Most of the infrastructure in the U.S. are in desperate need of an upgrade. Highways, bridges, water and sewer systems, electrical grid, railroads, etc. were built long time ago – some 50 years or more – and could use a makeover. The following is a summary of key points from a research report on the U.S. infrastructure by Christine Todd and Daniel Marques of Standish and my comments.

- State and local governments, not the Federal government, have fund over three-quarters of the nation’s water, roads, bridges, power transmission systems. etc.

- Infrastructure spending during the Great and Depression and the 1950-60s when the interstate highway system was built.

- The U.S. government estimates about 70,000 bridges (or) one in nine are structurally deficient.

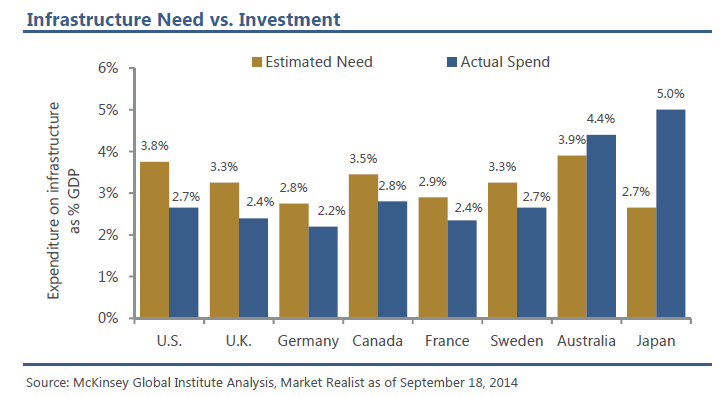

- Among Developed countries, the U.S. lags in infrastructure investment as the chart below indicates. Countries like Japan and Australia have excellent infrastructure as they spend substantially more. For example, Japanese transplantation infrastructure such as their high-speed rail network and the ease of commuting between two places puts the U.S. passenger rail “network” to shame.

Click to enlarge

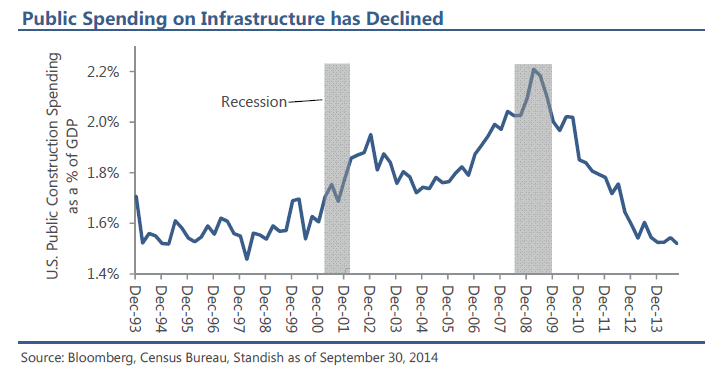

5. U.S. public spending on infrastrcure has dropped since the global financial crisis of 2008. It has dropped by 30% to reach a decades-low of -1.55%.

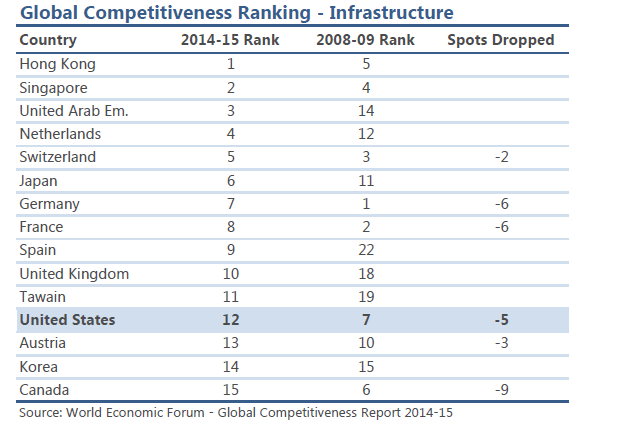

6. Globally U.S. infrastructure is rated very low when compared to other developed countries. In the past six years, the U.S. has dropped five spots to reach the 12th in the world.

7. The American Society of Civil Engineers(ASCE) gives a grade of D+ for the state of U.S. infrastructure.

It should be noted however that certain areas of infrastructure are good. For instance, toll roads are generally in good shape as private firms that build and operate these roads are able to invest and generate high revenues from them. Thats the case with public spending. Though primarily only two parties are in this democratic country, political fighting between them delays policy making decisions.As a result the general public suffers. Americans waste billions of hours each year sitting on traffic-clogged roads. Unlike the politicians in the past, nowadays every politician seems to lack a vision for the country and instead are selfish to the nth degree and is constantly thinking about holding on to power growing his/her own glory……

Source: Aging U.S. Infrastructure Drives Opportunity for Muni Bond Investors, Feb 15, Standish