Financial activity by banks and other financial institutions have increased exponentially in the past few decades according to a report by OECD. The authors of the report note that while increased credit is good for growth in the short-term it actually leads to slower growth in the long-term.

From an article previewing the report:

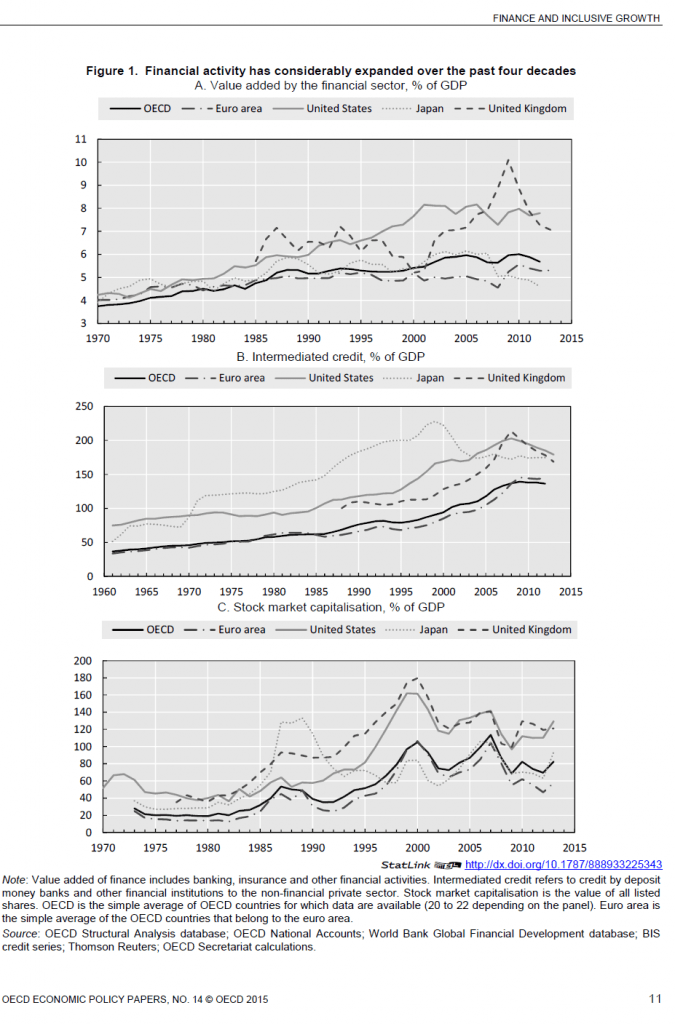

Over the past half-century credit by banks and other financial institutions to households and businesses in OECD countries has grown three times as fast as economic activity. Stock market capitalisation has tripled relative to GDP over the past 40 years, but today the value of stock markets still only equals 65% of GDP, just over half that of financial sector credit.

