The Indian equity market is under-performing so far this year. The benchmark S&P Sensex index is down 2% year-to-date compared to S&P 500’s gain of 1.05%. Among emerging markets China is down much higher than India but Brazil is up by about 24% as Brazilian equities are recovering due to clarity on the political crisis there.

From an investment perspective, are Indian stocks cheap or expensive now?

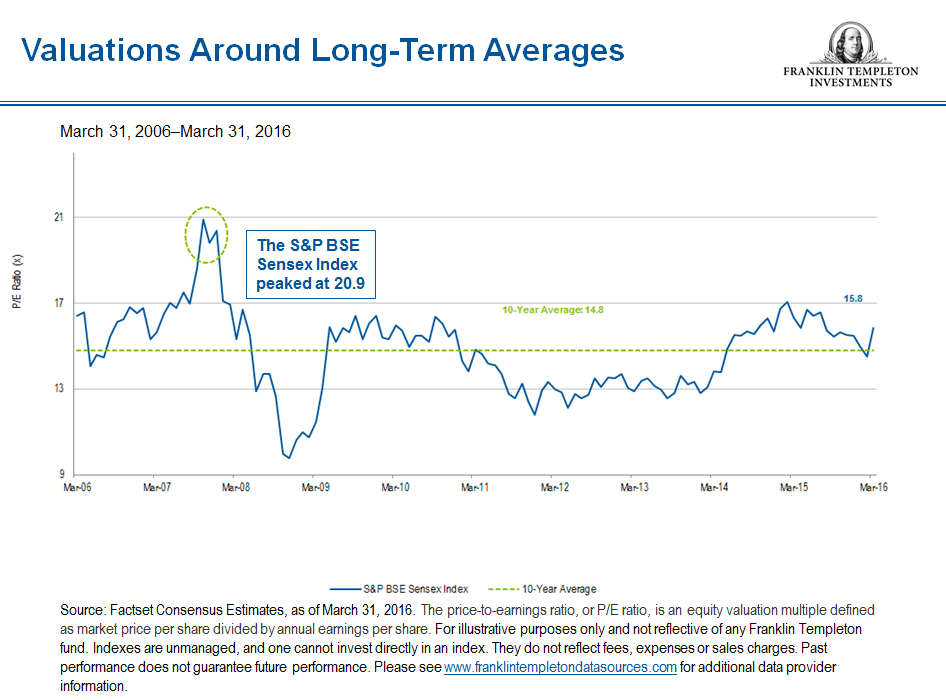

According to an article by Sukumar Rajah at Franklin Templeton Investments, valuations of Indian equities currently are around long-term averages as the chart shows below. The previous peak of 20.9 for the S&P Sensex is unlikely to be reached again unless corporate earnings improve.

Click to enlarge

Source: How India Is Stepping Out of China’s Shadow, Sukumar Rajah, Franklin Templeton Investments, April 28, 2016

The easiest way to invest in India is via ETFs as only a handful of companies trade on the US exchanges.

As an emerging market, Indian stocks can be very volatile. So an investor should perform a deep analysis before jumping into any individual equity. ETFs on the other hand offer a safer option since they can contain a basket of securities.

Investors looking for income opportunities should avoid India since dividend culture is yet to be adopted by many firms and Indian firms are not known for sharing their wealth with investors. The current dividend yield on the S&P Sensex is just 1.6%. Other emerging markets in Asia such as Thailand, Indonesia, etc. offer much higher yields of 3 to 4%. As a developing country one would expect Indian firms to offer higher dividend payouts to investors to attract capital. However that is not the case.

In summary, invest in Indian stocks for mostly capital appreciation.

ETFs: The Complete List of India ETFs and ETNs Trading on the US Markets