Bank stocks are hot again. With the planned increase in interest rates by the Federal Reserve the market is betting that banks are bound to benefit. Banks’ earnings would go higher as the Net Interest Margin (NIM) would rise. NIM is the difference in interest paid out to depositors and the interest received by banks for loans. Higher interest rates leads to banks charging higher rates for all types of loans such as mortgages, auto loans, home equity loans, personal loans, etc.

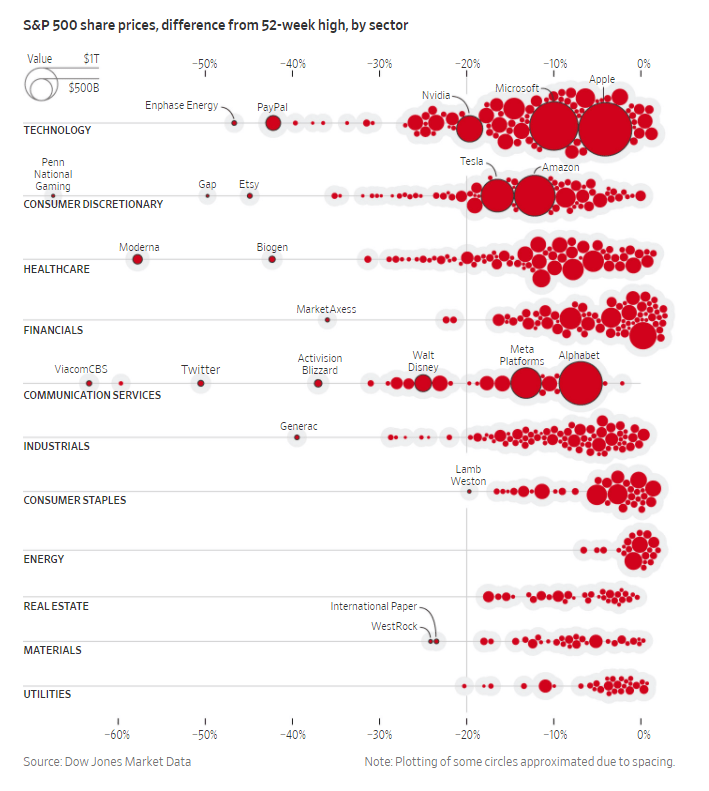

The S&P 500 is down 2.25% so far this year. However the KBW Bank Index is up 11.6% already for the year. Rising interest rates and the rotation from growth stocks to value will lead to further growth for bank stocks this year.

