The worst performing sector so far this year is the consumer-staples sector. Stocks of consumer staple makers such as cereal, toothpaste, soups, etc. have been hit hard due to a variety of factors. Rising costs of commodities, higher logistics costs, cheaper store-name or generic brands, consumers’ preference for healthier options, etc. are some of the reasons attributed to the downtrend in this sector. However extreme bearish views on the sector are not justified. After strong declines this year (12% thru April 24) the sector has become attractive at current levels. Investors with a long-term view of at least 5 years can consider adding stocks in a phased manner.

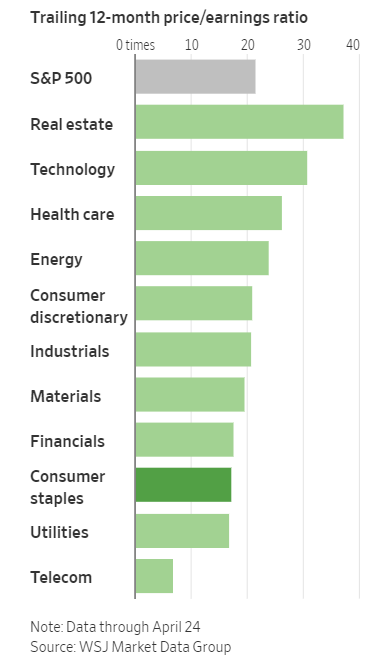

The trailing P/E ratio of S&P 500 sectors from a Journal article published on April 25:

Click to enlarge

The third cheapest sector in the S&P 500 is the consumer-staples sector.

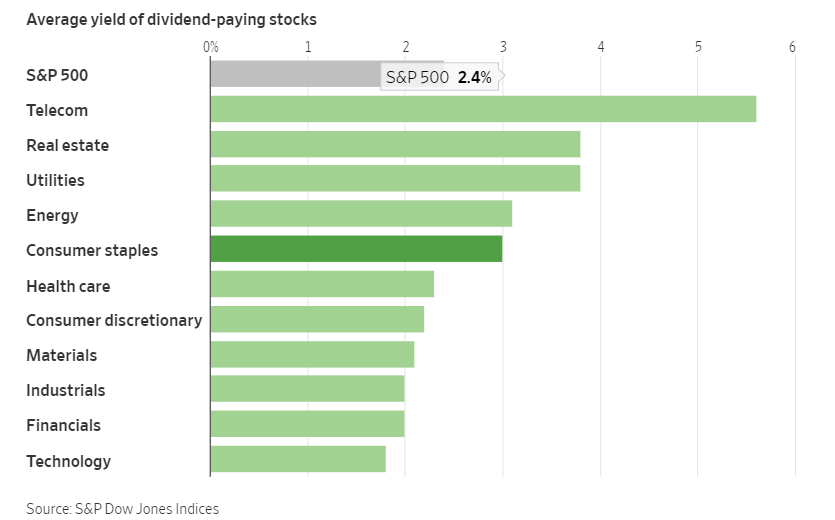

In addition, the sector also offers a solid dividend yield of 3% as shown in the chart below:

Source: Amazon Effect’ Stings Consumer-Staples Stocks as Pricing Woes Mount, WSJ

Investors have always found refuge in this sector during adverse market conditions. So the sector may enjoy a boost when there is a market downturn. Besides some of the fundamental factors favor holding consumer staples stocks. They not only offer a cushion to a portfolio during market corrections and offer a decent dividend yield they also offer consistent growth over the long-term. Despite the many threats based by them, people are not going to stop buying any of the items like toothpaste, paper towels, soups, cereal, etc.

From a recent article on General Mills at Barrons:

But there are bargains to be found in the sector. Consider General Mills (GIS), which has fallen 27% so far this year, to humble levels relative to earnings. At first glance, the drop seems deserved, because earnings growth has stalled, and the company recently paid what’s widely regarded as an ambitious price for Blue Buffalo, a fast-growing pet-food maker.

A closer look suggests sales trends are improving, thanks in part to new-product launches. General Mills has faced higher costs, but some of these are linked to growing pains, and are likely to abate soon. As for Blue Buffalo, investors might underestimate the payoff of expanding niche brands into mainstream stores.

“People said we paid too much when we bought Annie’s in 2014,” says General Mills CEO Jeff Harmening, referring to the organic-food brand. “We’ve doubled sales and tripled household penetration.”

As General Mills returns to growth, its stock could rise from a recent 14 times forward earnings projections to 16 times. That’s below the five-year average of 18 times, but enough to make 20% for investors, including the 4.5% dividend yield.

Founded as a roll-up of grain millers, General Mills went public in November 1928, less than a year before the crash that set off the Great Depression. While many companies went bust, it posted higher profits and dividends, in part by expanding from simple flour and meal to innovative pantry products such as Bisquick baking mix in 1931 and Kix puffed cornmeal cereal in 1937. Today, top brands include Cheerios, Betty Crocker, Pillsbury, and Häagen-Dazs. Snacks, cereal, quick-prepare meals, and yogurt together bring in 70% of revenue. Two-thirds of business is done via retail outlets in North America.

Until recently, packaged-food sellers were known for steady sales growth, but the industry is in upheaval. Sales of food eaten at home have grown only half as fast as food eaten out over the past five years. In grocery stores, perimeter items like fresh produce are growing faster than center-of-store items like canned soup. Upstart, independent brands such as Halo Top ice cream and Kind snack bars are booming. Investors worry that’s part of a lasting shift. Maybe a rising focus on health, or e-commerce, or millennial tastes have broken the power of big brands.

Not so, says Jefferies analyst Akshay Jagdale. His firm conducted a study of more than 1,400 consumers, eight Big Food chiefs, and sales data for 52 food and beverage categories. Its findings dispel some myths. For example, although shoppers are paying more attention to things like health benefits and social impact, overwhelmingly they say taste and price matter most. Brands remain important, including to millennials. Most leading brands — No. 1 or 2 in their categories — are growing. But emerging brands are taking share from nonleading brands.

In Jagdale’s view, recent sales challenges for Big Food came as companies pruned their portfolios and launched new products, and will soon give way to a return to modest sales growth, margin expansion, and higher valuations for innovative players. In February, he upgraded General Mills to Buy from Hold. His price target of $55 implies 25% upside from recent levels. Last month, Pablo Zuanic at Susquehanna Financial Group upgraded shares from Neutral to Positive, with a $52 target. “This scare about the balance of power shifting for food brands is overdone,” he told Barron’s this past week.

Source: General Mills Shares Are in the Bargain Aisle, Barrons

Some of the consumer staples stocks to consider are listed below with their current dividend yields:

1.Company: Kellogg Co (K)

Current Dividend Yield: 3.59%

2.Company: General Mills Inc (GIS)

Current Dividend Yield: 4.40%

3.Company: Mondelez International Inc (MDLZ)

Current Dividend Yield: 2.20%

4.Company: Campbell Soup Co (CPB)

Current Dividend Yield: 3.33%

5.Company: ConAgra Foods Inc (CAG)

Current Dividend Yield: 2.28%

6.Company: Kraft Heinz Co (KHC)

Current Dividend Yield: 4.34%

7.Company: Kimberly-Clark Corp (KMB)

Current Dividend Yield: 3.83%

Note: Dividend yields noted above are as of April 29, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long GIS