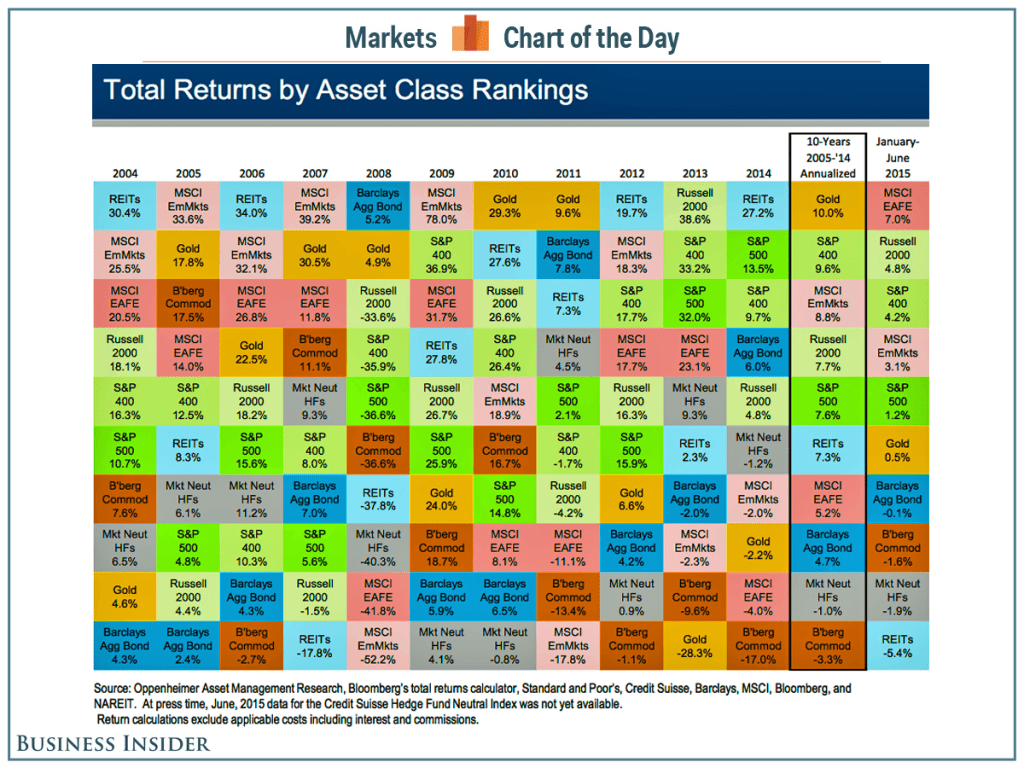

The OECD economists looked at how this growth in the financial sector affects growth in the rest of the economy. Initially, an expanding financial sector is beneficial, but it eventually reaches its ideal weight, and apart from contributing to inequality, “further increases in its size usually slow long-term growth”. This conclusion holds even when you consider a range of other factors including country specificities, the business cycle, and even financial crises. In general, more credit to the private sector slows growth in most OECD countries, while more stock market financing boosts growth. Bank loans slow economic growth more than bonds. Credit is a stronger drag on growth when it goes to households rather than businesses.

Source: Too much money is bad for you, June 2015, OECD

The following graphs show the tremendous growth in financial activity in OECD countries:

Click to enlarge

Source: Finance and Inclusive Growth by Boris Cournède, Oliver Denk and Peter Hoeller, June 2015, OECD

From the above research paper:

The analysis will therefore also use two direct measures of financial activity: the volume of credit provided by financial intermediaries to the non-financial private sector and stock market capitalisation.2 The volume of credit provided by banks and other financial institutions to non-financial firms and households, henceforth referred to as “intermediated credit”, measures a key output that financial intermediaries generate for the real economy. Stock market capitalisation also provides a gauge of the important service that the financial sector provides by facilitating the equity funding of businesses. Similarly to the value added of finance, intermediated credit and stock market capitalisation have both been on upward trends:

• Credit by banks and other intermediaries has risen strongly in nearly all OECD countries since the 1960s, on average more than tripling relative to GDP (Figure 1, Panel B). Several financial crises during the 1990s interrupted the upward trend in the Nordic countries, Mexico and some Asian countries, though in most cases only briefly. Credit-to-GDP ratios have also come down since the onset of the global financial crisis as lending activity has shrunk and write-downs have been taken on past loans (Bouis et al., 2013). In many OECD countries, the growth in credit

intermediation has outpaced the growth in financial sector value added. This difference relates to lower net interest margins, which may reflect possible increases in productivity as well as likely reductions in screening efforts and credit quality (Keys et al., 2010).• The amount of stock market financing has expanded considerably in OECD countries over the past four decades (Figure 1, Panel C). The expansion has been accompanied by very large bubbles in Japan in the late 1980s and globally in the late 1990s.

The key fascinating takeaway from this report is that high stock market financing and unrestrained credit availability is not a sound policy for economic growth.