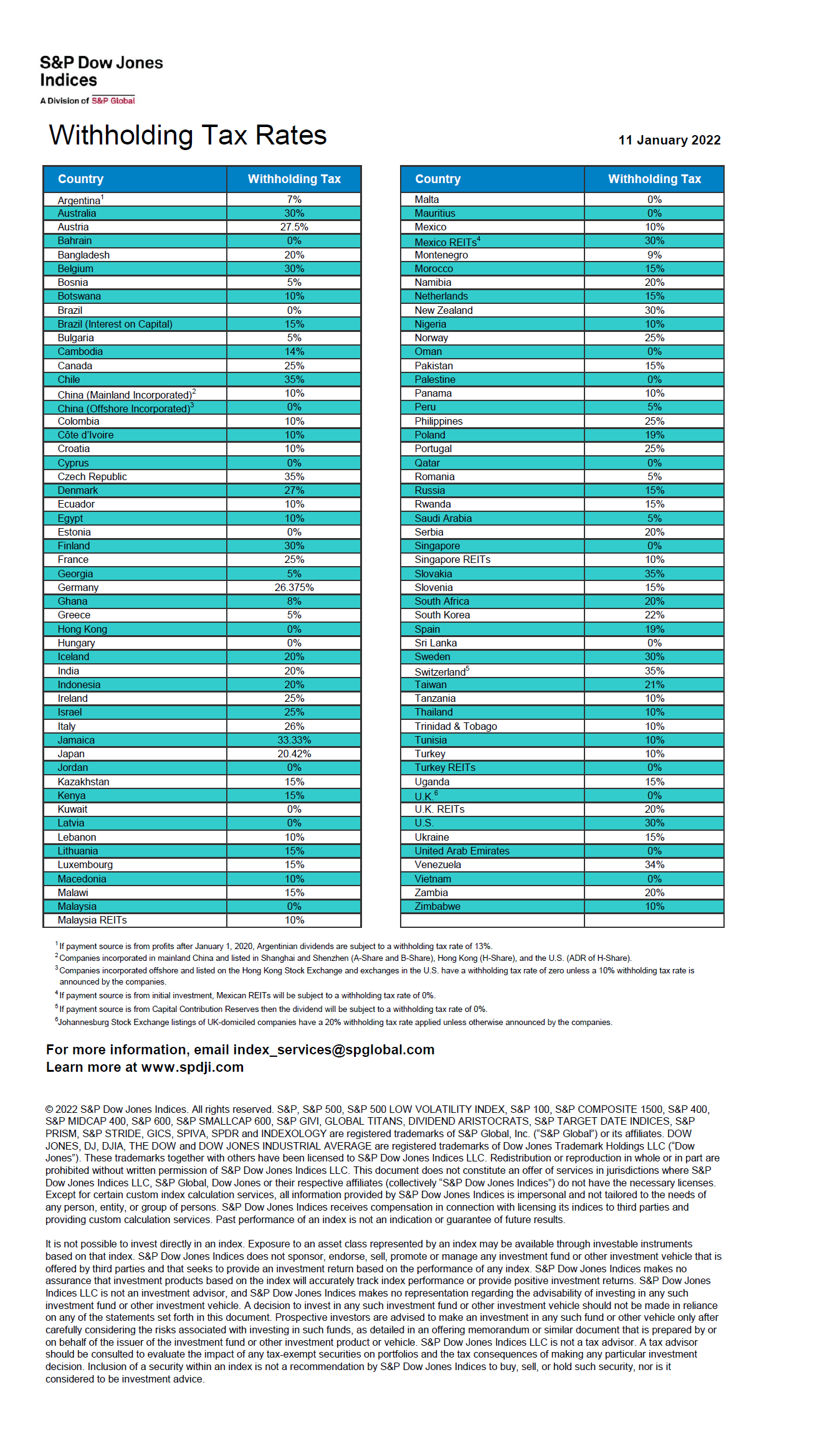

With over 4,370 commercial banks in the country and hundreds of them publicly listed it is important to identify the best banks for potential investment opportunities. One way is to review and consider the best banks in various categories already analyzed and published by reputed institutions. The Bank Director magazine has published the annual list of best banks in the US for 2022. Multiple criteria was used to select these banks as described in the below excerpt:

