Equity investing should always be for the long-term. Investing for the short-term rarely yields better returns considering the impact of taxes, costs, etc. Not to mention one can easily lose money since markets can be highly volatile in the short-term. Long-term can be defined as holding investments for 5 years or more. Holding periods of 10 to 20 years can significantly reduce volatility and can generate higher total returns due to price appreciation over the longer period and the effect of compounding due to dividend reinvestment.

The key to holding stocks for the long-term is to select stocks from sectors that are stable, easy to understand and have long-term growth potential. Examples of such sectors are consumer staples, utilities, chemicals, etc. Sectors that are not the best fit for long-term investments are internet technology which includes dot-coms in the social networking, data storage, e-tailing, semiconductors, software, and other areas, biotechnology, hot growth fast-food, etc. Companies that take advantage of some fads such as single-serve coffee machines, building a bear toy in a shop at the mall, crazy expensive yoga pants for women created by some smart Canadian should be avoided as well.

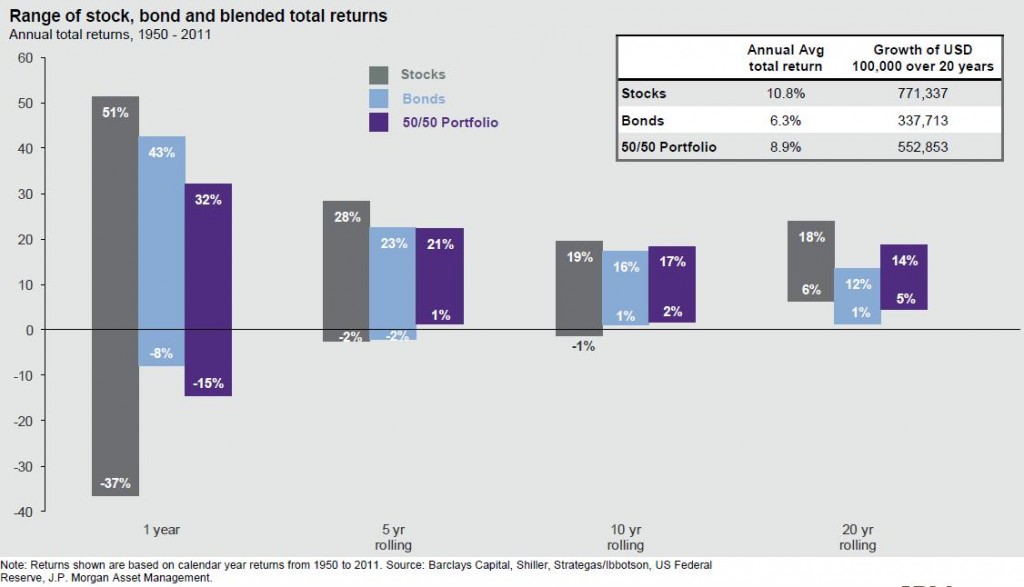

The following chart shows the performance of three U.S. asset types over the short and long-terms:

Click to enlarge

Source: Time’s ability to smooth out market volatility, J.P. Morgan Asset Management, UK

The total returns of US equities, Treasuries, and a 50/50 blended portfolio over 1 year and 20 years is interesting to analyze. For one year periods stocks returned between 51% and -37% over the previous year. But over the twenty year periods the variation range fell to 18% to 6%. In addition, stocks also yielded positive returns over 20-year periods. Bonds and the blended portfolio also performed better over 20-year periods with the blended portfolio having the least volatility.

For the period shown, the annual average total return was higher for stocks with 10.8% compared to pure bonds and the blended portfolio. The key takeaway is in the short-term volatility is higher and returns are unpredictable while the opposite is true in the long run.

Ten U.S. stocks to hold for the long-term are listed below with their current dividend yields:

1.Company:Colgate-Palmolive Co (CL)

Current Dividend Yield: 2.21%

Sector: Household Products

2.Company:Procter & Gamble Co (PG)

Current Dividend Yield: 3.09%

Sector: Household Products

3.Company: The Coca-Cola Co (KO)

Current Dividend Yield: 3.25%

Sector:Beverages

4.Company:The Clorox Co (CLX)

Current Dividend Yield: 3.26%

Sector:Household Products

5.Company: Kellogg Co (K)

Current Dividend Yield: 3.07%

Sector:Food Products

6.Company:Airgas Inc (ARG)

Current Dividend Yield: 1.83%

Sector: Chemicals

7.Company:PPG Industries Inc (PPG)

Current Dividend Yield: 1.29%

Sector: Chemicals

8.Company:AT&T Inc (T)

Current Dividend Yield: 5.61%

Sector: Telecom

9.Company: ConocoPhillips (COP)

Current Dividend Yield: 4.27%

Sector: Oil, Gas & Consumable Fuels

10.Company: Southern Co (SO)

Current Dividend Yield: 4.80%

Sector: Electric Utilities

Note: Dividend yields noted above are as of Feb 28, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions