Here are the Canadian stocks getting a lift from the anything-but-oil rally (Financial Post)

These ETFs Need an Exorcism (Bloomberg)

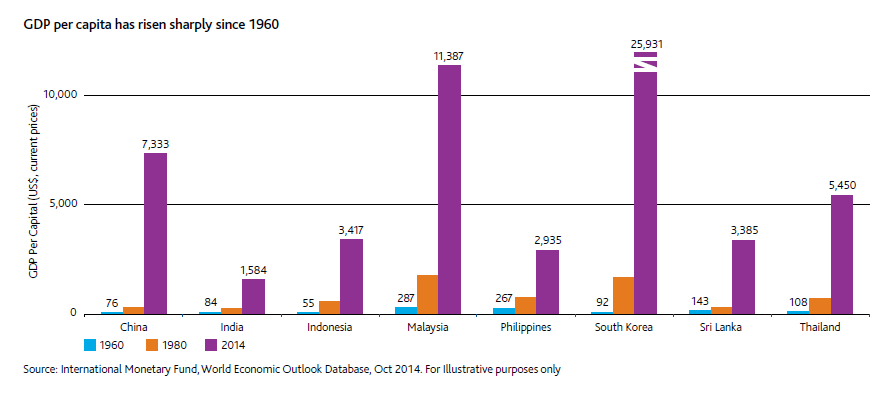

A Smart Way to Include International Stocks in Your Portfolio (WSJ)

The real story of US coal: inside the world’s biggest coalmine (The Guardian)

What facts about the United States do foreigners not believe until they come to America? (Quora)

Can businessmen make good politicians? (The Hindu Business Line)

Do Foreign Stocks Still Make Sense? (Forbes)

Jack Bogle: I Wouldn’t Risk Investing Outside the U.S. (Bloomberg)

10 outrageous predictions for 2015 (Citywire, UK)

Shareholder value maximisation: a dumb idea that we really have to dump (MoneyWeek) Also checkout: How the cult of shareholder value wrecked American business( The Washington Post)

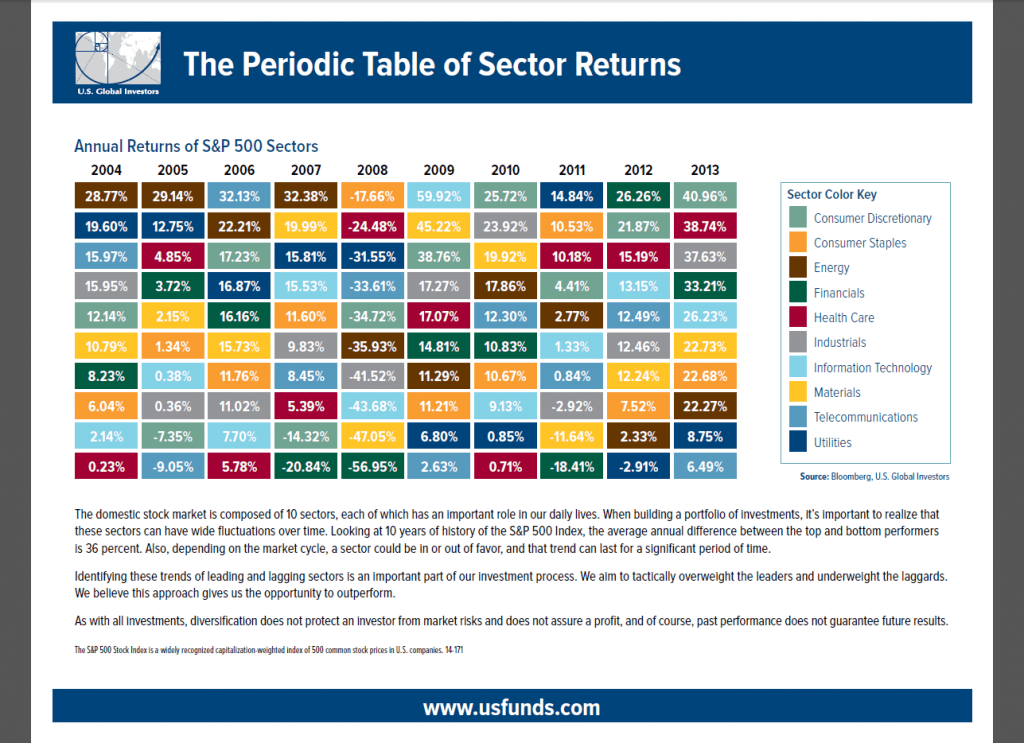

Why Invest Internationally? (From 2012, Charles Schwab)

Lincoln Memorial, Washington DC