In an earlier post we looked at the top mining and oil stocks in Australia. The following are the top 110 Industrial Stocks in the Australian equity market:

| S.No. | Company |

|---|---|

| 1 | Adelaide Brighton |

| 2 | AGL Energy |

| 3 | Air New Zealand |

| 4 | ALS |

| 5 | Altium |

| 6 | Amcor |

| 7 | AMP |

| 8 | Ansell |

| 9 | ANZ Banking Grp |

| 10 | APA Grp |

| 11 | Argo Invest |

| 12 | Aristocrat Leisure |

| 13 | ASX |

| 14 | Auckland Intl Airport |

| 15 | Aurizon Hldgs |

| 16 | AusNet Services |

| 17 | Aust Foundation |

| 18 | Bank of Qld |

| 19 | Bellamys Aust |

| 20 | Bendigo&Adelaide Bk |

| 21 | Boral |

| 22 | Brambles |

| 23 | Brickworks |

| 24 | BT Invest Mgt |

| 25 | Carsales.com |

| 26 | Challenger |

| 27 | Charter Hall Grp |

| 28 | Cimic Grp |

| 29 | Cleanaway Waste |

| 30 | Coca-Cola Amatil |

| 31 | Cochlear |

| 32 | C'wlth Bank of Aust |

| 33 | Computershare |

| 34 | Corporate Travel |

| 35 | Costa Grp |

| 36 | Crown Resorts |

| 37 | CSL |

| 38 | CSR |

| 39 | Cybg |

| 40 | DEXUS |

| 41 | Domino's Pizza |

| 42 | Downer EDI |

| 43 | DuluxGroup |

| 44 | EBOS Grp |

| 45 | Event Hospitality |

| 46 | Fisher & Paykel Hlth |

| 47 | Fletcher Bld |

| 48 | Flight Centre Travel |

| 49 | Goodman Grp |

| 50 | GPT Grp |

| 51 | Growthpoint Prop |

| 52 | Harvey Norman |

| 53 | Healthscope |

| 54 | Incitec Pivot |

| 55 | Insurance Aust Grp |

| 56 | Investa Office Fd |

| 57 | IOOF Hldgs |

