance brokerage industry. BanCorpSouth (BXS) of Mississippi and Huntington Bancshares (HBAN) of Ohio also have high insurance fee income making up about 31% and 8% of noninterest income respectively.

From the report:

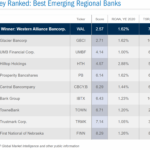

“Among BHCs with assets between $1 billion and $10 billion, leaders in insurance brokerage income in the first half 2009 included Eastern Bank Corporation (MA), Old National Bancorp (IN), Trustmark Corporation (MS), and Johnson Financial Group, Inc. (WI). BHCs of this size registered a 4.8% increase in insurance brokerage income to $319.7 million in first half 2009, up from $305.2 million in first half 2008.

Among BHCs with assets between $500 million and $1 billion, leaders were 473 Broadway Holding Corporation (NY), Texas Independent Bancshares (TX), and First Manitowoc Bancorp, Inc. (WI). These BHCs experienced 10.5% growth year-over-year in their insurance brokerage income. The smallest community banks, with assets less than $500 million, were used as “proxies†for the smallest BHCs, which are not required to report insurance brokerage income. Leaders among bank proxies for small BHCs were Soy Capital Bank and Trust Company (IL), Spirit of America National Bank (OH), and Hoosac Bank (MA).”

Banks depend on fee incomes now more than ever as loan losses continue to rise on various segments such consumer loans, residential mortgages, commercial real-estate loans, etc. And insurance is becoming a big slice of that noninterest fee income for some of the banks. Unlike other income for banks, insurance brokerage fees do not involve credit and usually banks get paid a hefty commission for these transactions.