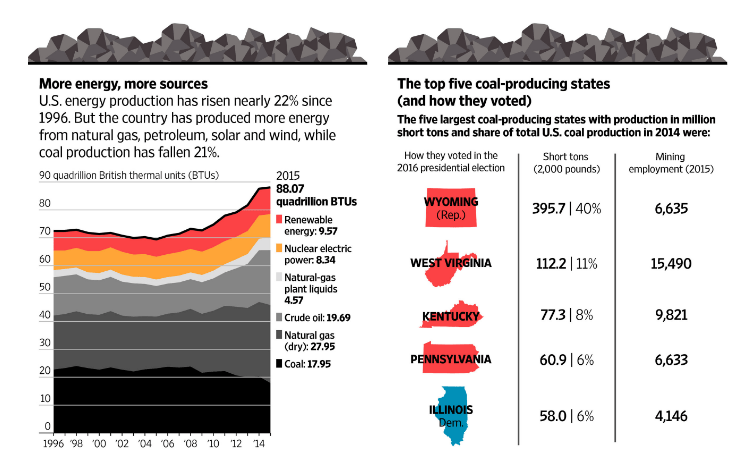

President-Elect Trump has announced that he will withdraw from the Trans-Pacific Partnership (TPP) on his first day in office. In addition he has also proposed to tear up other trade deals the US has with countries around the world such as the NAFTA with Canada and Mexico or enact barriers such as tariffs. So the question now is: How will his proposals impact the U.S. economy?

According to The Petersen Institute, with all other things being equal and trading counterparts act in kind (meaning they also retaliate by imposing tariffs for imports from US which will hurt US companies) the US economy will be adversely impacted leading to a mild recession in 2019 with a GDP drop of 0.10%

The chart shows the importance of global trade to US economy. According to Niels C. Jensen of Absolute Return Partners “In the US alone, the increased openness of the global economy has tripled the share of trade in national income in the last 50 years (chart 1).”

Click to enlarge

Trump plans to impose a 45% and 35% tariff to China and Mexico respectively. If these are implemented it may lead to a full scale trade war if those countries retaliate according to the The Petersen Institute. The chart below shows how that trade war could lead to a decline in US economic growth (marked in dark blue color line)

Click to enlarge

Source: Trump – another Brexit moment?, The Absolute Return Letter, November 2016 , Absolute Return Partners