| 58 | James Hardie Ind |

| 59 | Janus Henderson |

| 60 | JB Hi-Fi |

| 61 | Lendlease Grp |

| 62 | Link Admin Hldg |

| 63 | Macq Atlas Roads Grp |

| 64 | Macq Grp |

| 65 | Magellan Fin Grp |

| 66 | Medibank Private |

| 67 | Mercury NZ |

| 68 | Meridian Energy |

| 69 | Metcash |

| 70 | Milton |

| 71 | Mirvac Grp |

| 72 | National Aust Bank |

| 73 | NIB Hldgs |

| 74 | Nufarm |

| 75 | Orica |

| 76 | Orora |

| 77 | Platinum Asset |

| 78 | Premier Invest |

| 79 | Qantas Airways |

| 80 | QBE Insurance Grp |

| 81 | Qube Hldgs |

| 82 | Ramsay Health Care |

| 83 | REA Grp |

| 84 | Reece |

| 85 | Reliance Worldwide |

| 86 | ResMed Inc |

| 87 | Scentre Grp |

| 88 | Seek |

| 89 | Seven Grp |

| 90 | SkyCity Entertain |

| 91 | Sonic Healthcare |

| 92 | Spark Infrastructure |

| 93 | Spark New Zealand |

| 94 | Stockland |

| 95 | Suncorp Grp |

| 96 | Sydney Airport |

| 97 | Tabcorp Hldgs |

| 98 | Telstra Corp |

| 99 | The A2 Milk Company |

| 100 | The Star Entertain |

| 101 | TPG Telecom |

| 102 | Transurban Grp |

| 103 | Treasury Wine |

| 104 | Vicinity Centres |

| 105 | Wesfarmers |

| 106 | Westfield |

| 107 | Westpac Banking |

| 108 | Wisetech Global |

| 109 | Woolworths Grp |

| 110 | Xero |

Source: AFR

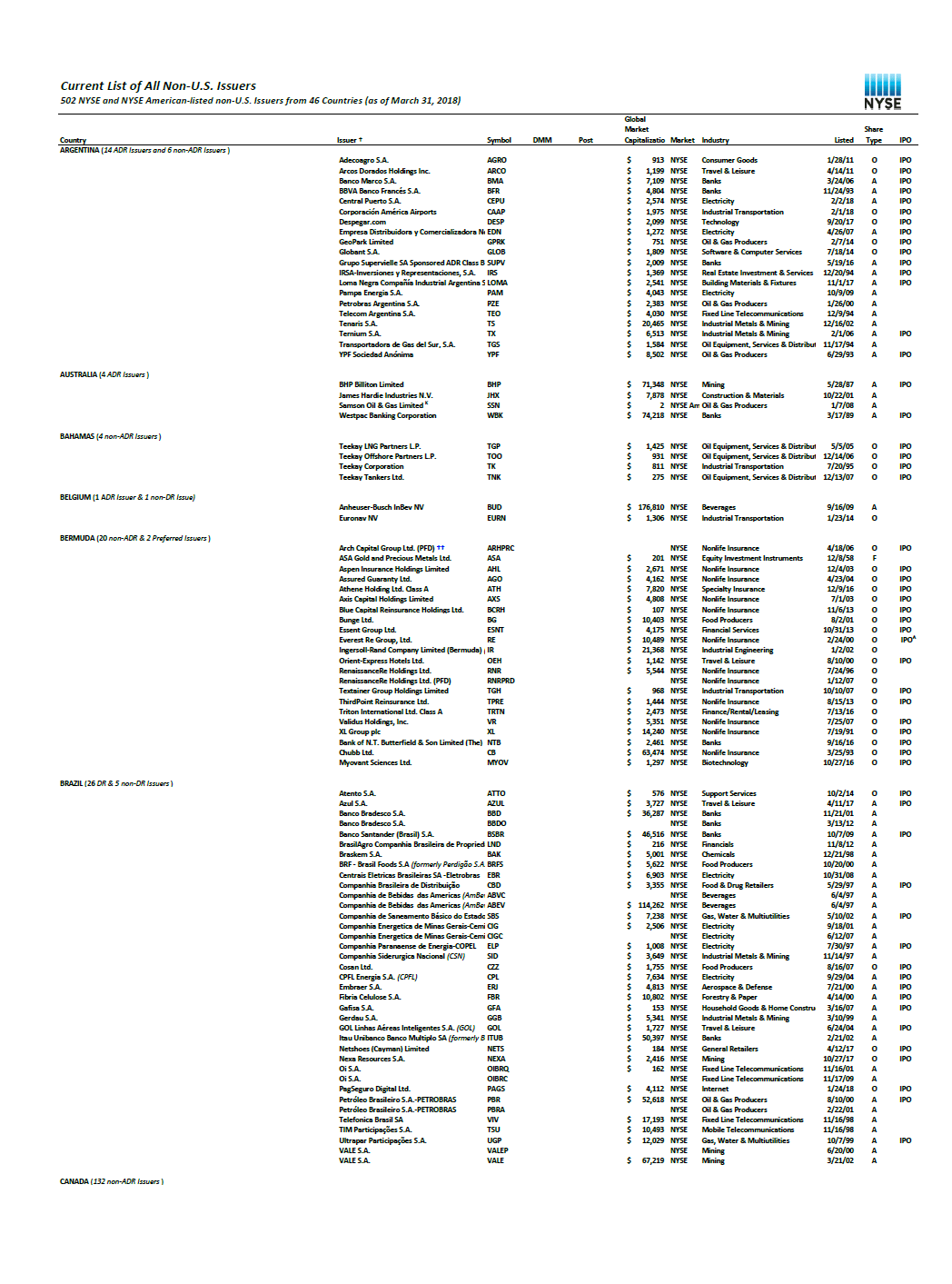

Some of the firms listed above trade on the OTC markets in the US. The complete list of Australian ADRs is listed here.

Download:

Disclosure: No Positions