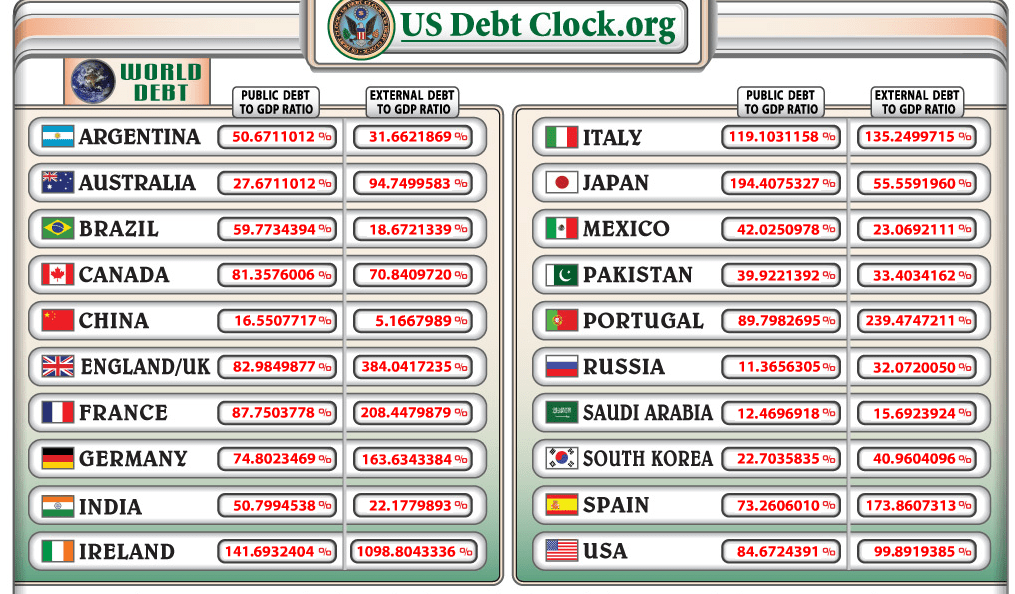

The live chart for the “Public Debt to GDP ratio” and “External Debt to GDP ratio” of select countries can found in the US Debt Clock site.

Click to enlarge

Source: US Debt Clock

The screenshot above is as of November 6, 2011. For the latest data please go to their website.