The latest IMF Country Report for U.S.A released yesterday says that the financial strains are still high and the recovery is likely be gradual.

Some of the key takeaways from this report are listed below:

- Exports of goods and services would be restrained due to the sluggish growth in countries with which the U.S. trades

- Near-term outlook is highly uncertain due to the continued deleveraging process of households with credit tightening and soaring unemployment

- Fall in commercial real state is likely to continue

- Economic forecasts projected by the U.S. government are still more optimistic

- U.S. households savings rate is expected to rise providing funds for investment

- The U.S. dollar is moderately over-valued

- Concerned about the high level of underwater mortgages

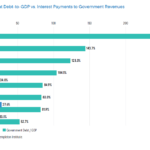

- The balance sheet of the Fed currently standing at 15% of the GDP, could double to 30% of GDP if all available facilities are deployed

- The U.S. government will need to slowly phase out its interventions in the markets

- The crisis revealed major weakness in the supervision and regulation of the financial sector

- Rising pension liabilities and health-care expenditures would widen fiscal imbalances

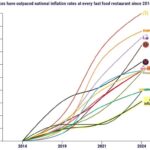

- Household consumption is likely to remain weak due to high debt to disposable income ratio

- The U.S. consumer is unlikely to be the global “buyer of last resort†and hence U.S. may not be the engine of global growth in the future

The last point is particularly important. Moving forward, the world cannot depend on the U.S. consumer since they are tapped out and will not consume stuff like they used to before. Programs to stimulate demand such as the “Cash-for-Clunkers” are great in the short-term but they are unlikely to provide long-term consistent growth. The winding down of the American consumer has major implications for export dependent countries. China especially will have to look elsewhere to export their goods and already due to lack of overseas demand thousands of factories have been shutdown there. This brings us to some critical questions. If U.S. consumers will not be the driver of global growth in the future who will replace them?. Which country would likely take the place of the U.S. and import the majority of goods made by China? Can the emerging markets continue to grow without depending on the U.S. economy?