- DRIVEN INTO DEBT – Riches Built on Subprime Auto Loans to the Poor (NY Times)

- Who’s winning: Active or passive investors? (Financial Post)

- Beware momentum stocks in sheep’s clothing (Money Observer)

- Chile, the star pupil of the Chicago school, has turned out to be a dope-smoking shoplifter (FT beyondbrics)

- India has a strong year – but there’s still plenty to be cheerful about & The factors driving the Indian market’s revival (FE Trustnet)

- Chart of the week: The biotech bubble (MoneyWeek) Also see Opinion: This is nothing like the 2000 dot-com bubble (Marketwatch)

- China rebalancing: Blessing and curse for Latin America (DB Research)

- 4 Reasons Japanese Stocks Could Continue to Rise (Charles Schwab)

- Once Forbidden Frontiers (Mark Mobius Blog)

- Euphoria and Reality in European Stocks (AB Blog). Also see Europe – what investors need to know (Fidelity UK)

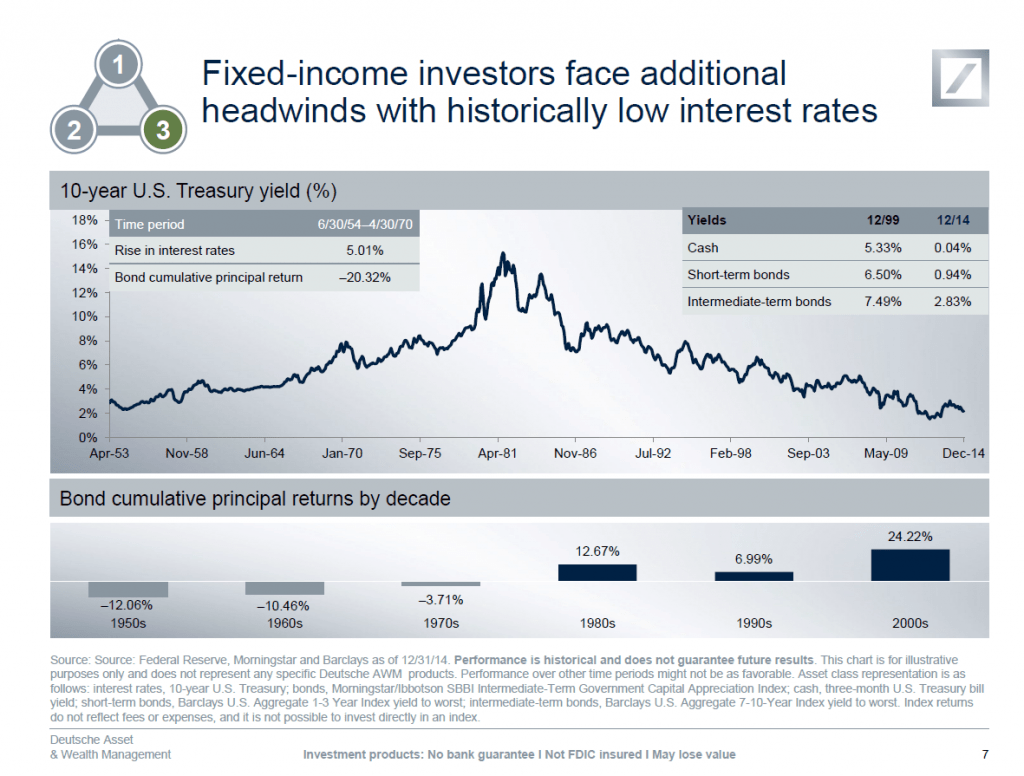

- How to Prepare for Volatile Markets (Blackrock Blog)

- The End of the Commodity Boom: What’s Next for Latin America? (The Financilist)

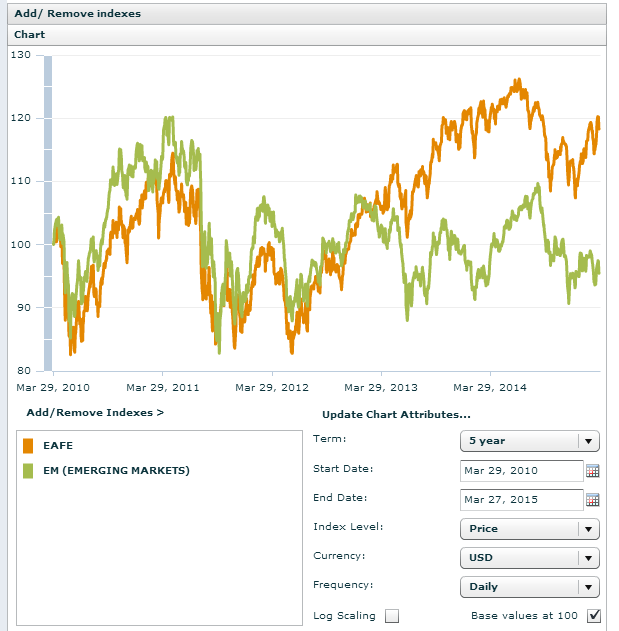

Click to enlarge

U.S. Capitol, Washington D.C.