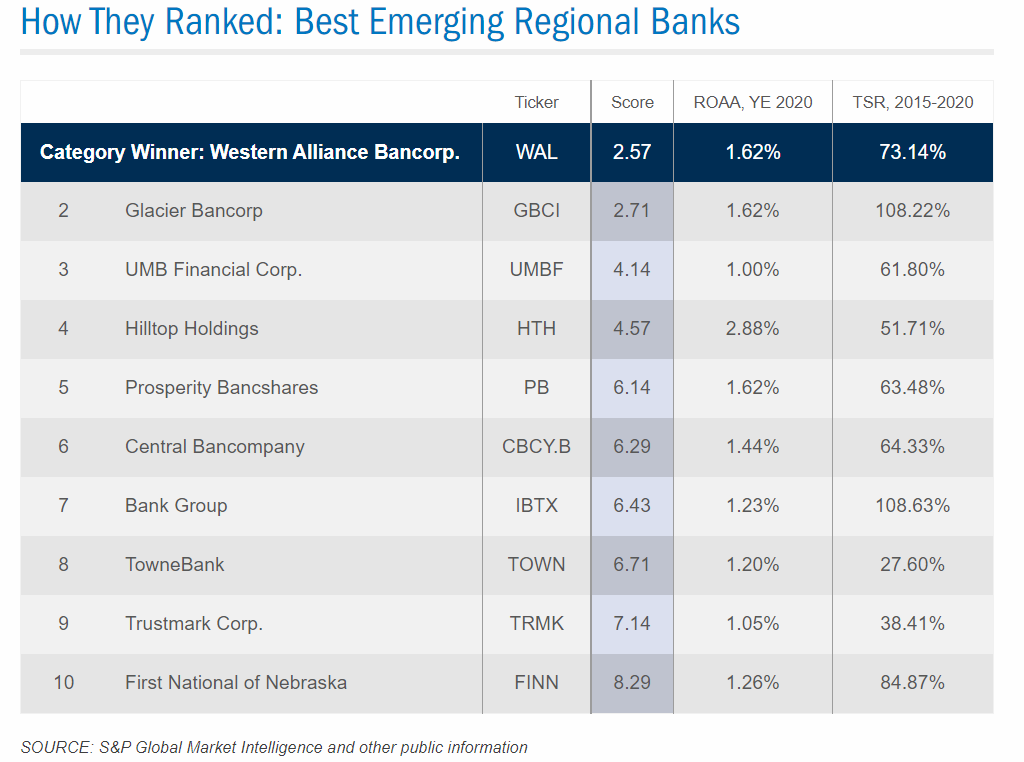

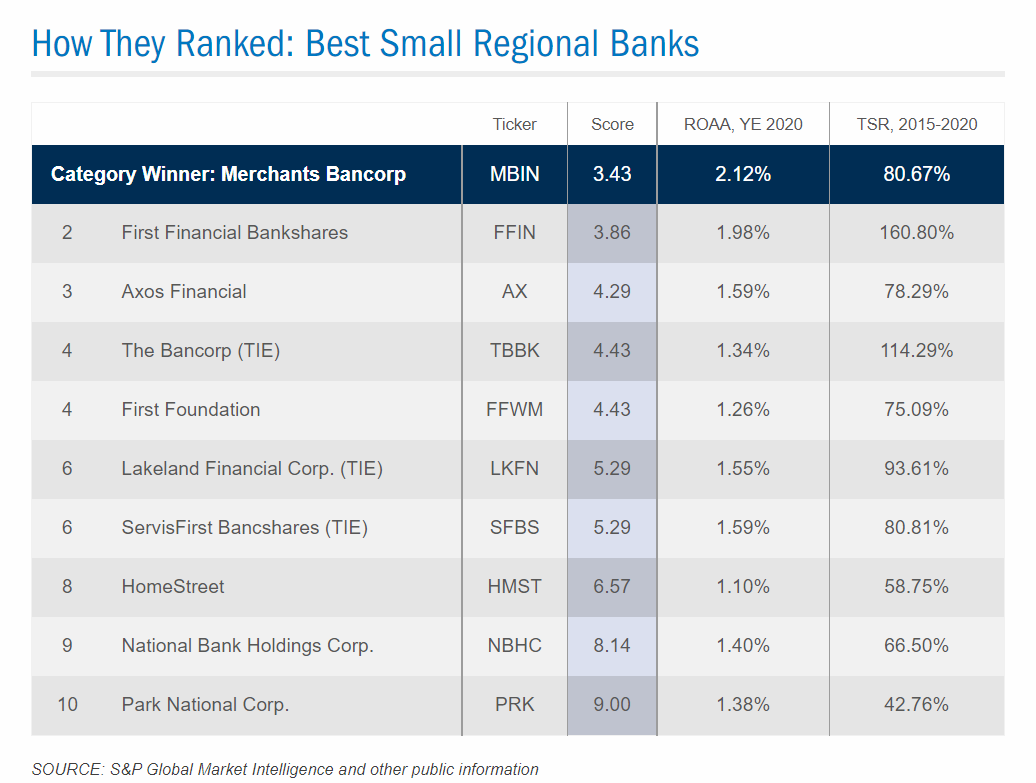

To determine the top 10 in each category, we calculated a profitability score based on return on average assets (ROAA) and return on average equity (ROAE) as of year-end 2020. We also looked at year-over-year growth in pre-provision net revenue (PPNR) from 2019 to 2020, as well as absolute PPNR as of year-end 2020. Credit quality was also examined, based on net charge offs and nonperforming loans as a percentage of total loans for 2020. To award building shareholder value, we included five-year total shareholder return from 2015 to 2020. All of these factors were ranked and then averaged — with profitability receiving a double weight — to develop a score.

The final list includes the biggest banks, as well as regional and community banks leveraging traditional operating models in robust markets. Many took advantage of the mortgage boom, and some leaned into the digital economy. While high-performing, privately-held banks can be found across the country, we focused on public banks due to the wealth of data available on these institutions via Securities and Exchange Commission filings, press releases and other public information. We also excluded banks that issued announcements before July 1, 2021, that their organization would be acquired or merged into another institution.

