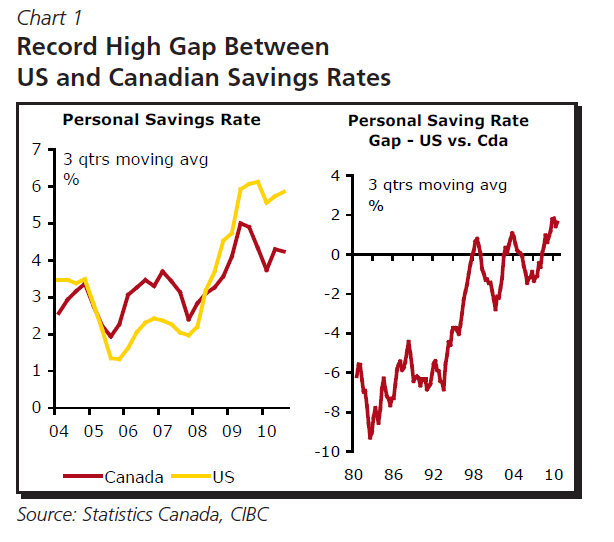

Generally Canadians have a higher propensity to save compared to Americans in spite of having a better social safety-net such as free healthcare, pensions, job security, etc. under the socialist form of government. Up until the credit crisis hit most U.S. consumers saved very little. In fact, the personnel savings rate in the U.S. went negative a few years ago. As a consumer-driven economy Americans were bombarded with ads to spend their hard-earned money on all types of products and services that promised a rich-lifestyle and most obliged which kept the economy growing. However all that changed after the global financial crisis and the ensuing recession in which millions of jobs disappeared. As a result of the deleveraging process undertaken by American consumers, the savings rate has risen by over 3% in the past three years and the debt to income ration has decreased.

Canadians on the other hand have been saving less in recent years due in part to the soaring real estate prices. This “wealth effect” reduced savings and increased consumption. The Canadian savings rate averaged just 4.2% in the first three quarters of 2010. The American savings rate on the other hand is at near 6% which is 1.6% higher than the rate in Canada as shown in the graph below. This gap is the largest on record, according to a research report from CIBC World Markets.

Source:

Back to Old-Fashioned Saving, Benjamin Tal, CIBC World Markets

Back to Old-Fashioned Saving, Benjamin Tal, CIBC World Markets