- Ashmore: This hated market’s bounce-back isn’t over yet (FE Trustnet)

- Perfect Nails, Poisoned Workers (NYTimes)...yet another article on labor exploitation

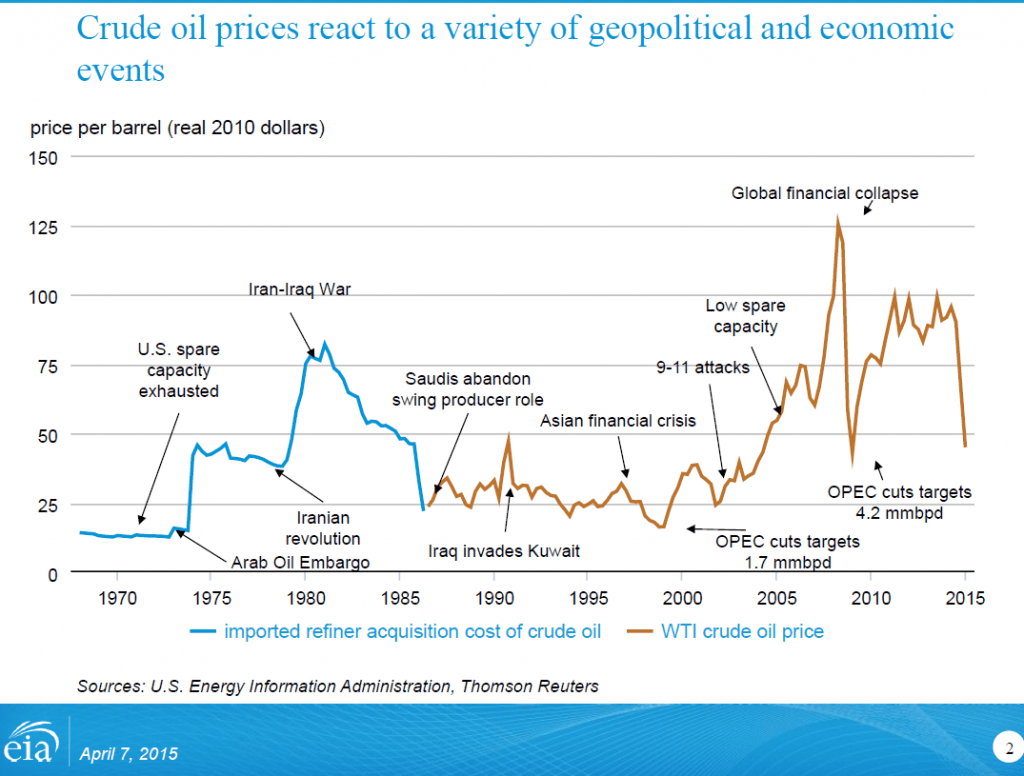

- 15 years of Vladimir Putin: 15 ways he has changed Russia and the world (The Guardian)

- Have profits peaked? (Fidelity) Also see Why Corporate Profits Are Falling and What It Means for the Stock Market (Schwab)

- Against the tide: Greece – the joker in the pack (Euromoney) Also see Greece debt: What’s it like to live under threat of default? (BBC)

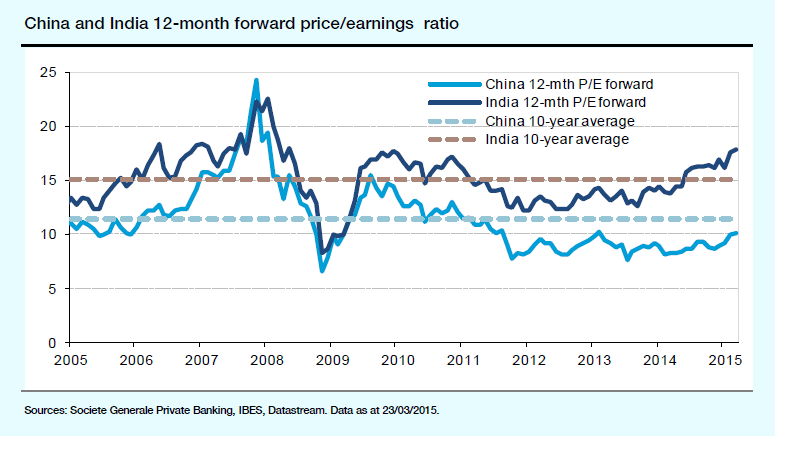

- China: ‘Challenging the bears’ (Invesco Perpetual, UK)

- Bacteria to the rescue (OECD Observer)

- The Dead Money Syndrome (Canadian Investment Review)

- Emerging-Market Opportunities: Look Under the Surface (AB Blog)

- Where Dividend Investors are Seeking Income (Blackrock Blog)

Armata Tank

Photos Courtesy: RT and EnglishRussia