Once the top 10 in each size category were selected, Bank Director then studied each institution across four subcategories that contribute to overall performance: leadership, board, innovation and growth. Each category has its own unique methodology, and each bank’s within-peer rank factored into its final score in the asset size categories. The result was a ranking of the best banks in the nation, banks that excel across multiple criteria: profitability, credit, shareholder value, executive and board leadership, and innovation.

The best banks in four categories are listed below. Investors looking to add exposure to this sector can use these lists as a starting point for further research:

The Best Regional Banks:

Click to enlarge

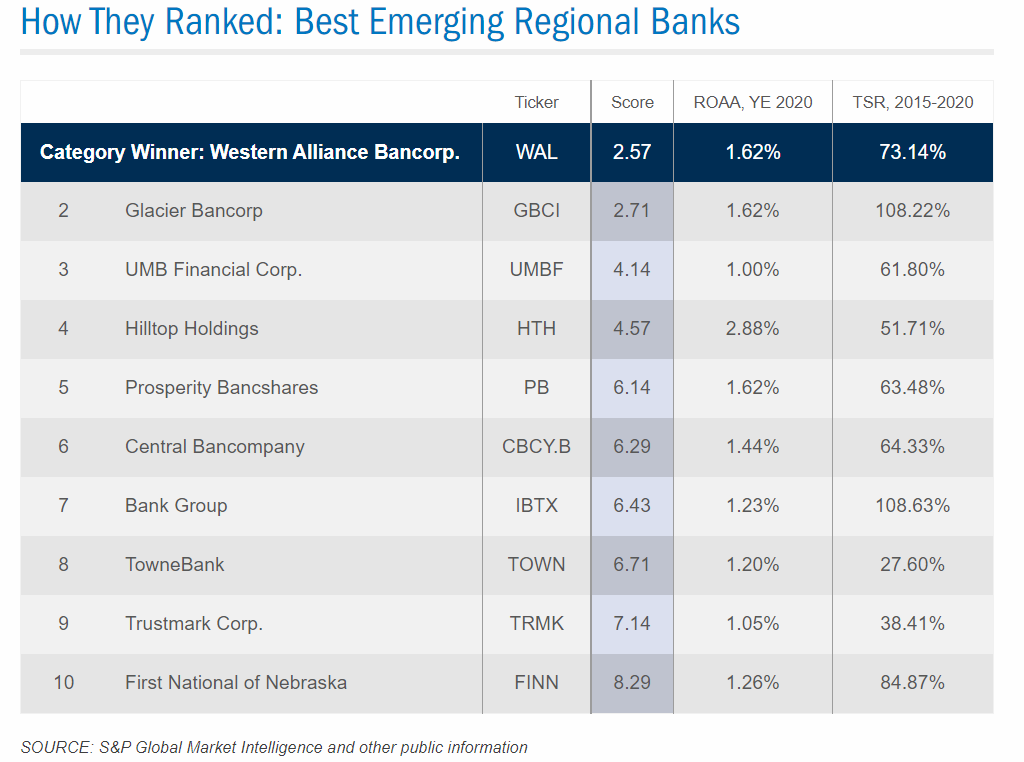

The Best Emerging Regional Banks:

