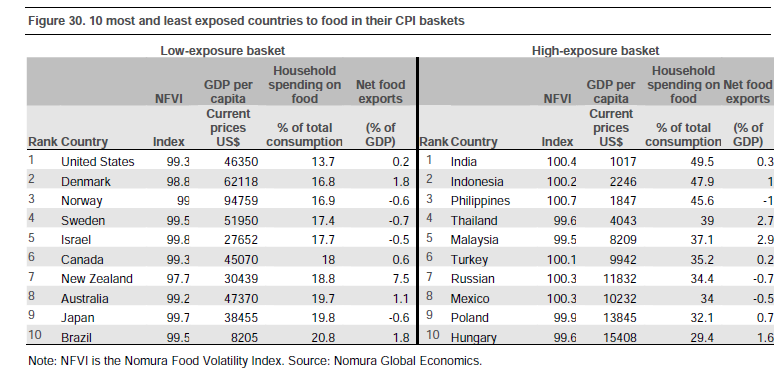

Soaring energy and food prices have low impact on Consumer Price Indices (CPI) in developed countries than in emerging countries. This is because unlike in the emerging markets, food and energy make up a lower share in the more service-oriented CPI baskets of developed countries. Emerging markets such as India, China, Brazil are experiencing high inflation rates now since energy and food prices have a higher allocation in their CPI calculations.

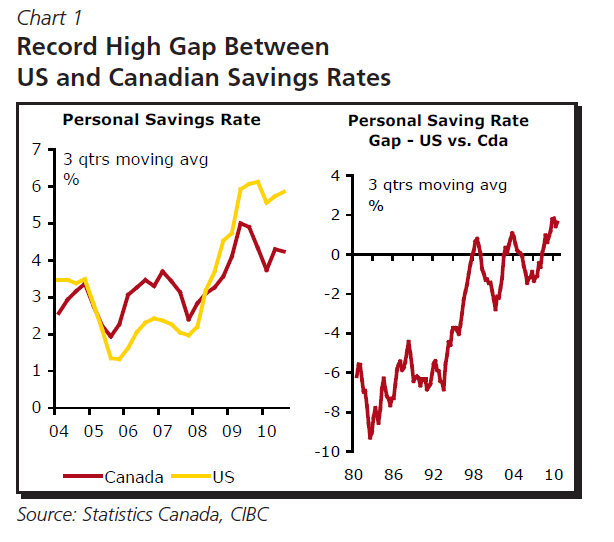

Source: US Treasuries and the Three Bears, CIBC World Markets

The following chart shows that many developed countries have the least exposure to food in their CPI calculations:

The emerging countries of India, Indonesia and Philippines are the top three countries with the highest exposure to food in their CPI baskets.

Source: Nomura Global Economics

Back to Old-Fashioned Saving, Benjamin Tal, CIBC World Markets

Back to Old-Fashioned Saving, Benjamin Tal, CIBC World Markets