Technology stocks are off to rough start this year. The tech-heavy NASDAQ Composite Index is down 4.8% so far this year. The S&P 500 on the other hand is off only 2.2%. Since late last year many technology stocks are in a downward trend. The market breadth is also not good for NASDAQ. For example, last Friday 690 stocks reached their 52-week lows compared to 84 for 52-week highs on the NASDAQ according to WSJ market data.

Many large-cap stocks trading on the exchange have declined 20% or more from their 52-week highs. A recent journal article noted that as of Jan 7, 36% of stocks in the NASDAQ Composite were down 50% or more from their recent 52-week highs.

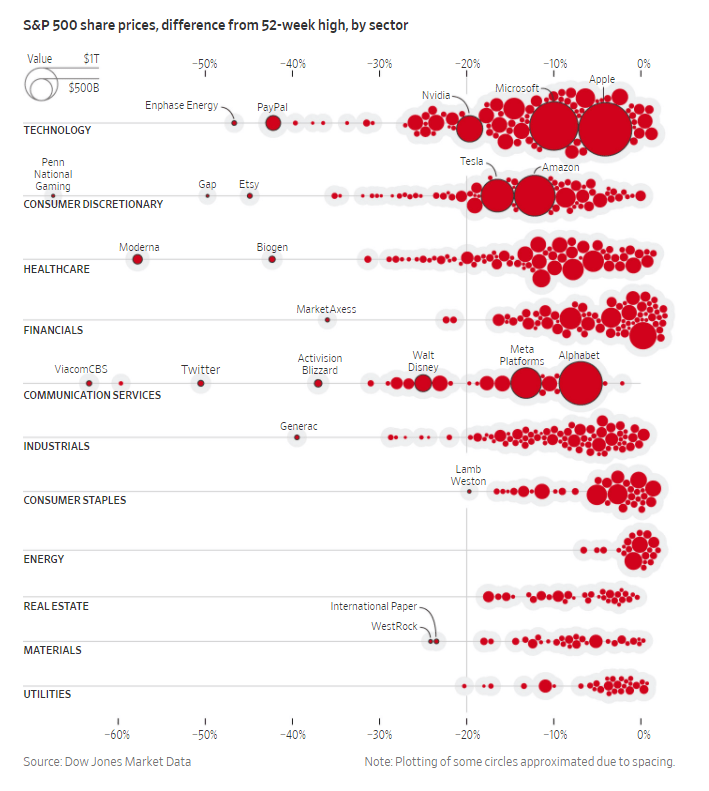

The following chart shows the heavy losses some of the hi-flyers are taking. The poster boy of investor irrational exuberance during the pandemic is none other than exercise equipment maker Peloton Interactive Inc(PLTN).Peloton stock has plunged over 81% from its 52-week high. The other pandemic winner Zoom(ZM) is off over 65%. Momentum investors favorite online furniture retailer Wayfair Inc (W) has crashed by over 52%.

Click to enlarge

Data Source: Barchart

US large-cap stocks’ decline from 52-week highs:

| S.No. | Name | Ticker | Decline from 52-week high |

|---|---|---|---|

| 1 | Curevac N.V. | CVAC | -81.59% |

| 2 | Peloton Interactive Inc | PTON | -81.19% |

| 3 | Draftkings Inc | DKNG | -68.82% |

| 4 | Rocket Companies Inc Cl A | RKT | -68.79% |

| 5 | Oak Street Health Inc | OSH | -66.82% |

| 6 | Boston Beer Company | SAM | -66.72% |

| 7 | Ozon Holdings Plc ADR | OZON | -66.64% |

| 8 | Novavax Inc | NVAX | -66.59% |

| 9 | Roku Inc | ROKU | -65.87% |

| 10 | Zoom Video Communications Cl A | ZM | -64.65% |

| 11 | Farfetch Ltd Cl A | FTCH | -63.18% |

| 12 | Chewy Inc | CHWY | -62.62% |

| 13 | Carvana Co. Cl A | CVNA | -58.50% |

| 14 | Guardant Health Inc | GH | -57.15% |

| 15 | Snap Inc | SNAP | -54.36% |

| 16 | Square | SQ | -53.92% |

| 17 | Sofi Technologies Inc | SOFI | -53.29% |

| 18 | Twilio | TWLO | -52.95% |

| 19 | Twitter Inc | TWTR | -52.40% |

| 20 | Wayfair Inc | W | -51.83% |

| 21 | 10X Genomics Inc | TXG | -50.24% |

| 22 | Elastic N.V. | ESTC | -50.20% |

| 23 | Clarivate Analytics Plc | CLVT | -48.26% |

| 24 | Natera Inc | NTRA | -47.81% |

| 25 | Bentley Systems Incorporated Cl B | BSY | -45.38% |

| 26 | Brookfield Renewable Corp | BEPC | -45.11% |

| 27 | Paypal Holdings | PYPL | -42.47% |

| 28 | Blackline Inc | BL | -42.46% |

| 29 | Yandex N.V. | YNDX | -39.92% |

| 30 | Arrowhead Pharma | ARWR | -38.28% |

| 31 | Burlington Stores Inc | BURL | -35.64% |

| 32 | Veeva Systems Inc | VEEV | -34.92% |

| 33 | Brookfield Renewable | BEP | -34.30% |

| 34 | Yum China Holdings Inc | YUMC | -33.23% |

| 35 | Iaa Inc | IAA | -28.05% |

| 36 | Elanco Animal Health Inc | ELAN | -27.90% |

| 37 | Cable One Inc | CABO | -26.98% |

| 38 | Ross Stores Inc | ROST | -23.80% |

Disclosure: No positions

Update: 1/17/22

From a WSJ article today:

The tech-heavy Nasdaq Composite has been particularly turbulent. Around 39% of the stocks in the index have at least halved from their highs, according to Jason Goepfert at Sundial Capital Research, while the index is roughly 7% off its peak. At no other point since at least 1999—around the dot-com bubble—have so many Nasdaq stocks fallen that far while the index was this close to its high, Mr. Goepfert said.

The selloff in many individual stocks highlights how shaky the stock market’s 2022 has been. U.S. stocks last week posted a second-straight weekly decline, dragging the S&P 500 and Nasdaq down 2.2% and 4.8%, respectively, to start the year. Some stocks and sectors have moved even more dramatically.

Source: Giant Stock Swings Kick Off 2022, WSJ