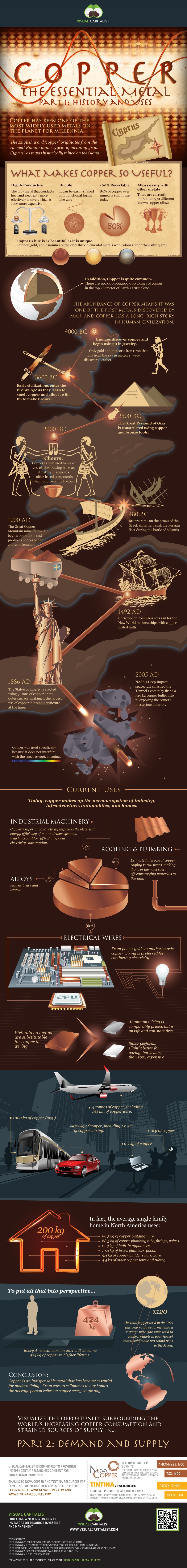

One of the important factors for success with investing in equities is diversification. While diversification can be done in many ways, one way investors can benefit is to own overseas stocks in addition to stocks from their local market. This is because different markets perform differently each year and also putting all assets in a single country including the home market is not a wise idea. For instance, holding emerging market equities can boost portfolio returns due to the higher growth rate usually found in these markets.

Similarly one developed market may be more co-related to the performance of one sector while another may mirror the returns of another sector. For example, the Canadian equity market is mostly co-related to the performance of the energy sector. The Australian market is highly dependent on the mining sector.

With that said, some US investors may avoid investing in foreign stocks due to the belief that it is unnecessary as many large American companies derive a high portion of their revenue from foreign countries. In simple terms, the argument here is that why invest in a British consumer goods firm like Unilever(UL) when an American giant in the same industry such as Proctor & Gamble (PG) has significant overseas operations. This line of thinking does not cover the full picture and is inherently incorrect. To give one reason, the scope, number of countries and the culture of these two firms are different. Many of Unilever’s brands have a strong historical presence and popularity in former British colonies. This is not the case with the brands of P&G.

Recently I read an interesting article at Schwab on the importance of investing internationally. The author Jeffrey Kleintop supports his arguments using the example of Nestle and Coca Cola which are in the same sector. From the article:

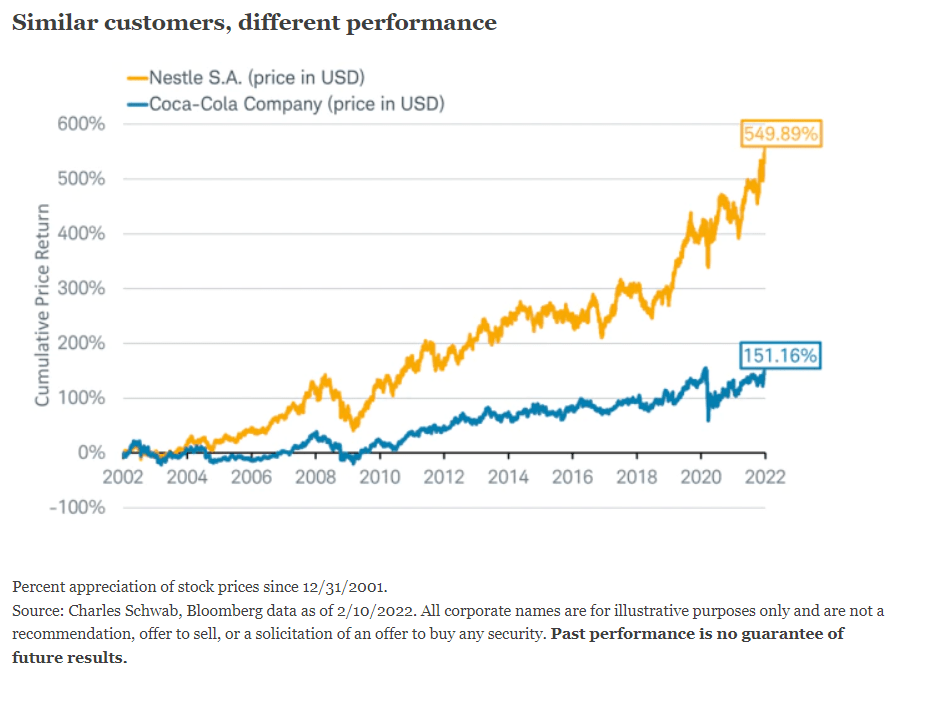

Big companies in the same sector or industry typically serve the same global customer base. For example, U.S.-headquartered Coca Cola and Nestle, a Swiss-headquartered company, have the same geographic distribution of sales by region, to within a few percentage points. They both get about 25-35% of their revenue from the U.S., about 20% from the rest of the Americas, 20-25% from Europe and another 20-25% from Asia, and about 5-10% from Africa and the Middle East.

Coca-Cola and Nestle both sell beverages and snacks to the same folks around the world. This similarity seems to suggest that there shouldn’t be much difference in the performance of stocks in the same industry that are headquartered inside or outside the United States. But, in truth, there is a difference. Over the 20 years ending in December 2021, Nestle’s stock rose 550%, vastly outpacing Coca-Cola’s gain of 151%. Why? Because there are many factors that drive stock performance besides revenue allocation.

Source: Why Invest Internationally? by Jeffrey Kleintop, Charles Schwab

The entire linked article above is worth a read.

Referenced stocks:

Disclosure: No positions