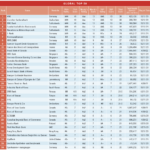

The Tier 1 common capital to risk-weighted assets ratio historically stood at 7¼% over 1997–2007 for all FDIC banks in the U.S. The U.S. Supervisory Capital Assessment Program (SCAP) which performed the stress tests to assess risks faced by banks assumed a target of 4% Tier 1 common capital to risk-weighted assets ratio which is lower than the historical standard.

The SCAP also assessed the capital needs of the largest 19 Bank Holding Companies (BHCs) under pessimistic scenarios. To achieve the target 4% ratio, it found that the banks needed $185B in capital. The IMF’s April 2009 Global Financial Stability Report (GFSR) “estimated that all U.S. banks would need $275 billion of additional capital to maintain a 4 percent leverage ratio (tangible common equity/tangible assets) or $500 billion to maintain a 6 percent leverage ratio, over the same period.”

Note: Top four banks include Citigroup, JPMorgan, Bank of America and Wells Fargo. Tier 1

common capital is total tier 1 capital less qualifying minority interests in consolidated subsidiaries,

qualifying trust preferred securities, and preferred stock and related surplus. Tangible common equity

is total equity capital excluding goodwill and other intangible assets and preferred shares and related

surplus.

Source: IMF Country Report No. 09/228, United States

The top four banks Citigroup (C) , JPMorgan (JPM) , Bank of America(BAC) and Wells Fargo(WFC) have lower capital ratios than the total BHCs in Q1,2009 based on both SCAP and IMF measures. By IMF’s measure the ratio is just 2.9% which is much lower than the target level of4%. If the recessions continues to worsen and losses mount, IMF estimates that for the period 2011-2014 U.S. banks’ capital needs would increase dramatically.

Related Post: A Review of Tier 1 Capital Ratios of Large US Banks