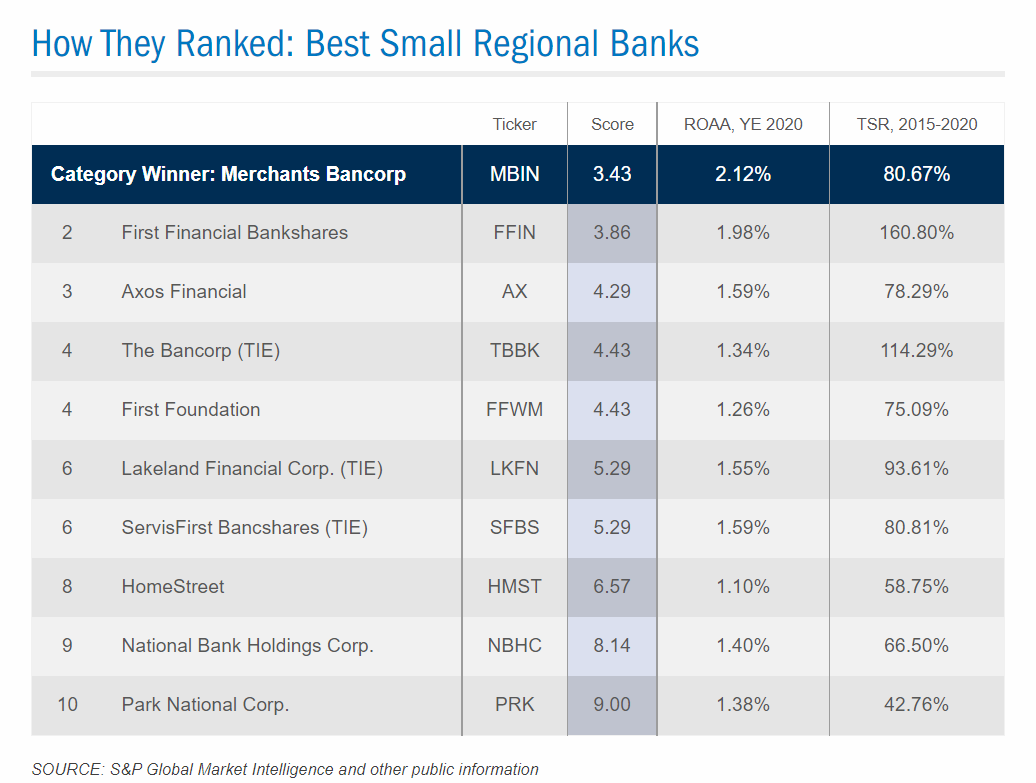

The Best Small Regional Banks:

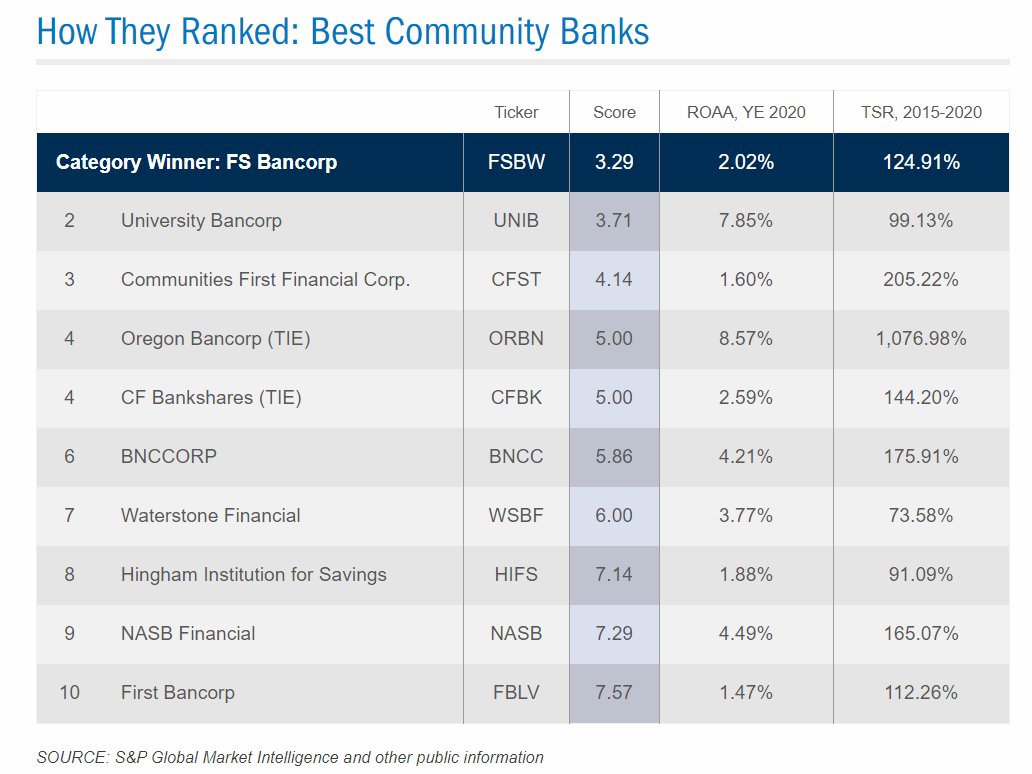

The Best Community Banks:

Note: TSR means Total Shareholder Returns (Share price appreciation + dividends paid)

Source: 2022 Ranking Banking: The Best Banks, Bank Director

In the Regional Banks category, California-based SVB Financial Group had a 5-year TSR of over 226%. As the name suggests Emerging Regional Banks are the on the path to becoming the next regional banks.

Disclosure: Long GBCI