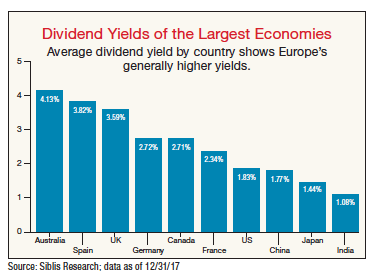

The Dividend Yields of the world’s largest economies is shown in the chart below:

Click to enlarge

Source:Dividends And Buybacks: The Last Hurrah?, Global Finance

Among the developed markets, Australia offers the highest dividend yield at 4.18% followed by Norway and the UK.

The dividend yields of the developed markets are shown in the following chart:

Click to enlarge

Note: Data shown above is as of December end, 017

Source: Singapore Loves Dividends, Australia Most Generous, Bloomberg