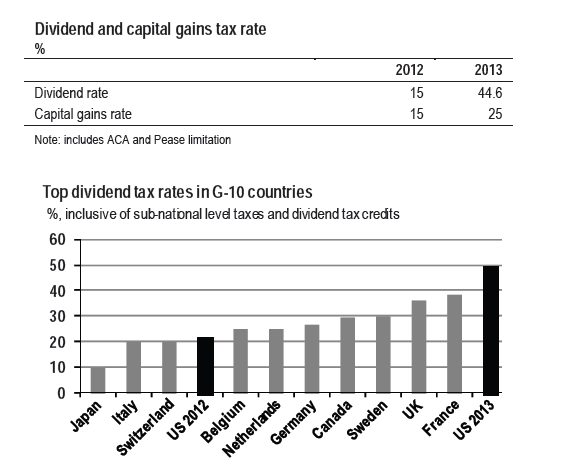

The top dividend tax rate is currently 15% in the U.S. This 15% dividend tax rate is applicable to Qualified Dividends earned by all investors who fall in the 25% to 35% ordinary income tax range. Unless Congress takes action, the dividend tax rate is set to jump to the ordinary income tax rates on January 1, 2013. For people in the highest income tax category, this would mean a dividend tax rate of 39.6%. When changes due to the Affordable Care Act and the re-introduction of the Pease limitation on itemized deductions are included, the top marginal dividend tax rate will reach 44.6% for those in the highest income tax brackets.

Click to enlarge

Comparison of Top Dividend Tax Rates among G-10 Countries:

Source: Economic Research, Global Data Watch, October 5, 2012, J.P. Morgan

As shown in the chart above, the U.S. may end up having the highest dividend tax rates among the G-10 countries next year the current dividend tax rates are not extended.

Similar to the tax rate on dividends, the capital gains tax rate is also set to jump from the current 15% to 25% for those in the highest tax-brackets.

The research note from J.P. Morgan notes that one of the impacts of the rise in tax rates would be companies may opt to implement more share buybacks and pay fewer dividends to shareholders. Share buybacks is one of the worst unproductive strategies followed by mostly U.S. companies that do not benefit shareholders for the most part. Hence investors may face a double whammy next year if dividend tax rates increase. This is because companies may not only pay fewer dividends but also waste excess earnings on buying back their own shares.