Immigrants are some of the largest successful community in the U.S. Highly educated and skilled immigrants dominate the high-tech industry in the U.S. especially in Silicon Valley. Many of the well-known startup success stories were founded by immigrants. Unlike other countries plenty of American venture capital firms are willing to bet on the next great startup.

According to a research report:

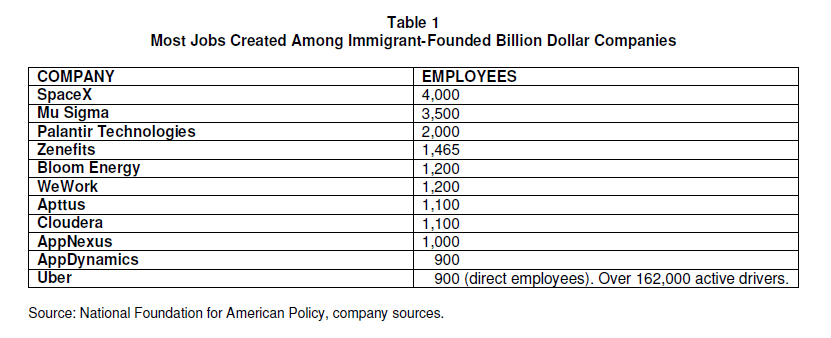

The research finds that among the billion dollar startup companies, immigrant founders have created an average of approximately 760 jobs per company in the United States. The collective value of the 44 immigrant-founded companies is $168 billion, which is close to half the value of the stock markets of Russia or Mexico.

Among the countries where immigrants came from and founded billion dollar startups, the top three countries are India, Canada and the UK.

The following table shows the startups with the high number of jobs created:

Click to enlarge

Source: Immigrants and Billion Dollar Startups by Stuart Anderson, National Foundation for American Policy, Mar 2016

Tesla’s (TSLA)founder Elon Musk is an immigrant and so is Garrett Camp, the co-founder of Uber.

The full report is worth a review as it contains many other fascinating details.

Disclosure: No Positions