Global trade has been running smoothly among countries for a few decades now. However with the election of Trump trade has become an important factor to consider for investors. This is because President-elect Trump has proposed to withdraw the US from trade agreements or amend the terms and conditions of those deals. In addition, he has also warned of imposing tariffs on goods imported into the US especially from countries like Mexico and China.

So should he implement any of those campaign trade promises, which countries will be negatively impacted the most?

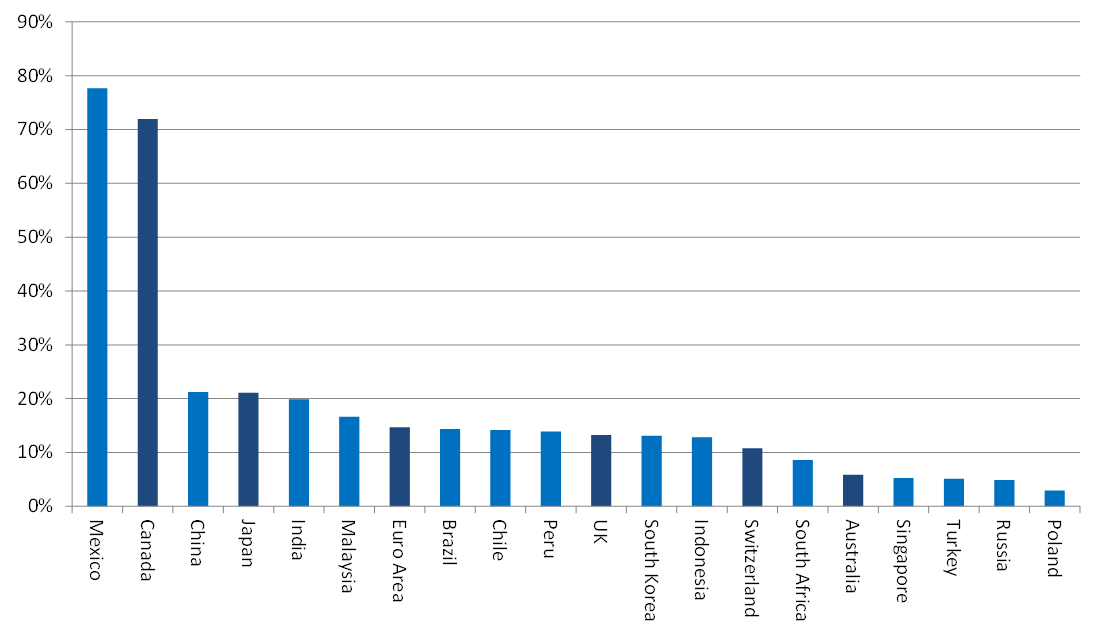

The chart below shows the countries that are most exposed to the US:

Click to enlarge

Source: Global Emerging Markets: Possible Impacts from a Trump Presidency, Nikko Asset Management

The top countries that stand to lose the most are the neighbors – Mexico and Canada. China will suffer heavily since only over 20% of its total exports go the US. Though China exports over $500 billion worth of goods to the US it is still only a small portion of its overall exports. Because the US imports more than its exports to China, it runs a trade deficit year-after-year. This deficit stands at well over $300 billion annually.

The Mexican economy stands suffer significantly since over 80% of its total exports head to the US market. Because the economies of Mexico and USA are highly integrated it will be very difficult to decouple them.

Canada is the second major exporter to the US with its exports accounting for over 70% of total exports. Some of the major items that Canada ships to its southern neighbor include autos, auto parts, lumber,agricultural grains, crude oil, natural gas, etc. In fact, the Canadian economy is so highly dependent on USA that it is said that when US sneezes Canada catches a cold. For years and years Canadian politicians failed to diversify the economy and explore additional markets to trade with and simply made Canada as the 51st state of the US.