** New November-2008: For “The World’s Top Ten Safest Banks 2008” click here.

For “The Top Ten Banks of China 2007” click here.

For “The World’s 20 Biggest Banks 2008” click here

For “The Top 10 Banks in the World 2008” click here.

For “The World’s Best Banks 2007” click here.

For “The Top 5 British Banks” click here.

For “The Top 10 German Banks” list, click here.

For “The Top Banks of Canada” click here.

For “The Top 5 Banks of Australia” list, click here.

Have you ever thought about which banks makeup the list of Top 10 or Top 25 or Top 50 banks in the world for 2008?

Well if you haven’t then read on. This post contains the Top 50 banks for 2008 listed in a simple table.

SCROLL DOWN for: The Top 50 Banks in the World for 2008 list.

BankersAlmanac.com has this year’s list of the “Top 50 Banks in the World“. This site is run by Reed Elsevier, the information database company from Holland. They own the highly respected Lexis-Nexis database as well that is used by academics,lawyers and others.

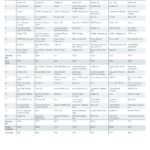

THE TOP 10 BANKS IN THE WORLD for 2008 (based on assets held as of April 30,2008):

[TABLE=87]

THE TOP 50 BANKS OF THE WORLD for 2008 are as follows:

[TABLE=75]

The world’s top 50 banks are selected and ranked based on the total assets they own as of April 30,2008. When you look at this list, it is interesting to note the following:

1. The world’s top bank by assets is Royal Bank of Scotland, UK.

2. There is NOT a single US bank in the top 10.

3. Last year’s #1 bank, UBS bank from Switzerland moved to #6 this year.

4. Ranking numbers 11,12 and 13 go to US banks – JP Morgan Chase,Bank of America and Citibank respectively.

5. Out of the top 10 banks, 9 are from Europe.

6. Two banks from Canada are in this top 50 list – Royal Bank of Canada and TD Bank.

7. Out of the top 50, eight banks are from Germany.

Now you may be wondering what does the above analysis has to do with this post. Well here you go.

Banks stocks are not the most popular stocks now. Some are treated as though they are rotten fish. In this market some of the top high quality banks have been thrashed together with the bad ones. So the trick here is to analyze and invest in top banks that have strong balance sheets and pay high dividends. This is where “The Top 50 banks in the world” list comes into play.

Lets say you have $10,000 to invest now. If you save in a 1 year CD with ING Direct you will a lousy 3.30% interest rate. That is lower than the current inflation rate of 4.0%+. Last month the inflation rate was 5.02% as per http://www.inflationdata.com.

US Treasury bills yield about 2.1%. This is even lower than the CD rate offered by ING.

The average US stock pays about 2.1% as dividend.US stocks have one of the lowest dividends of the world. As the following chat shows, most of overseas stocks have higher yields.

Chart credit: http://www.streetauthority.com

So in order to get higher yields than US stocks one has to look at overseas markets. There are plenty of high dividend yield plays in foreign countries ranging from closed-end funds to Canadian income trusts and plenty of common stocks in between.

One way to achieve high yields from investing in shares is to invest in top foreign bank stocks. These banks may be volatile in the short-run due to the credit crisis.But in the long-term their dividend yields will be awesome.Many of the banks listed below will not cut dividends as their exposure to the current mess is limited.

Of the world’s top 50 banks, 17 are available to invest in the US as they as ADRs or interlisted stocks. The following table contains these stocks with their current price and yield rates.

Top Bank ADRs (or interlisted stocks) and their dividend yields:

[TABLE=68]

Three banks in this list have double digit yields. The top bank in the world, Royal Bank of Scotland has an yield of 21.25%. FORSY scrapped the dividend this year and UBS cut their dividend rates by a third from last year.

Thanks for the comment. Yes its pretty scary how rankings can change drastically just in one year based on each banks involvement in the credit mess.