For many years US investors turned to foreign stocks for their higher returns, stability and better diversification. Foreign stocks especially European stocks have high dividend yields which helps in the long-term due compounding of returns. An investor who just invests in US equities and ignores foreign stocks will not realize the maximum returns possible.

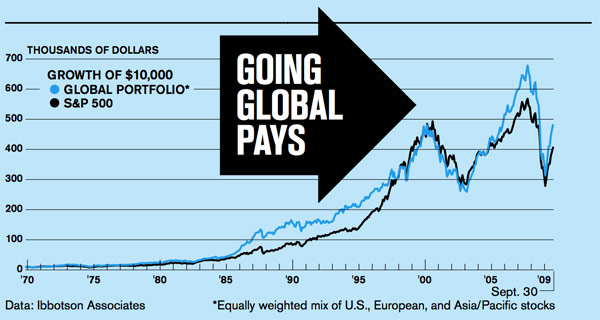

In the column, What happens if Dollar Crashes BusinessWeek presents an interesting chart that shows the performance of an S&P 500 portfolio vs. a global portfolio.

From BusinessWeek:

“The dollar is in its eighth straight month of decline against other major currencies. An easy way to hedge a portfolio against continued and possibly deep losses is to increase your exposure to international companies less affected by a volatile U.S. currency. Since 1970 a global portfolio has outperformed the Standard & Poor’s 500-stock index.”

A $10,000 investment in a global portfolio in 1970 would have grown to about $500,000 in 2009 compared to about $410,000 only if invested in an S&P 500 portfolio.

Among US stocks, small caps perform much better than large caps over the long-term as the chart shows below.

From 1926 thru 2006, small caps grew four times higher than large caps. Stock also easily outperformed government bonds and T-Bills in the same time period. In this 83 year period, stocks outperformed bonds easily.