The majority of the states in the U.S. are running deficits and hence are cutting government services when they are desperately needed by the middle and the lower classes in this sluggish economy. While the causes for the budget shortfalls are many, one of the main reason is that public workers at the state and local level are paid lavishly compared to their private sector peers. In addition to astronomical salaries, government workers get paid fat pensions when they retire, generous healthcare benefits during employment and after retirement,etc. The monthly pension amounts received by public workers are guaranteed regardless of the performance of equity/bond markets. In the private sector, most companies have eliminated defined pension plans in favor of 401-K and other contribution-type retirement plans.

Similar to the state and local public sector workers, Federal employees also receive above-market salaries and luxurious benefits. However despite being in deep debt like the states, the Federal government is able to “print” money of out thin air and pay such high packages to employees without any issues. States on the other hand have to depend on tax revenues in order to fund the massive labor costs. As tax revenues fall they find themselves in trouble and state workers who are used to the rich-benefits are unwilling to take any cuts.

Public workers are able to maintain the status quo because of the unions and their collective bargaining power. Unions fund politicians with millions of dollars in campaign contributions and then once in power politicians return the favor by agreeing to the demands of public workers and adding more burden on taxpayers. This is in sharp contrast to private sector workers where real wages have fallen for many years now and all the benefits due to productivity and technological advancements are reaped by a few at the top.

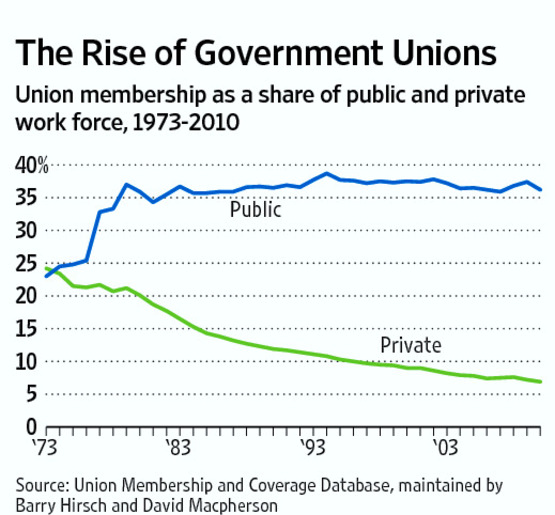

The following chart from a Journal article shows the rise of public sectors unions and the fall of private sector unions:

Source: The Wall Street Journal

From the article:

“We first started running the nearby chart on the trends in public and private union membership many years ago. It documents the great transformation in the American labor movement over the latter decades of the 20th century. A movement once led by workers in private trades and manufacturing evolved into one dominated by public workers at all levels of government but especially in the states and cities.

The trend is even starker if you go back a decade earlier. In 1960, 31.9% of the private work force belonged to a union, compared to only 10.8% of government workers. By 2010, the numbers had more than reversed, with 36.2% of public workers in unions but only 6.9% in the private economy.

The sharp rise in public union membership in the 1960s and 1970s coincides with the movement to give public unions collective bargaining rights.”

With official unemployment rate hovering over 9% and falling wages levels in the private sector, it is high time that politicians take on the powerful public unions and abolish their collective bargaining power. Productivity and efficiency in the public sector have to be increased and the benefits and wages of public workers must be brought down to be in-line with the current market conditions.

Related:

Union Contracts, Not Pay, Are States’ Problem

Typical corporatespeak baloney in this article. Government employees are ALWAYS second from the bottom of the list, just above retail in pay. Yes, because they forgo the chance at the big private sector bucks they generally get good benefits, but when calculating such things as the value of retirement benefits, the so-called financial people, who should (and do) know better, never bother to calculate the present value of the pensions, instead simply prorating the cost of current and future pensioners and slapping it on top of the salary and other benefits. It is pure distortion. Government employees VERY MODESTLY compensated, and the financial writers are not totally stupid, ergo they lie.