Long-term returns quoted for an investment based on decades should not be taken at face value. This is because such returns can be skewed over many years due to various reasons including bull and bear markets, economic expansion and contraction, geo-political events and so forth. Hence when reviewing a long-term return investors have to take a deep dive and analyze the factors behind the return. For example, a 20-year equity return of a stock in a sector is totally meaningless today as much of the return could have been generated during the dot-com bubble mania which is unlikely to occur again.

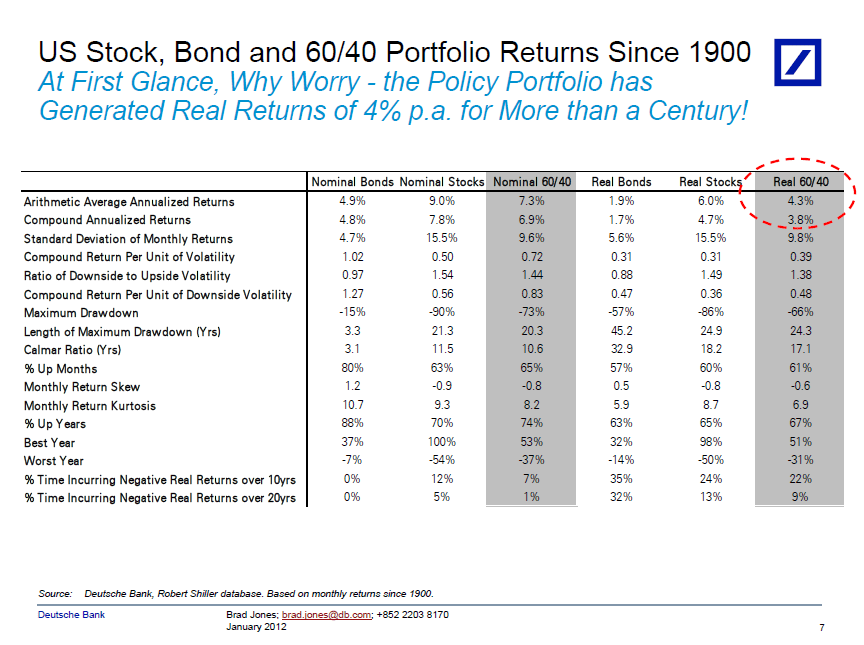

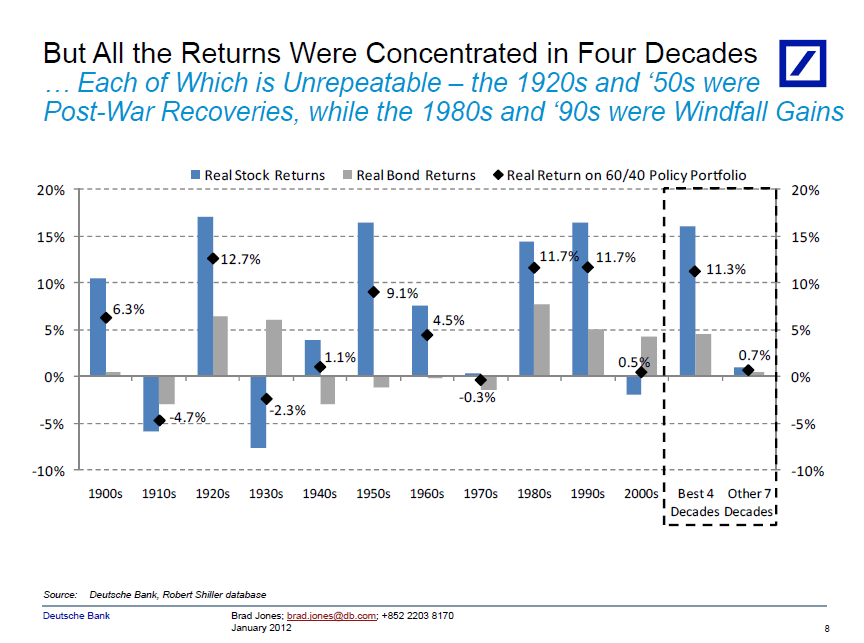

The following two charts show how long-term real returns can easily mislead investors. Real returns are returns calculated accounting for inflation.

Click to enlarge

Source:

Rethinking Portfolio Construction and Risk Management, A Third Generation in Asset Allocation, January 2012, Bradley A. Jones, Ph.D, Macro Investment Strategist, Deutsche Bank

At first glance, a real return of 4% per year for a portfolio of 60% stocks and 40% for over a century sounds reasonable. However the reality is much different. The second chart shows that most of the returns were earned in the best 4 decades each of which is a one-time event. Though World War III can be started by world powers anytime it highly unlikely to start anytime in the near future. So the possibility of an investor enjoying sky-high returns of a post-war recovery are almost nil. Similarly the high-tech revolution that occurred in the 1980s and 90s are once in a life-time events that are useless to a current investor. None of the hyped up new technologies such as renewable energy, nano-technology, social media, internet 2.0, etc. are going to start a technological revolution and earn fantastic returns for equity investors like in the 80s and 90s.