The higher education industry one of the large industries in the U.S. The industry provides millions of jobs and more importantly creates billions of dollars worth of economic activity each year. For example, some college presidents make over $1.0 million per year in salary. All this money has to come from somewhere. One place where it usually comes from are the students.Tuition in U.S. universities continue to soar consistently year after year. For most of U.S. students the rising tuition leads to higher student loan debts.

One of the big source of revenue in terms of tuition and other charges for U.S. schools is foreign students. Hundreds of thousands of foreign students studying in these schools pay much higher tuition applicable to foreign students. Hence many universities prefer these students as they bring in much-needed cash to the university’s coffers.It is not unheard of some schools to reduce the number of domestic students in order to take in more foreign students.

In this post lets take a look at a few charts related to foreign students in U.S. higher education.

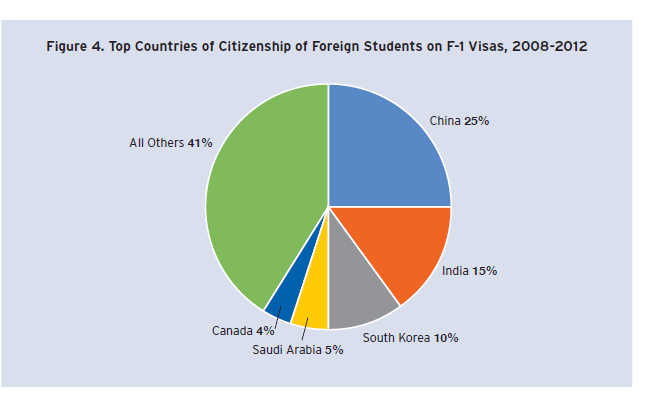

1) Top Countries of Foreign Students in U.S. universities:

Click to enlarge

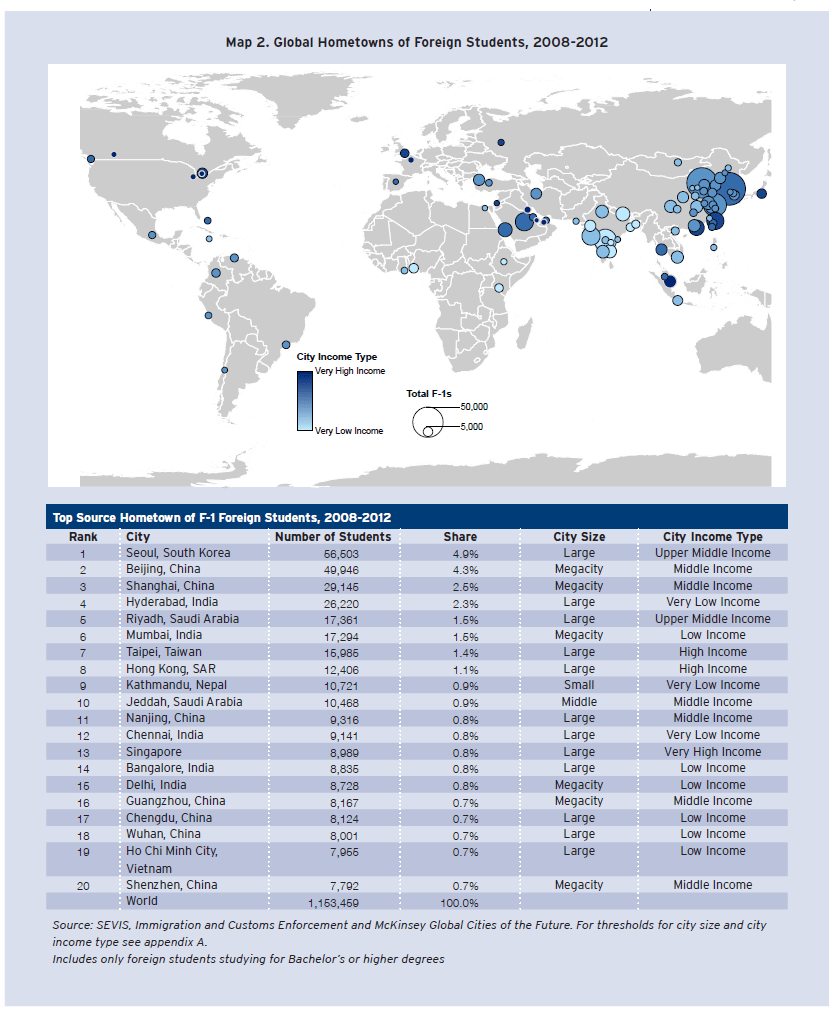

2) Top Hometowns of Foreign Students:

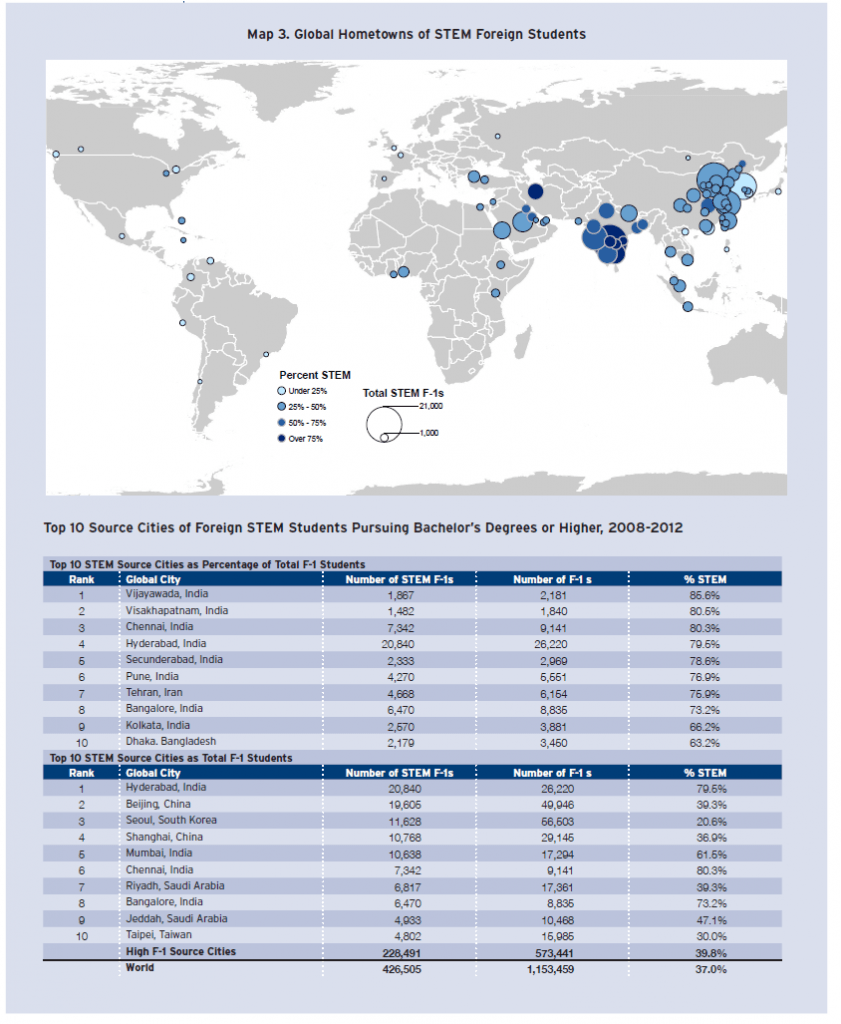

3)Top Hometowns of Foreign Students in STEM(Science, Engineering, Technology and Mathematics) programs:

Source: The Geography of Foreign Students in U.S. Higher Education: Origins and Destinations by Neil G. Ruiz, Aug 2014, The Brookings Institution